[ad_1]

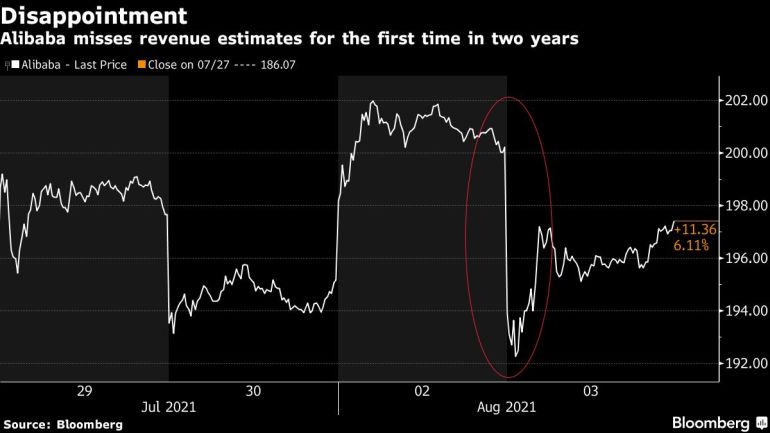

The revenue of Alibaba Group Holdings Ltd. fell below expectations for the first time in more than two years, highlighting how much Beijing’s months-long crackdown on the Internet industry is having.

The slowdown in growth of most of Alibaba’s major sectors, from cloud to e-commerce, underscores concerns that a growing list of new government regulations is restricting expansion and increasing the company’s burden. As a sign of the times, CEO Zhang Yong on Tuesday approved a series of government policies formulated in the turbulent 2021, ranging from strict restrictions on data collection to excessive subsidies. In particular, he expressed his support for the six-month campaign initiated by the Internet industry regulator last week, which clearly called for blocking the services of competitors.

Alibaba and rival Tencent have long excluded each other’s services from their respective platforms, forming a so-called walled garden. This rift helps the empire of China’s two major companies to survive, and is a key point in the growing debate over the influence of Internet companies by regulators, as it encourages businessmen and startups to lean toward one of them.

“We do see cross-platform openness and connectivity as a positive trend that can release greater dividends in the Internet era,” Zhang told analysts.

Alibaba shares fell 1.4% in New York. As one of the first Chinese Internet giants to feel pressure from Beijing, the company has been closely watched to find clues about the actual impact of self-regulatory agencies on the turmoil in industries ranging from online commerce to ride-hailing and education technology.

A few months after being fined $2.8 billion for violations such as mandatory exclusivity with merchants, Jack Ma’s flagship e-commerce company is investing funds in areas such as its cheap platforms and community commerce to offset the slowdown in growth. At this time, Pinduoduo and JD.com are in a difficult situation. com Inc. is eroding its dominance.

Revenue for the three months ended June climbed to 205.7 billion yuan (31.8 billion US dollars), while the average analyst forecast was 209.4 billion yuan. Net income was RMB 45.1 billion, rebounding from the loss after the record antitrust penalty in the previous quarter. The company announced on Tuesday that it will increase its stock repurchase program by 50% to $15 billion.

According to Bloomberg’s report earlier this year, after the crackdown, Alibaba has taken initial steps to contact Tencent and apply to create a mini-application for its Taobao trading platform on Tencent’s WeChat service. The Wall Street Journal also reported that Alibaba is considering allowing customers to use WeChat Pay on Taobao and Tmall.

“If Tencent and Alibaba are open to each other, it’s like each taking what they need,” said Xiao En Yang, an analyst at Blue Lotus Capital. “Alibaba will benefit more because it is eager for user traffic, not Tencent’s desire for GMV. But no one knows how this will develop.”

Since Alibaba was punished, the scope of scrutiny on the technology industry has expanded. In April this year, the antitrust regulator launched an investigation into Meituan and ordered 34 Internet giants, including Alibaba and its subsidiaries, to conduct internal reviews and correct any excessive behavior. In July, cyberspace regulators stepped in and announced an investigation into Didi Global and removed its services from the Chinese app store after its listing in the United States, expanding the scope of the crackdown to the field of data security.

Alibaba’s market value has fallen by more than US$300 billion from its peak in October, just before the initial public offering of its subsidiary, Ant Group, was cancelled and the technological crackdown officially began. After Chinese regulators required it to overhaul its huge business, Ant Financial’s March quarterly profit fell to US$2.1 billion.

However, as the first major economy to recover last year, China’s re-emergence of pandemic risks cast a shadow over the prospects of companies such as Alibaba. Since the pathogen first appeared at the end of 2019, the country is currently battling the most widespread coronavirus outbreak.

Alibaba predicted in May that revenue growth for the 12 months ending in March will be at least 30%, down from 41% in the same period last year. Industry research firm eMarketer said in a report on July 30 that this forecast indicates that Alibaba’s share of China’s e-commerce sales will drop below 50% for the first time in 2021.

In the June quarter, the annual active consumer growth rate in the Chinese retail market was slower than expected, reaching 828 million, driving a 35% growth in its commercial business. Overall, the company’s goal is to have 1 billion users in the domestic market and 912 million users in China by the end of 2021. After Alibaba began to combine commissions with this figure, its main customer management revenue grew by only 14%, the lowest level in at least three quarters.

Cloud revenue grew 29%, slowing for the second consecutive quarter after the exit of major customers. Bloomberg News previously reported that the client was TikTok owner Bytedance Ltd. Management told analysts on Tuesday that the exit will continue to drag down cloud growth for the rest of the year, and the new regulatory regime for education technology companies may curb their spending on Internet services.

Executives last quarter committed to investing all incremental profits to refocus on their business. On Tuesday, executives pledged to maintain this strategy.

Alibaba merged its Ele.me food delivery app, Word of Mouth local business platform, and map and online travel businesses into a new lifestyle service department last month. This move will help it better challenge Meituan’s dominance in these areas. status. As part of the change, the company also merged Tmall’s online grocery service with Alibaba’s cross-border commerce business.

[ad_2]

Source link