[ad_1]

kiwi fruit

Where is the action in the investment community? Look for market disruptions caused by changing tastes, technological advances and overheated competition in media and entertainment.

More specifically, let’s review the fortunes and prospects of three public companies in the industry: Paramount Global (for), Netflix (NFL) and world wrestling entertainment (wwe).

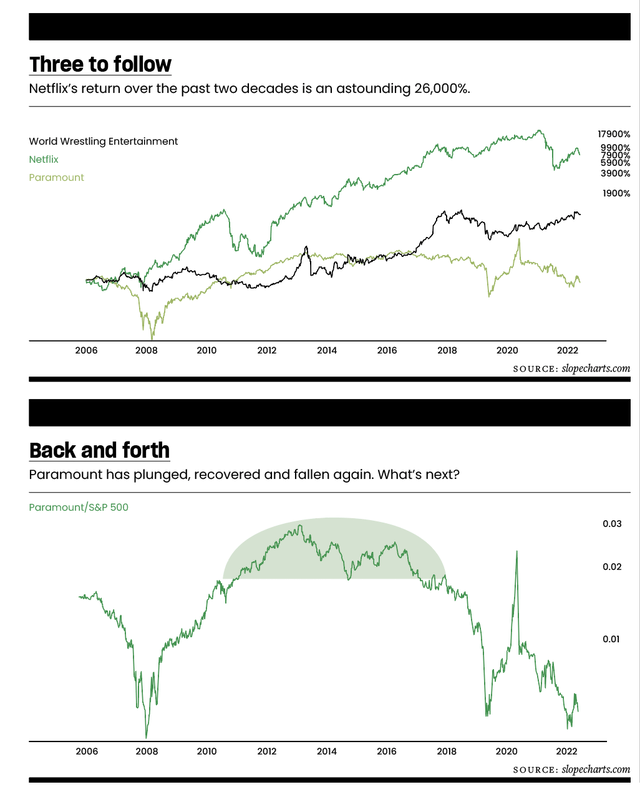

The easiest way to compare the three is using a percentage chart, and we can start with the year of the most recent IPO.as the picture shows Three follow, leave, To illustrate, Netflix is by far the biggest percentage winner, Paramount is the weakest, and WWE is in the middle.

This type of chart shows at a glance which companies have been strong or weak over time, but doesn’t necessarily reflect the recent strength of a particular security.

most important

use different ways To compare the three stocks, the ratio chart back and forth, turn left, Shows each divided by a consistent, independent price history – in this case, the S&P 500 Cash Index. This normalizes the graph and shows the security’s history. It provides insight into the strength of each stock compared to the general market.

The weakest, Paramount, went public in early 2007. Over the next 16 years, it returned about 0%, which is pretty bad in a generally strong market.

The stock fell even more than the broader market in 2007 and 2008, rebounded strongly by 2013, and has been weak since.

Even though this is a ratio chart, patterns such as domes still apply. The sharp, brief spike seen during the COVID-19 crisis — likely due to the popularity of streaming during lockdowns — has dissipated, returning the stock to deep underperformance.

new blockbuster

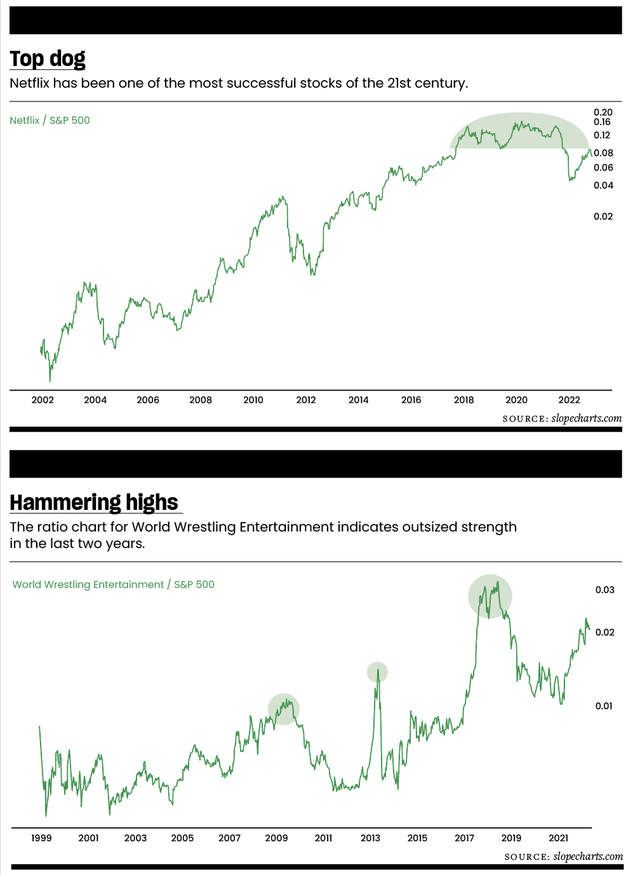

Netflix, one of the most successful stocks of the 21st century, went public in mid-2002 and returned a whopping 26,000% even after a devastating decline in 2023.

However, despite the astonishing performance, the stock has actually formed a terrifyingly bearish pattern over the past five years, judging by the 2018 ratio chart Top dog, right.

It’s not visible on the original price chart, but the chart shown here shows a huge top formation, a sharp drop and then back to resistance. Netflix seems to be very vulnerable.

full body punch

World Wrestling Entertainment has underperformed Netflix over the years, but shows super strength in its ratio charts, as Hammer the highs, yes. The green areas of the graph represent power peaks.

Compared to the broader market, the stock appears to be hammering out a steady series of lows and highs — the most basic definition of an uptrend.

The stock’s 650% return pales in comparison to its 26,000%, but World Wrestling Entertainment has been strong recently and its uptrend could remain in place long-term.

medium change

Don’t take anything in the entertainment world for granted. In the 1990s, the famous Blockbuster video rental chain ignored the threat of a company called Netflix, which sealed DVDs in small red envelopes and mailed them to subscribers. By the time Blockbuster took its new competitor seriously, it was too late.

But disruption doesn’t always require a better business model. Sheer opportunity can make a difference. As mentioned, COVID-19 gave Paramount a short-lived boost, and the stock price was quick to reflect that.

The point is, investors shouldn’t just focus on a stock’s raw price, or even its comparative performance. Instead, they can look at securities through an additional lens, in this case, relative performance against a broad index. That way, they can tease out a stock’s unabashed behavior compared to its peers.

This article is provided by Luckbox Magazine.

[ad_2]

Source link