[ad_1]

tobiasjo/iStock via Getty ImagesUnpublished

Caesars Entertainment (Nasdaq:Czech Republic) is a casino and gaming stock with a market cap of $9.62 billion.it recently released its Q1 2023 Earnings Reported double-digit year-over-year revenue growth due to Increased sports betting, high group attendance and its investments in the digital space have provided tailwinds. Over the past five years, CZR stock has rewarded investors with a 6% return.

Five-Year Stock Trends (SeekingAlpha.com)

Before the pandemic, Caesars invested heavily in group facilities that didn’t yield meaningful returns until this quarter. Additionally, the company has seen growth in both physical and digital entertainment. Management has been working to reduce debt levels, divest unprofitable businesses, and invest in the growing online entertainment segment to improve overall performance.With high margins, double-digit growth, and positive free cash flow, investors may want to consider the prospects of this well-known brand In the hospitality and gaming industry, there is an ever-increasing number of in-person and online visitors.

overview

Caesars is a major player in the gaming industry with 51 hotels in 16 states. They provide gaming and hospitality services, owning, branding, leasing or managing a total of 52,100 electronic gaming tables, slot machines, video lottery terminals, 2,800 table games and 47,200 hotel rooms. In addition, Caesars has made significant investments in the digital space through the Caesars Sportsbook, Caesars Racebook and iGaming mobile applications. Their competitive advantage lies in their strong US presence and global brand recognition.Since 2005, the company has grown through major acquisitions, including the most recent £2.9 billion Acquisition of William Hill PLC in 2021.

business portfolio (Caesar Net)

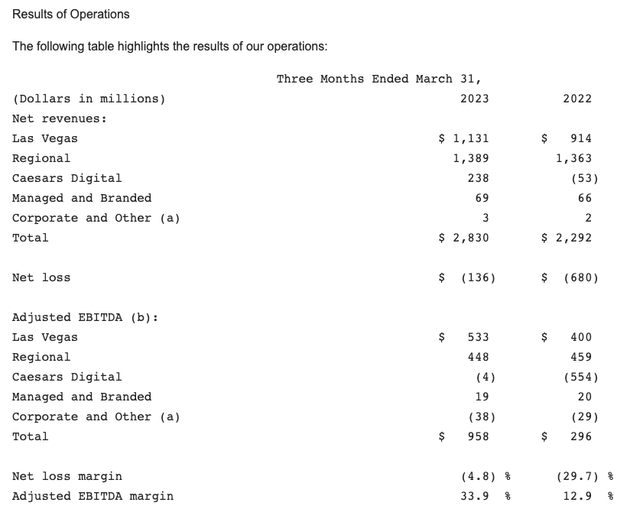

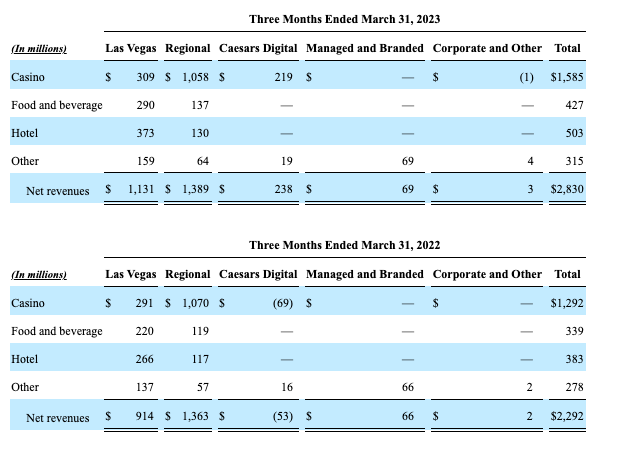

Caesars generates revenue through four segments: brick and mortar stores in Las Vegas and the area, Caesars digital division (including retail and mobile sportsbooks, online casinos, poker and horse racing), management and branding (from real estate and local and international brand use permissions). Caesars had a strong first quarter of 2023 and expects continued success due to increased group attendance, sports betting tailwinds and digital expansion strategy.

Market Segments in Q1 2023 vs. Q1 2022 (sec.gov)

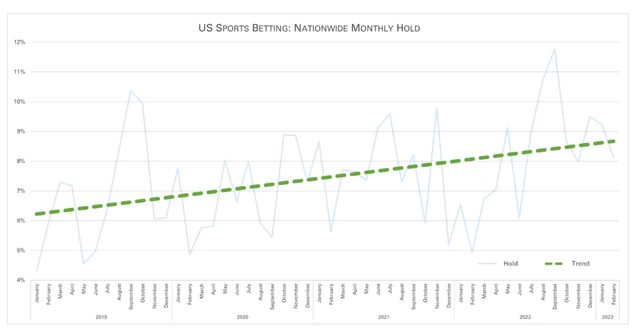

Sports betting is a long-term tailwind for the gaming industry.It’s been five years since the regulated sports betting market opened, and it’s now possible to 36 states, Three more are expected this year.Sports betting is on the rise, with operators raking in $7.6 billion in 2022, forecasts suggest it could $20 billion 2023.

US Sports Betting Monthly (Legalsportsreport.com)

Additionally, the number of group events is increasing, and Caesars is capitalizing on the facilities it invested in pre-COVID. Group attendance accounted for 21% of rooms occupied in the first quarter, which was related to group segment room, ADR and banquet revenue, while bookings continued to increase for the remainder of the year. The management team expects record business for the group in 2023. Additionally, management believes its EBITDA could reach $5 billion by the end of 2025.

