[ad_1]

| The UAE has one of the highest levels of non-performing loans among major Middle East and African economies, in part due to its high exposure to the construction sector. Source: Dan Kitwood/Getty Images News via Getty Images Europe |

According to market watchers, it will become more common for banks in the United Arab Emirates to sell portfolios of bad loans as lenders prioritize clearing their books and improving regulations make such deals more attractive to buyers.

Abu Dhabi Commercial Bank PJSC, or ADCB, is selling about $1.1 billion in bad debts, including personal and business loans and real estate assets, Bloomberg reported in September. Jaap Meijer, managing director of research at Dubai-based Arqaam Capital, said it would be the largest non-performing loan (NPL) portfolio sale of its kind in the UAE.

James Dervin, managing director of Alvarez & Marsal Middle East, said there had been some modest sales of bad loan portfolios by local units of international banks, while deals involving individual borrowers had been going on for some time.

However, few of these deals are made public, and some of them involve international investment firms. An exception is the UAE-based asset manager and investment bank SHUAA Capital PSC, which acquired in January 2021 the AED1.13 billion debt owed by Stanford Maritime to various lenders.

“It’s not a deep market, there are very few transactions, which is why the sale of ADCB is so important,” said Michael Rainey, a partner at law firm King & Spalding in Dubai.

Borrowing and cleaning

Mayer said ADCB’s proposed loan sale would benefit the bank as it “reduces the overall number of non-performing loans without negatively impacting the income statement, as these loans have either been written off completely or on a net basis” full provision”. It will also free up management time to move the business forward rather than dealing with legacy roles, he said, as ADCB has been hit by the collapse of several companies in recent years.

The most notable of these failures was Abu Dhabi’s NMC Health PLC, which admitted in 2020 to “substantially misrepresenting the debt profile of its financial accounts,” according to ADCB’s annual report. The bank supported the motion to bring NMC Health into administration and blamed the company and its associated entities for most of the impairments. ADCB declined a request for comment.

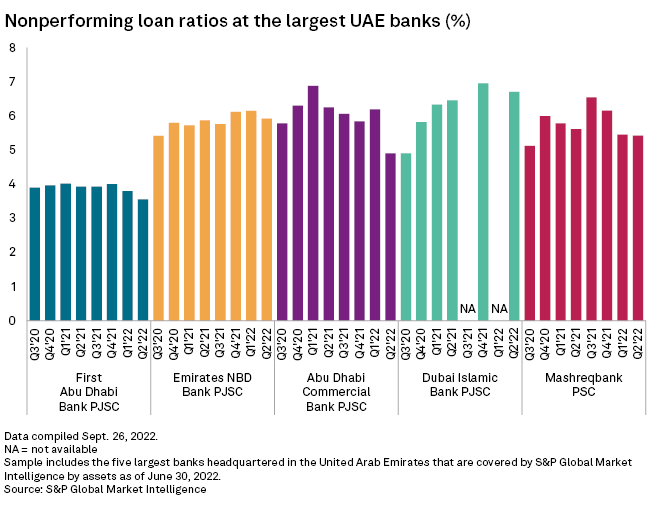

S&P Global Market Intelligence data shows the bank has made progress in reducing its non-performing loan ratio, which stood at 4.91% in the second quarter, compared with 6.19% in the previous quarter and 6.26% in the same period a year earlier.

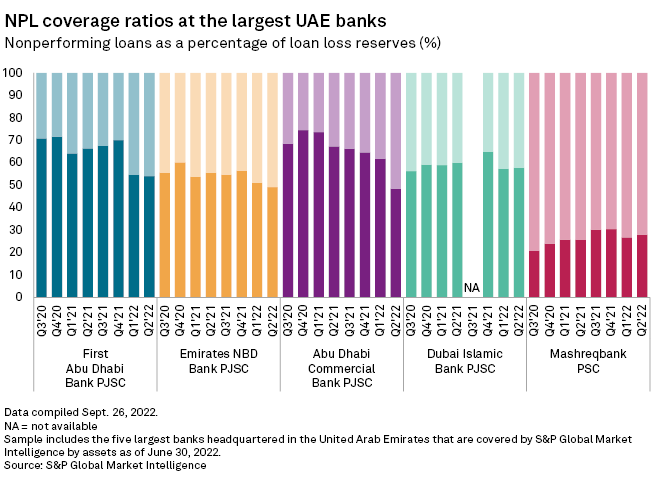

ADCB’s non-performing loan coverage ratio in the second quarter was 48.5%, lower than peers First Abu Dhabi Bank PJSC, Emirates NBD Bank PJSC and Dubai Islam Bank PJSC.Of the five largest banks in the UAE, only Mashreqbank PSC has a NPL coverage ratio lower than ADCB Period was 27.9%.

