[ad_1]

Jürgen Sack/E+ via Getty Images

NIO (New York Stock Exchange:NIO) received a $738.5 million investment from the Abu Dhabi government last week and found a new anchor investor. The investment deal comes after Nio released its first-quarter earnings report, which showed lower auto profit margins, Weak delivery expectations for the second quarter put NIO’s valuation under pressure again. However, the Abu Dhabi investment is a potential game-changer for NIO, as it not only provides additional resources amid mounting losses, but may also provide support for NIO’s electric vehicle business in Abu Dhabi. The production center opens a road along the road.

I believe Abu Dhabi is following in the footsteps of Saudi Arabia, which is spending billions of dollars to build domestic EV manufacturing capabilities, and NIO may use Abu Dhabi as a springboard to enter the Middle East market!

Impact of latest financing agreement

A few days ago, NIO notified the market that it had received a Strategic equity investment CYVN Holdings, an investment company majority-owned by the government of Abu Dhabi, will invest $738.5 million in NIO’s newly issued Class A shares at a purchase price of $8.72 per share. Nio also said that CYVN Holdings entered into a share purchase agreement with an affiliate of Chinese conglomerate Tencent (OTCPK:TCEHY) will purchase 40,137,614 NIO Class A shares from CYVN Holdings. After the transaction is completed, Abi Dhabi’s investment fund will hold about 7% of Nio’s outstanding shares.

Tencent is an important player in the autonomous driving market, and NIO has signed a cooperation agreement with Tencent strategic agreement In the fourth quarter of last year, the two parties formulated terms of cooperation in areas such as cloud driving technology, smart driving maps, and R&D efficiency.

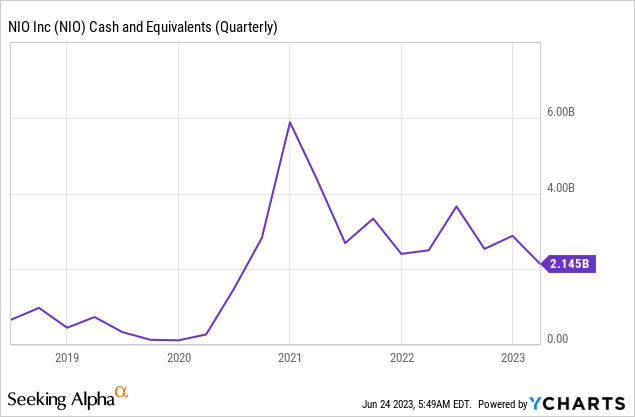

The $740 million investment deal with Abu Dhabi comes as losses widen for the Chinese electric car maker, whose Automobile profit margins plummet in the first quarter. It also helps boost Nio’s cash reserves, as it continues to roll out new models, such as the ES6, which goes on sale on May 24, 2023. The addition of NIO sedan models in particular has put pressure on NIO’s cash balance, and the Abu Dhabi investment will ensure the company will be able to expand its sedan lineup, including the ET5 and new ET7.

My expectations for the investment agreement between NIO and Abu Dhabi

But in addition to making financial sense for Nio, the deal also makes strategic sense for the electric car maker. That’s because Abu Dhabi is starting to emerge as a homegrown challenger to Saudi Arabia, which through one of its affiliates, Ayar Third Investment, owns a 60% investment stake in electric car maker Lucid Group (LCID).Ayal Third Investment also participated Lucid’s latest stock offering.

Sober signed a protocol In 2022, the Saudi Arabian government mandated the delivery of up to 100,000 electric vehicles by 2030. Lucid is further strengthening its ties to Saudi Arabia by building an AMP-2 manufacturing plant in the country with an expected annual production capacity of 155,000 EV vehicles.Kingdom also signed Another deal with Chinese EV startup Enovate It is also building an electric vehicle manufacturing plant in Saudi Arabia.

Nio may now strike a similar deal with Abu Dhabi. While it has not been announced that NIO will supply the Abu Dhabi government with electric vehicles, the competition between the United Arab Emirates and Saudi Arabia is likely to result in a “sober-like” deal between NIO and the Abu Dhabi government . Nio faces stiff competition in its home market of China, but has moved into other markets in northern Europe to reduce its reliance on China.

Abu Dhabi is an emerging player in the electric vehicle industry. Consulting firm Arthur D. Little, in its “Global Electric Vehicle Readiness Index 2022The world’s eighth most promising EV market, the company’s consultants estimate that the UAE EV market could grow 30% annually between fiscal 2022 and 2028. For Nio, entering the United Arab Emirates market, possibly by setting up a manufacturing facility, could be the next logical step.Strategically entering the UAE/Middle East, is seeing Accelerating Electric Vehicle Adoption rate, which could eventually lead to a re-acceleration of NIO’s delivery growth.

