[ad_1]

Symbol of the post-pandemic new normal, embattled cinema operator AMC Entertainment’s wild narrative (NYSE: AMC) initially suffered huge losses due to sudden disruptions in personal mobility. However, the meme phenomenon eventually took hold, sending struggling businesses soaring to new all-time highs. Unfortunately, the journey appears to be over, leaving a ray of hope for contrarian speculators. Everyone else should probably stay away from AMC stock.

Before diving into the discussion, I must explain my ownership disclosure below. While I do have some AMC stock in my portfolio, I got out of it during the skyrocketing valuation. So, let’s say, everything I do is speculating with the money from the house. The wave of meme stocks has the potential to positively impact movie theater operators once again. However, it’s fair to say that most people don’t have the luxury of playing for “free” money.

Fundamentally, conservative investors must stay away from AMC stock. One of the biggest concerns about the troubled company is its debt issuance. Over the past three years, management has issued $1.3 billion in debt, reflecting significant concerns about underlying demand. Likewise, several key financial performance measures remain in limbo.

For example, the company’s three-year cumulative revenue growth rate was a staggering -53.7%. Likewise, AMC’s three-year cumulative free cash flow (FCF) growth rate was -1,246%.

So it’s no surprise that AMC’s Altman Z-Score hit a trough at -0.9. For reference, when a company’s score is below 1.81, the company is considered to be in distress. The rating indicates that the company may be at risk of bankruptcy within the next two years. At the time of writing, AMC stock has lost more than 75% of its equity value so far this year.

Expecting these and other painful situations to magically improve can represent stupid errands (pardon the derogatory term). So anyone who isn’t a die-hard speculator might well avoid this struggling entity.

AMC stock gains silver lining

While the financials underpinning AMC stock may keep most fundamental investors out, it’s surprising that the theater operator isn’t entirely without bullish catalysts. In fact, Netflix’s latest earnings report (NASDAQ: NFLX) may have extended a fragile lifeline.

As TipRanks reporter Vince Condarcuri puts it, the company’s Third quarter disclosure“Adjusted EPS was $3.10, Beat analysts’ consensus estimate of $2.14 per NFLX. The company has beaten estimates six times in the past nine quarters. “

Also, “Sales increased 6% year over year, with revenue from $7.48 billion to $7.93 billion. That’s also higher than the $7.843 billion analysts were looking for. Talking about subscriber growth, Netflix’s subscriber base increased by 2.4 million, out of 100 more than double its target. Going forward, the company expects to add 4.5 million net new subscribers in the fourth quarter.”

The point here isn’t to repeat Netflix’s excellent third-quarter beat.Rather, these results strongly suggest that after consumers enjoy exercising their revenge travel, they are now ready to seek entertainment and escapism in the living room. Of course, that’s fundamentally in the best interest of the streaming company, and that’s putting competitive pressure on AMC stock. It’s also good for the box office, though.

After all, watching summer blockbusters on the big screen is fun and far cheaper than other forms of in-person entertainment. Examples include watching a ball game or attending a live concert. So, the movie theater industry still brings a lot of relevance.

Also, bad news could be good news for AMC stock. At present, consumers are still worried about inflation, deflation, Stagflation, and other economic issues. During these times, escapism may be valued.

As it turns out, Hollywood may be able to fulfill the fantasies that society craves in a downturn. Combined with the human experience of box office attendance, it’s not impossible for AMC stock to perform well.

Is AMC stock a buy, sell or hold?

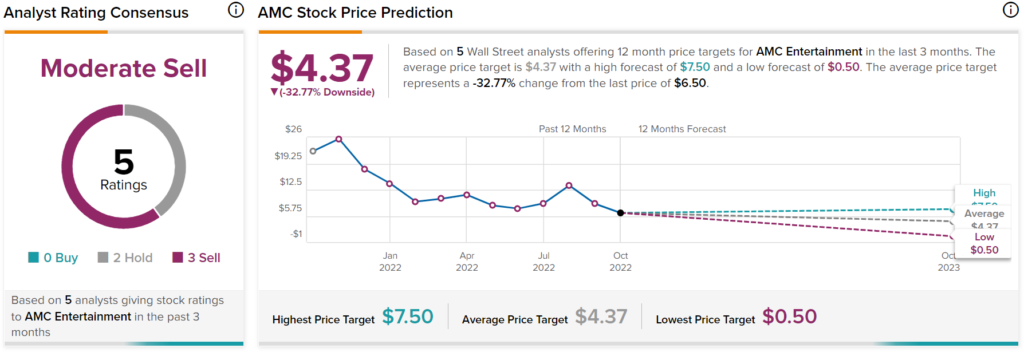

Turning to Wall Street, AMC stock has a Moderate Sell consensus rating based on zero Buys, two Holds and three Sells allocated over the past three months. AMC’s average price target of $4.37 implies a downside potential of 32.77%.

Do not buy your AMC lottery tickets yet

Still, as TipRanks contributor Steve Anderson might say, this narrative may be very close to impossible.Recently, Anderson mentioned that AMC stock represents a 6 yuan lottery now. Frankly, it’s hard to draw any other conclusions.

Regardless of the impact of the COVID-19 pandemic, movie theater operators continue to face pressure from streaming services.As my colleague put it, “In general, theaters have been suffering with the rise of streaming video. While it’s clear that there are still blockbusters making money for theaters, those blockbusters have become somewhat rarer. Remember no time to dielatest issue James Bond series? Its shooting budget is more than three times its size, which makes it popular by most standards. “

To be fair, certain blockbusters like Top Gun: Maverick Benefit from a big-screen experience that your living room TV can’t replicate. However, here is the problem.As I mentioned a few months ago, “There’s no guarantee that spending millions equals box office success. When a movie blows up, they can significant damage to its financial backers, which means production studios will be very careful about their exposure. “

Of course, that’s not what supporters of AMC stock want to hear.However, here’s news for investors who rely on fundamentals to make informed decisions must hear.

[ad_2]

Source link