[ad_1]

Chris is a technologist in Dubai who has been using facial recognition technology for retail purchases.

“I’ve been using it for over a year in the UAE and other countries, both online and in-store. Thankfully, I’ve never had any security issues,” he told gulf news.

Louie is a data administrator in East Asia and an avid Android user. He didn’t use Google Pay’s facial recognition for the payments feature, which first rolled out in 2019. “QR codes and fingerprints are my go-to authentication – QR codes for retail, fingerprints for banking.”

“It’s important that you have secure transactions,” Louie said, adding that he might consider facial recognition in the future if a second layer of security, such as fingerprints, was provided to secure transactions.

living the future today

Facial biometrics for retail have many benefits: First, it eliminates the need for you to carry a physical payment card or cash.

Futurists predict that your face will eventually become your password. Well, the future has arrived – facial recognition payment technology is starting to enter the mainstream. Facial recognition has some benefits: Not only does it provide a quick and easy way to pay, it’s also relatively secure.

Facial recognition has some benefits: Not only does it provide a quick and easy way to pay, it’s also relatively secure.

Since payments are linked to a unique biometric identifier, such as a face, it becomes more difficult for fraudsters to impersonate legitimate customers and steal their payment information. As such, it offers the potential for wider adoption in the future.

What is facial recognition payment?

Face payment refers to a biometric payment method in which the customer’s face is used as a form of identification and authentication for payment.

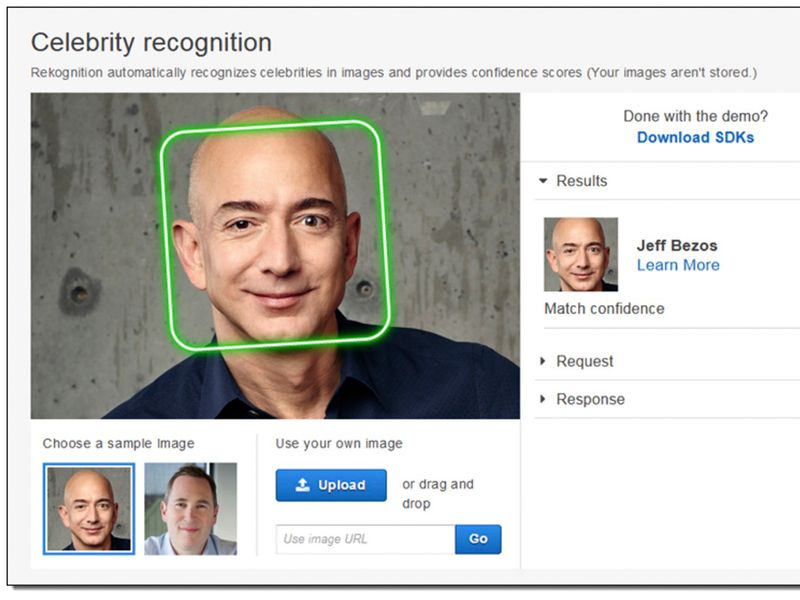

Real-time face verification has become mainstream in the retail industry, adding convenience to customers. An image provided by Amazon on the company’s website shows how its Rekognition software works.

How does it work?

Usually, it works like this:

- You, the customer, first set up facial recognition on your mobile device or a separate device linked to your payment account.

- When you’re ready to buy, you can hold up your device or glance at the camera (preferably a glance) at the point of sale (POS).

- The system uses your face as a form of identification and compares it to the image on file.

- If a match is found, your payment information will be automatically retrieved and the transaction will be completed.

- You will receive a transaction confirmation on your device.

Which places in the UAE use face payment?

In the United Arab Emirates (UAE), facial recognition payment technology has been adopted by several financial institutions and payment service providers.

- Network International, a Dubai-based payment service provider, offers facial recognition payments through its mobile app “Nique”.

- Emirates NBD, one of the largest banks in the UAE, offers facial recognition payment services through its mobile banking app “enbd”.

