[ad_1]

Americans continued to spend last month, causing retail sales to rise unexpectedly-but the number of initial jobless claims also increased last week, triggering people’s concerns that the highly contagious variant of the Coronavirus Delta is and may continue to affect the U.S. economy The question of what effect will be restored.

The latest data from the US Department of Commerce and the Department of Labor paints a subtle picture of a country experiencing a surge in COVID-19 infections in certain regions.

Although the country’s number of job vacancies hit a record high and federal unemployment benefits expired earlier this month, making unemployed workers more selective when looking for their next job, weekly unemployment benefits applications are still rising.

So what happened to the world’s largest economy? This is a snapshot of what you need to know.

Start with today’s data. What does it show?

Americans are spending money, but they don’t necessarily have to go back to work.

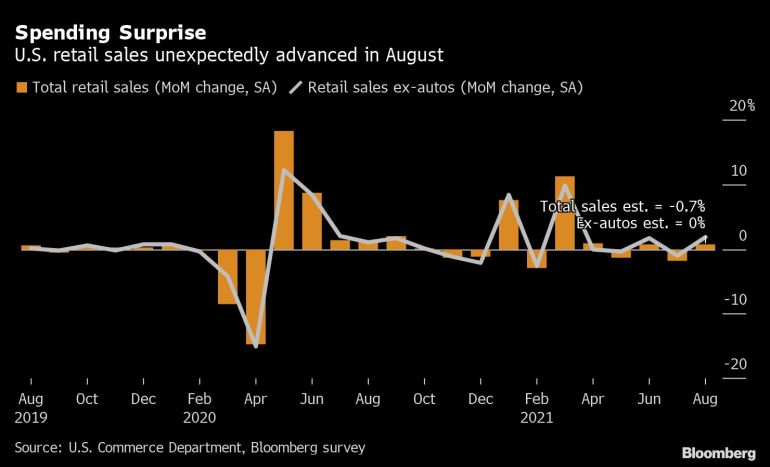

According to data from the Ministry of Commerce, although many economists predicted a decline, retail sales in August rose by 0.7% after seasonal adjustments.

At the same time, data from the Department of Labor showed that the number of initial jobless claims increased by 20,000 last week to 332,000 after seasonal adjustment.After the initial increase in the number of claims for unemployment benefits last week, this rise was unexpected. The pandemic is low.

Why is this data so important?

The job market data and retail sales data are a barometer of the health of the U.S. economy. This is because consumer spending accounts for two-thirds of US economic growth. When the number of layoffs increases, it may indicate that business activities are slowing down, which may make consumers less certain about their future financial situation and therefore less willing to spend money.

understood. So where do Americans spend their money?

The biggest driver of the August surge was online sales, which increased by 5.3% from July, furniture and furniture sales increased by 3.7%, and department store sales increased by 2.4%.

There are several possible explanations. August and September are traditionally the months when American students return to school. Parents usually stock up on clothes and school supplies before returning to the classroom, which can explain the increase in online and department store sales.

At the same time, existing home sales, Up 2% in JulyAccording to the National Association of Realtors, Americans may therefore spend money to buy a new house.

Where do they not spend their money?

It is worth noting that the sales of restaurants and bars in August did not increase compared with the previous month. The service industry has been hit hard by the coronavirus pandemic, and while many states are hesitant to reimplement restrictions that weaken their businesses, concerns about the spread of Delta variants may keep Americans at home.

The airline also recently reported that ticket sales have fallen because the increasing number of cases makes people think twice when booking air travel again.

So what does the job market data tell us?

There is still some disconnect in the labor market between the unemployed Americans and the millions of jobs that need to be filled.

Job vacancies reached a record 10.9 million in July, but about 8.7 million Americans were considered unemployed in the same month. Hiring slowed in August, and the US only added 235,000 non-agricultural jobs.

The gap between record vacancies and the lack of Americans willing to accept these jobs has forced Wall Street to reassess the pace of the U.S. economic recovery [File: Nam Y Huh/AP Photo]

The gap between record vacancies and the lack of Americans willing to accept these jobs has forced Wall Street to reassess the pace of the U.S. economic recovery [File: Nam Y Huh/AP Photo]Why can’t the company hire workers?

Some explanations for the lag in recruitment may be workers’ reluctance to accept jobs in the service industry that may expose them to COVID-19, ongoing childcare issues before face-to-face schools reopen, and some workers’ decision to retire early.

Some workers had previously received $300 in federal unemployment benefits, which gave them a little buffer when they were looking for a job, and in some cases made them more selective about what to do next. But these benefits expired earlier this month, which is expected to stimulate people to return to the labor market.

At the same time, companies including online retail giant Amazon have already Trying to attract workers back This is achieved quickly through sign-in bonuses, increased hourly wages and other incentives.

What happened next?

This is exactly what economists-and policy makers-are eager to discover. Both hope that as the children return to school and federal unemployment benefits expire, job fairs will increase.

The health of the labor market also affects many economic factors. Before raising interest rates from close to zero or withdrawing financial support, the U.S. Central Bank has made “substantial further progress” to maximize employment as one of its goals.

All of this means that September is definitely an interesting month for the US economy-so stay tuned.

[ad_2]

Source link