Q1 Earnings Highlights

Caesars is off to a strong start to fiscal 2023; its revenue rose 24% YoY to $2.83 billion, net loss shrank 70% YoY to negative $136 million, and EPS improved to a loss per share of $0.63 compared to a loss per share in Q1 2022 $2.11. We can see that in all segments, net revenue increased year-on-year, but regional revenue decreased year-on-year due to adverse weather conditions affecting tourist numbers.

Q1 2023 vs. Q1 2023 (sec.gov)

Looking at the earnings history for each quarter, we can see that Caesars has beaten estimates in terms of EPS and revenue for the past five quarters.

Quarterly Earnings History (SeekingAlpha.com)

Caesars has healthy leveraged free cash flow of $1.26 billion, based on the latest figures for the last 12 months. However, leveraged free cash flow turned negative in the first quarter of 2023, totaling negative $114.9 million, due to the large debt payments.

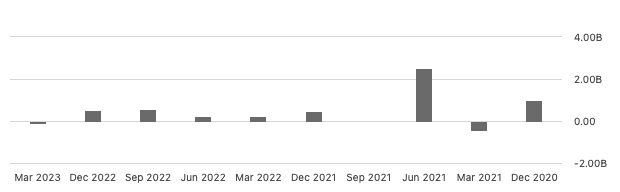

Quarterly Leveraged Free Cash Flow (SeekingAlpha.com)

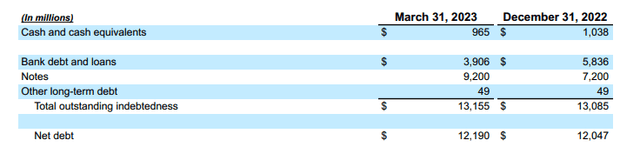

When examining the balance sheet, it is clear that the company currently has a significant amount of outstanding debt. It’s worth noting, however, that the company has been aggressively reducing its debt by $1 billion per year for the past two years, with a view to continuing this trend going forward. As of March 31, 2023, the company’s net leverage was 4.2x based on its bank credit facilities.

Valuation

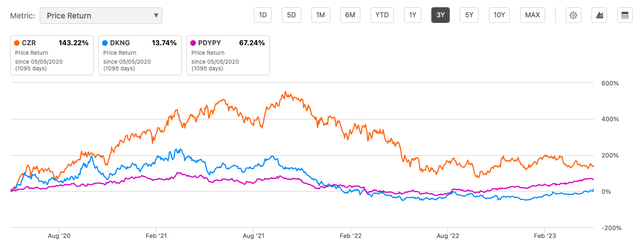

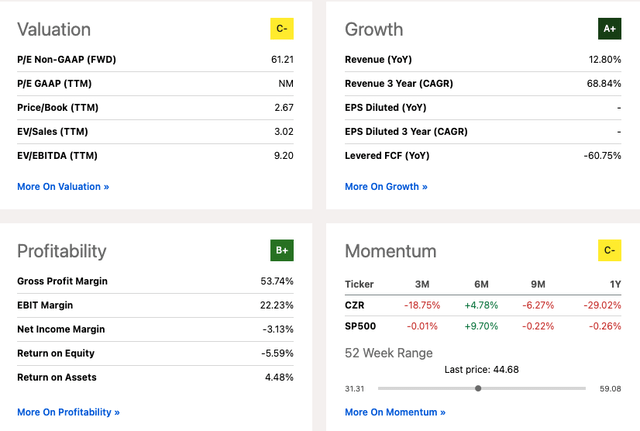

Analysts are generally bullish on Caesars, with an average price target of $70.33, well below the current share price. Compared to other bookmakers over a three-year period, holding CZR stock has proven more profitable with a return of 143.22%. However, over the past year, the stock has experienced a decline in value, falling 29.02%.

Price return compared to peers (SeekingAlpha.com)

The stock is valued at C-, based on Seeking Alpha’s Quant rating. The price-to-book ratio of 2.67 may seem high, but it is lower than competitors DKNG (11.15) and PDYPY (2.79). Moreover, the company boasts an impressive three-year CAGR of 68.84% and a gross margin of 53.74%. Its EBITDA is expected to reach $5 billion by the end of 2025, making it an attractive investment opportunity. However, it’s worth noting that the stock has underperformed the S&P 500 over the past year.

quantitative rating (SeekingAlpha.com)

risk

Caesars is classified as a consumer discretionary stock that could be affected by a recession. The company’s performance could suffer, especially since it has accumulated significant debt from past acquisitions. If Caesars were unable to meet debt obligations due to poor performance, it could cause major problems. Nonetheless, the company has managed to reduce its debt intake over the past two years.

final thoughts

This past quarter, Caesars’ financial performance improved significantly compared to the previous year. The company is benefiting from investments in group facilities and digital expansion, as well as increased visitor numbers to its brick-and-mortar stores, especially in Las Vegas. While it is important to remain cautious with economic markets, there are encouraging signs of growth in sports betting demand forecasts and group bookings. Additionally, management has committed to reducing its annual debt by $1 billion and expects underlying EBITDA of $5 billion by the end of 2025. Given these factors, investors might want to consider bullish on this company.

[ad_2]

Source link