- Abu Dhabi Commercial Bank (ADCB) also offers facial recognition payments through its mobile banking app.

- The United Arab Bank (UAB) also offers facial recognition payments through its mobile banking app.

- Carrefour stores in Deira and Amsaf have also rolled out facial verification for retail transactions. It is one of the first retailers to launch oat batter in the UAE in partnership with PopID and Network International.

What drives their use?

The system has a key enabler: high-speed connectivity, the use of mobile devices and cheaper computer processing. With the adoption of advanced technology, facial recognition payment is becoming an increasingly popular transaction method for customers.

The aforementioned service providers form part of a growing list of adopting facial recognition as a safe and convenient option for customers to make payments.

There are several factors driving the adoption of facial payment technology:

- Convenience: Face payment does not require customers to carry physical payment cards or cash, making transactions faster and more convenient.

- Improved security: Face Pay is more secure than traditional payment methods because it associates payments with a unique biometric identifier, such as a human face, which is harder to impersonate.

- Increased use of mobile devices: With the widespread adoption of smartphones and other mobile devices, facial recognition payment technology has become more accepted by consumers.

- Adoption by financial institutions and merchants: More and more financial institutions and merchants see the adoption of facial recognition payment technology as a competitive advantage, making it easier for consumers to use and increasing its popularity.

- Non-intrusive: Facial authentication is non-intrusive because it does not require any physical contact with the device, making it ideal for personal identification and authentication in a range of scenarios from banking to healthcare.

- Integration with other technologies: Face authentication can be easily integrated with other technologies such as biometrics and blockchain to provide stronger security and privacy protection. Overall, face authentication is seen as the future of secure personal identification and authentication because of its combination of convenience, security, widespread adoption, non-intrusiveness, and integration with other technologies.

Not everyone is happy with it, as protesters rallied against Amazon’s facial “recognition” system.

An unnamed man had his face painted to represent efforts against facial recognition as he protested the company’s facial recognition system “Rekognition” at Amazon’s headquarters in Seattle.

Image credit: Associated Press

How big is the market?

According to Grandview Research, the global facial recognition market size was valued at USD 3.86 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 15.4% from 2021 to 2028.

It estimates the facial recognition market will reach $12.11 billion in 2028. Key growth regions identified: United States, Canada, Mexico, Germany, United Kingdom, France, China, Japan, India, and Brazil,

$December 11b

Global Facial Recognition Market Size by 2028 According to Grandview Research Estimates.

What are the challenges?

As with any new technology, there are limitations. These challenges need to be addressed before face-to-face payments become the norm.

- Security | Privacy: Privacy concerns and data security risks may be an issue for some users.

- Technology: There may also be technical challenges associated with the implementation of a face payment system – i.e. network speed, availability of system support, cultural factors, etc.

Do Apple Pay and Google Pay support Face ID?

Yes. On some Apple devices, you can use Face ID to authenticate purchases made through Apple Pay and purchases made in the iTunes Store, App Store, and the Apple Books store.

For Android devices, the Google Pay mobile payment platform now also enables facial recognition as a method of authentication.

Can face recognition be used while wearing a mask?

Yes, if Face ID with a mask is set up. No, if not. Generally speaking, if you wear a mask to cover your mouth and nose, but have not set up Face ID with a mask, you can choose to click “Pay with Password” and enter your password. Wait for “Done” to show a tick.

Additionally, some services already accept login recognition. In August 2021, Twitter rolled out the ability to confirm account logins with Apple (for later iPhone and iPad models) and Google via facial recognition (Twitter users will still be required to provide dates of birth and other information).

When will face payment become the norm?

It’s hard to predict exactly. But facial recognition payment technology is likely to become more popular in the future.

Given the above challenges, it is possible to find solutions sooner.

As face-swiping payment technology continues to gain popularity, the possibility of its widespread adoption will increase. Whether or not that happens, the mass market — users like you and me — will have the final say.

[ad_2]

Source link