[ad_1]

interested investors Six Flags Entertainment (NYSE ticker symbol: VI) should definitely note that Gary Mick, CFO and interim controller, recently purchased $155,000 worth of stock at $22.12 per share. We think this is a good sign, especially after the acquisition increased their holding by 67%.

Check out our latest analysis for Six Flags Entertainment

Insider Trading at Six Flags Entertainment Over the Past 12 Months

In the past year, the largest insider transaction we could see was CEO, President and Executive Director Selim Bassoul’s purchase of $4.4 million worth of stock at $38.64 per share. This means that insiders want to buy shares even if the stock price is above $22.31 (the most recent price). Their views may have changed since then, but at least it shows they were feeling optimistic then. We always pay careful attention to the prices insiders pay when they buy shares. It’s usually more encouraging if they’re paying a higher price than current prices, as it shows they see value, even at a higher price.

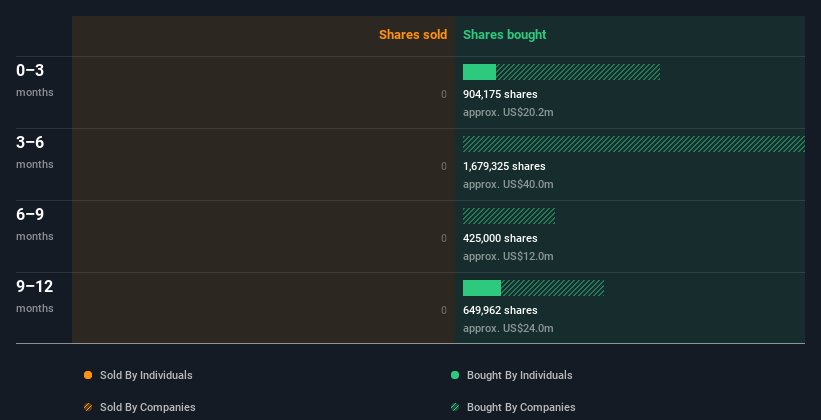

While Six Flags Entertainment insiders bought shares last year, they didn’t sell them. The chart below shows insider trading by company and individual over the past year. If you click on the chart, you can see all individual trades including share price, individual and date!

Six Flags isn’t the only stock insiders are buying.so look at this free List of growth companies with insider buying.

Inside Ownership of Six Flags Entertainment

Another way to test the alignment between a company’s leaders and other shareholders is to look at how many shares they own. We generally like to see fairly high levels of insider ownership. Six Flags Entertainment insiders own a stake worth about $18 million. This equates to 1.0% of the company. We’ve certainly seen higher levels of insider ownership elsewhere, but these are enough to indicate alignment between insiders and other shareholders.

So what do these numbers tell Six Flags Entertainment insiders?

Good to see recent insider buying. And longer-term insider trading also gives us confidence. Combined with the significant insider ownership, these factors suggest that Six Flags Entertainment’s insiders are very consistent in their belief that the stock price is too low. While we want to know about insider ownership and trading, it is also important to consider the risks to a stock before making any investment decisions.Case in point: we found 3 Warning Signs of Six Flags Entertainment You should know that 2 of them are important.

But please note: Six Flags Entertainment Might Not Be the Best Stock. so look at this free List of interesting companies with high return on equity and low debt.

For the purposes of this article, an insider is an individual who reports their transactions to the relevant regulator. We currently consider open market transactions and private dispositions, but not derivatives transactions.

Have feedback on this article? Concerned about content? keep in touch Contact us directly. Alternatively, email the editorial team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only an unbiased methodology to provide reviews based on historical data and analyst forecasts, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no positions in any of the stocks mentioned.

Join Paid User Research Sessions

you will receive a $30 Amazon Gift Card Take 1 hour of your time while helping us build better investing tools for individual investors like you. register here

[ad_2]

Source link