increased risk

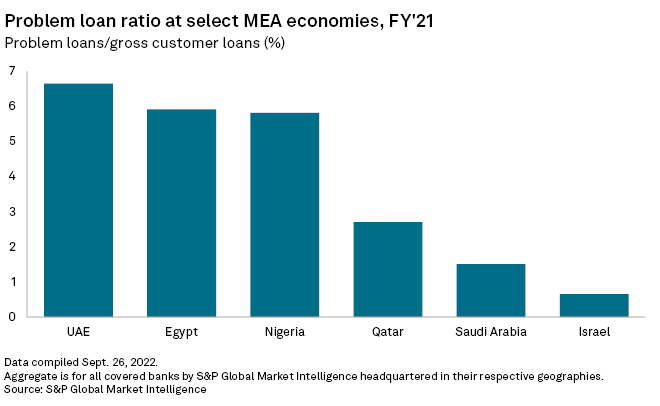

Market intelligence data shows that the UAE has a higher problem loan ratio than many major Middle East and African economies.

According to S&P Global Ratings, UAE banks face very high credit risk, given the industry’s aggressive lending and underwriting practices and its structurally high concentration in the real estate and construction sectors. Loan portfolios are often concentrated in one name, and banks also have significant exposure to some troubled government-linked entities, the agency wrote in a July report.

The credit losses of UAE banks have historically been higher than in other GCC countries, although the strength of the economy means that new non-performing loan formation is fairly limited, Meijer said. Ratings forecasts that third-stage (or non-performing) loans of UAE banks will be 5.8% to 6.2% in 2022-23, compared to 6.1% at the end of last year.

Dervin said the business case for banks to sell bad loans was compelling. “Assuming the sale price is higher than the write-down value, you can not only improve your financial performance, but you can also get out of the capital constraints associated with bad loans,” he said.

The discount a buyer might expect to receive from the face value of a non-performing loan depends on the specifics of the loan in question, as well as external factors such as the jurisdiction and the strength of the enforcement regime in that jurisdiction, Dervin said.

Regulatory challenges

One”According to a July report by law firm Mayer Brown, a “historically unhelpful legal system” and “negative attitudes towards financial distress often lead to a recliner reshuffle” are the keys to the slow development of the UAE’s distressed debt market factor.

The UAE’s recent mortgage laws and civil codes allow the concept of assignment – where a third party has title to an existing debt – but it is not often used and the requirements are not “particularly clear,” writes Mayer Brown.

Instead, dMortgage debt buyers who lack a local lending license typically act in the market through “participation” in which the buyer acquires rights to the debt, but the seller remains its legal owner.

“It’s not unique to the region as a mechanism. It’s a feature of developed markets when buyers and sellers transact in this way simply because they don’t want to make it public,” Devin said, adding that in some In some cases, a lender’s ability to exit a position may be limited by original loan documents or other regulatory considerations.

U.S. or European distressed debt funds considering buying NPL portfolios in the Middle East must analyze all regulatory challenges before considering a deal, Rainey said.

“If you’re buying a bad loan, there’s a potential regulatory issue with whether you can hold such a loan, because the business of lending, including holding loans originated by third parties, is generally considered a regulated activity,” said Rainey.

brighter future

Mayer Brown noted that considerable progress has been made in overcoming these problems in recent years, including the introduction of a new corporate insolvency regime.

In early 2020, India and the United Arab Emirates agreed to allow UAE court rulings on loan defaults to be enforced in India. Historically, loans in the UAE have been secured by the normally required guarantees and post-dated cheques, but recent legal changes have enabled creditors to secure debtors’ liquid assets such as bank accounts and inventory receivables, Rainey said.

Rainey noted that for the ADCB sale, lenders may want to obtain approval from the UAE Central Bank before closing the deal. A positive result could give other banks and investors more confidence to pursue similar deals in the future.

“As the regulatory, recognition and legislative regime improves, the prospects for recovery increase and therefore the potential attractiveness and viability of the market increases,” Devin said.

As of October 25, 1 US dollar is equivalent to 3.67 UAE dirhams.

[ad_2]

Source link