[ad_1]

It might be a little too easy to figure out casino stock. After all, inflation remains high and economic uncertainty plagues the landscape. Golden Entertainment (NASDAQ: GDEN), however, proved that the area still has life, as it surged to a fresh 52-week high. Investors were clearly pleased with one of its biggest moves and invested accordingly.

So, what puts Golden Entertainment at the top of the list? New plans for some of its businesses. Golden Entertainment sold its slot machine interests in Nevada and Montana to J&J Ventures Gaming. The deal calls for J&J Venture Gaming to pay $213.5 million, plus approximately $34 million in “cash for purchase” for the Nevada business. Montana, meanwhile, has far less business. $109 million plus $5 million in “cash for purchase.” Also, this is not a one-and-done exercise. J&J Ventures Gaming has also agreed to support gaming operations at the Golden Tavern location as usual.

That’s actually good news for Golden; what CBRE analysts say john decree Note that Golden Entertainment trades at a long-term multiple of 7.3. Golden sold the slot machine business at around 9 times adjusted EBITDA, a substantial premium indeed. That could give Golden a real advantage in future deals. It’s a leaner business, but still has a lot of real estate in a very desirable area.

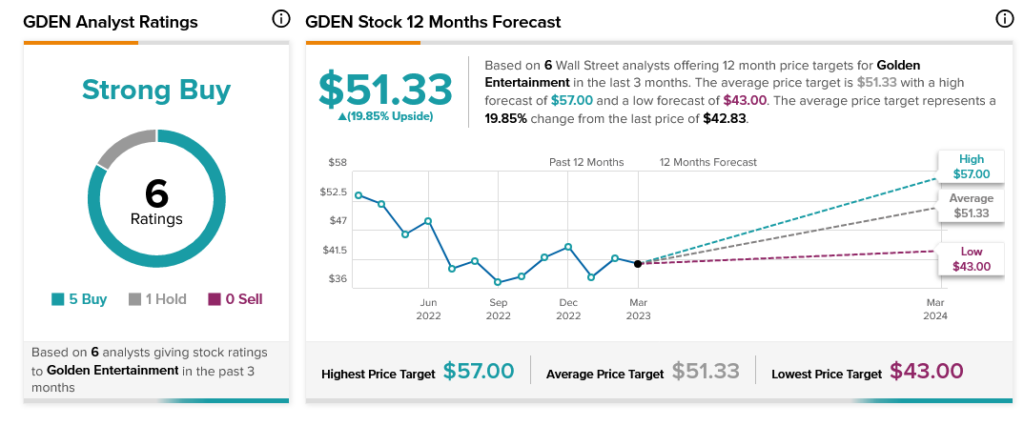

Overall, Wall Street is very happy with the company. Right now, the analyst consensus is that Golden Entertainment is a Strong Buy. Additionally, GDEN stock has an average price target of $51.33, implying an upside potential of 19.85%.

[ad_2]

Source link