[ad_1]

“A leader is one who knows the way, walks the way, and shows the way.” – John C. Maxwell

When positioning stocks for our portfolio, we want to focus on stocks that are leading the pack and outperforming. Back in March, many Chinese stocks appeared to have bottomed out, and as the recent stock market rally continues, these companies are leading the charge. As China eases its strict COVID policies and continues to lift lockdown restrictions, there’s plenty of reason to believe the gains in these stocks may just be getting started.

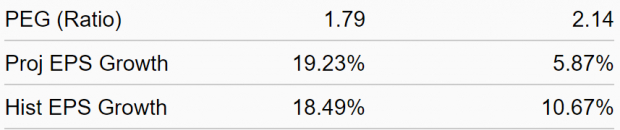

One company showing relative strength is Tencent Music Entertainment Group (TME – free report), a Zacks Rank #2 (Buy). TME has been a victim of a broader decline in Chinese stock markets over the past year. This presents a unique opportunity as the stock has become relatively undervalued and undervalued. TME is ranked highly in our Zacks Style Scores, including a best-in-class “A” rating in each of our Growth and Momentum categories. This suggests that the stock has a good chance of moving higher on the back of a strong combination of favorable growth metrics and share price performance.

TME is a component of the Zacks Internet – Content industry group, which is currently in the top 23% of approximately 250 industries. Because it is in the top half of all Zacks Ranked Industries, we expect the group to outperform the market over the next 3 to 6 months. Historical research shows that approximately half of a stock’s future price appreciation is due to its industry grouping. In fact, the companies in the top 50% of the Zacks Ranked Industries have outperformed the bottom 50% by more than 2 to 1.

By targeting stocks included in the top industry groups, we can greatly increase our odds of success. Note also the following promising characteristics of the industry:

Image Credit: Zacks Investment Research

Company Profile

A subsidiary of Tencent Holdings Limited, Tencent Music Entertainment Group operates an online music entertainment platform that provides music streaming, online karaoke and live streaming services in China. Its services enable users to discover and listen to personalized music. TME also offers its users the opportunity to interact and share songs and performances with friends through an online stage. In addition, Tencent Music provides a variety of entertainment content including audiobooks, cross talk, and radio dramas through its strategic cooperation with China Literature.

Over the past few years, there have been rumors that Chinese companies will be delisted from U.S. stock exchanges because of a lack of transparency in Chinese accounting practices. But back in August, U.S. and Chinese regulators reached an agreement to allow Chinese accounting firms to share more information about companies listed on U.S. exchanges. The agreement marks a turning point in resolving a major conflict that initially pointed China’s largest companies to withdraw from domestic exchanges.

Earnings Trends and Future Estimates

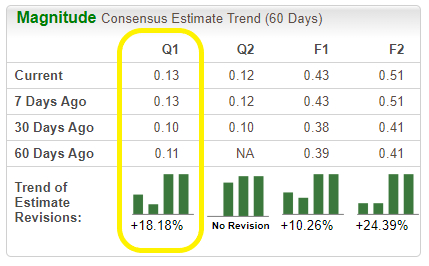

TME has built an impressive earnings history, beating earnings estimates in each of the past four quarters — with an average earnings surprise of 8.52% over that period. The online music provider recently reported EPS of $0.12 per share for the third quarter last month, beating the consensus estimate by 9.09%. Consistently and substantially beating earnings estimates is a recipe for future success.

Analysts agreed, raising expectations for the future across the board. For the fourth quarter, analysts have raised their EPS estimates by 18.18% over the past 60 days. The Zacks Consensus Estimate is currently at $0.13 per share, reflecting growth of 62.5% compared to the same period last year. Clearly, momentum is building for TME investors.

Image Credit: Zacks Investment Research

Stock price movement and valuation

Back in March, TME’s stock had been bottoming out at $2.95 — well ahead of the major indexes. The stock has more than doubled in the past month and shows no signs of slowing down. Also notice how the 50-day and 200-day moving averages appear:

Image Credit: Stock Charts

Empirical studies have shown a strong correlation between recent stock movements and trends in earnings estimate revisions. As we know, TME has recently witnessed a positive correction. As long as this trend holds (and TME continues to turn a profit), the stock could remain bullish in the next year.

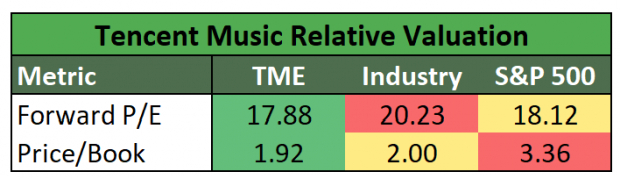

Despite the recent price movement, TME is relatively undervalued by any metric:

Image Credit: Zacks Investment Research

the bottom line

TME holds a Top “A” Zacks Overall VGM Score, and it’s easy to see why. Strong fundamentals coupled with strong technical trends certainly justify adding to the stock. With a leading industry group and a history of beating earnings estimates, it’s not hard to see why this company is a compelling investment.

Be sure to keep an eye on TME as we head into the new year.

[ad_2]

Source link