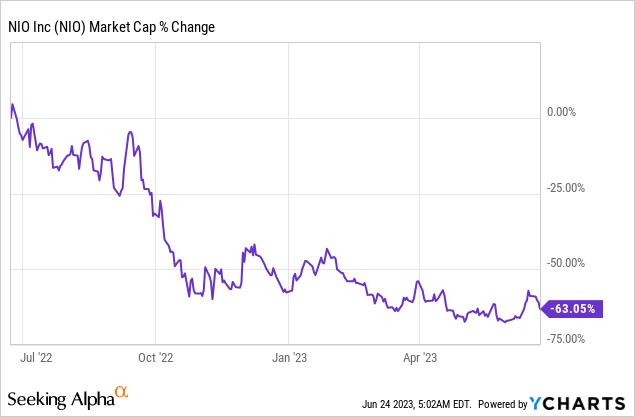

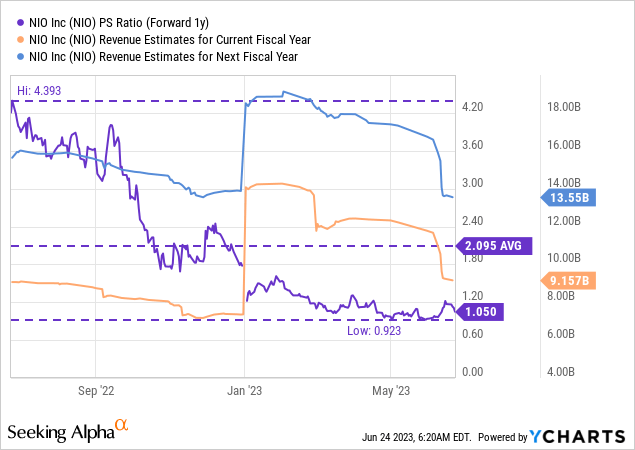

NIO’s valuation suggests its shares are still grossly undervalued

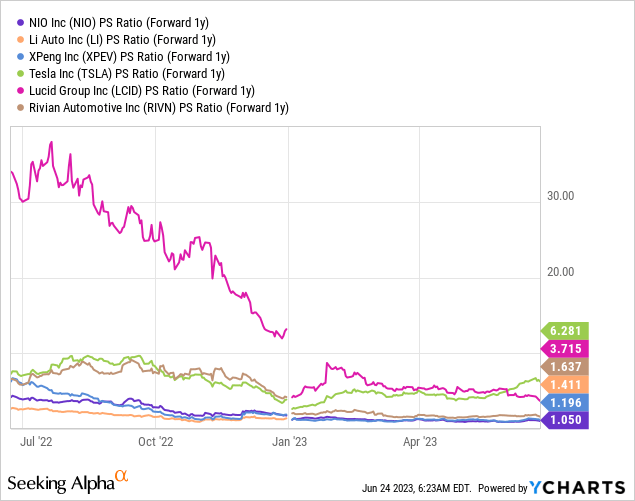

I think NIO is grossly undervalued both relative to its competitors and relative to its historical average. Nio’s current P/E ratio is 1.05 times, which is about half of its 1-year average P/E ratio. Despite a recent downward trend in revenue forecasts due to slowing Chinese consumer demand, NIO still expects to achieve nearly 50% year-over-year revenue growth next year.i said before NIO’s valuation may doubleI continue to stick to this.

NIO also appears undervalued compared with its EV rivals in the U.S. and abroad. Nio’s price-to-earnings ratio is the lowest in the industry, while U.S. electric vehicle companies have the highest valuation multiples.

Nio’s risk

Nio’s margins were under pressure in the first quarter, mainly due to pricing pressure, increased competition in China’s domestic EV market (growing EV portfolio, and weakening consumer demand). As I said before, if the company fails to rapidly expand its sedan portfolio and auto margins continue to decline in the coming quarters, then my view on NIO will change.

final thoughts

NIO’s investment partnership with Abu Dhabi could be a game-changer for both Abu Dhabi and NIO. The investment deal not only helps NIO provide financial support and boost its cash resources as it launches new models and ramps up sedan deliveries, but also creates a path for the Chinese company to enter the attractive emerging electric vehicle market. way east. If I were to speculate, I would say that Abu Dhabi is not only looking to invest in the growth of the electric vehicle industry, but eventually wants to encourage domestic electric vehicle production, in part because the UAE’s arch-rival, Saudi Arabia, is spending billions of dollars to build a domestic Electric vehicle manufacturing capabilities. So not only does NIO secure an anchor investor through a $740 million investment in Abu Dhabi — which also bolsters confidence in NIO’s long-term growth prospects — but it also potentially opens up the door for access to the growing Middle East. Electric vehicle market creates a springboard.

[ad_2]

Source link