[ad_1]

key insights

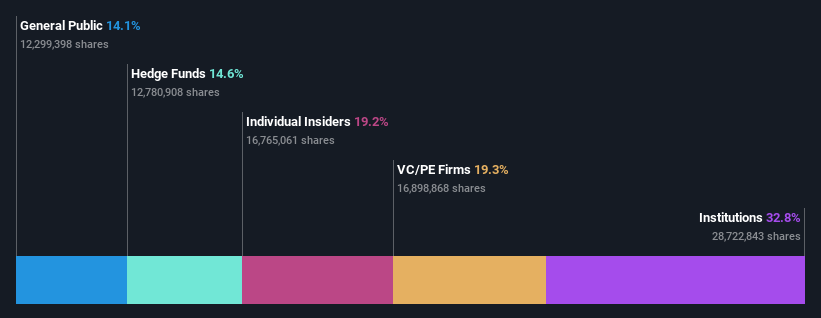

- Extremely high institutional ownership means that Accel Entertainment’s share price is sensitive to its trading behavior.

- The top 6 shareholders hold 54% of the shares

- Insiders have been selling lately

Each investor in Accel Entertainment, Inc. (NYSE ticker: ACEL) should know the most powerful shareholder group. We can see that institutions hold the majority of the company with 33% ownership. In other words, the group faces the greatest upside potential (or downside risk).

Given the disappointing one-year return of 25% for institutional investors, last week’s 6.6% jump in shares was worth it.

Let’s take a closer look at what different types of shareholders can tell us about Accel Entertainment.

Check out our latest analysis for Accel Entertainment

What does institutional ownership tell us about Accel Entertainment?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to the companies that are included in the main index.

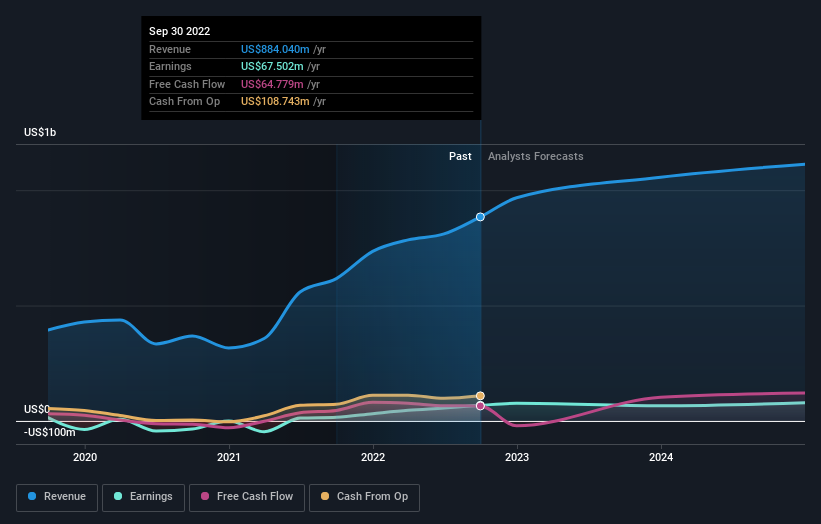

Accel Entertainment already has a body on the share registry. In fact, they own a sizeable stake in the company. This can indicate that the company has some credibility in the investment community. However, it is best not to rely on hypothesis validation from institutional investors. They too, sometimes get it wrong. If multiple institutions change their views on a stock at the same time, you could see the share price drop rapidly. As such, it’s worth checking out Accel Entertainment’s earnings history below. Of course, the future is what really matters.

Our data shows that hedge funds own 15% of Accel Entertainment. This is notable because hedge funds are often very active investors who may try to influence management. Many want to see value creation (and higher stock prices) in the short or medium term. Looking at our data, we can see that the largest shareholder is Clairvest Group Inc. with 19% of outstanding shares. Meanwhile, the second and third largest shareholders hold 9.9% and 8.5% of the issued shares, respectively. The second largest shareholder, Andrew Rubenstein, also happens to be in the title of CEO.

We did some more digging and found that 6 of the major shareholders make up about 54% of the register, which means that in addition to the major shareholders, there are also some minor shareholders, thereby balancing each other’s interests to a certain extent.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiment to see which way the wind is headed. There are plenty of analysts covering this stock, so it’s worth checking out their forecasts as well.

Insider Ownership of Accel Entertainment

While the precise definition of an insider can be subjective, nearly everyone considers board members to be insiders. Company management runs the business, but the CEO will be accountable to the board, even if he or she is a member of the board.

I generally think insider ownership is a good thing. In some cases, however, it is more difficult for other shareholders to hold the board accountable for decisions.

Our latest data shows that insiders own a reasonable percentage of Accel Entertainment, Inc. . The company’s market capitalization is just $836 million, and insiders hold $160 million worth of shares in their names. We’d say this shows alignment with shareholders, but it’s worth noting that the company is still small; some insiders may have started the company.you can Click here to see if these insiders have been buying or selling.

General public ownership

With 14 percent ownership, the public, consisting mostly of individual investors, wields some sway over Accel Entertainment. While ownership on this scale may not be enough to turn policy decisions in their favor, they can still have a collective influence on company policy.

private equity

The private equity firm owns 19 percent and can influence Accel Entertainment’s board. Sometimes we see private equity for a long time, but generally they have shorter investment horizons and – as the name suggests – don’t invest much in public companies. After a while, they may look to sell and redeploy capital elsewhere.

Next step:

It is always worth considering the different groups that own shares in a company. But to understand Accel Entertainment better, we need to consider many other factors. For example, consider risk.Every company has it, we found 2 warning signs for Accel Entertainment You should know.

finally the future is the most important. You can access this free Reports on analyst forecasts for companies.

Note: Figures in this article are calculated using data from the trailing 12 months, which refers to the 12-month period ending on the last day of the month on which the financial statements are dated. This may not be consistent with the annual reported figures for the full year.

Valuation is complicated, but we’re helping make it simple.

find out if accelerated entertainment It may be overvalued or undervalued by viewing our comprehensive analysis, which includes Fair value estimates, risks and caveats, dividends, insider trading and financial health.

Have feedback on this article? Concerned about content? keep in touch Contact us directly. Alternatively, email the editorial team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only an unbiased methodology to provide reviews based on historical data and analyst forecasts, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no positions in any of the stocks mentioned.

[ad_2]

Source link