[ad_1]

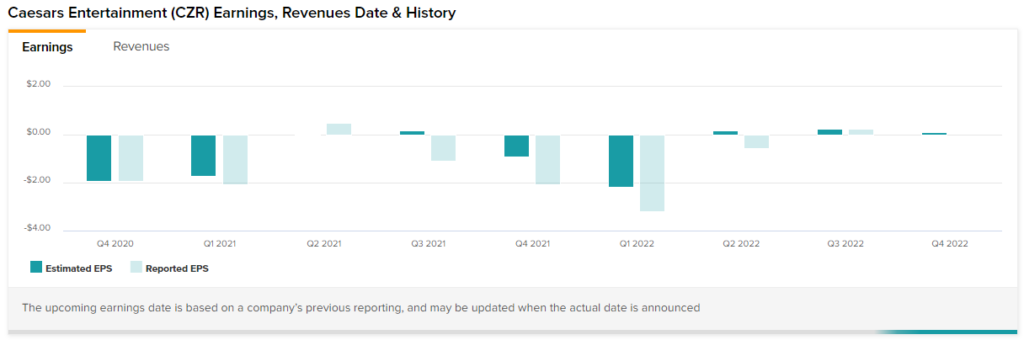

It’s been a year of ups and downs for Caesars Entertainment (NASDAQ: CZR), as the gambling giant sees progress and setbacks almost equally. The company surged 6.8% in premarket trading after the earnings report, but has since clawed back some of its gains.The company reported EPS of $0.24, just Beat estimates, $0.23 per share.

As for revenue, Caesars brought in $2.89 billion in the quarter. Not only did that beat the consensus estimate of 1.7%, but it also beat the figure for this time last year. The company brought in $2.69 billion at the time.

The Caesars may be a little narrower, but it’s still a win. Caesars also made some uplifting news that, in addition to the digital victory, helped make for a more optimistic proposition. I have been bearish on casino stocks in the past.

Still, after seeing how well Caesars is doing this quarter, I think I’m going to have to come back. I’m neutral on Caesars and most other casino stocks because they’ve had notable results despite some major issues. Their odds of continuing to weather the storm — possibly even a worsening one — may be better than some expected.

Is Caesars Entertainment Stock Worth Buying?

Turning to Wall Street, Caesars has a Strong Buy consensus rating. This is based on nine buys and one sell allocated over the past three months. Caesars’ average price target is $69.20, implying an upside potential of 46.24%. Analysts’ price targets range from a low of $27 a share to a high of $102 a share.

Most investor sentiment indicators are currently mixed. E.g, Retail investors on TipRanks are turning around The numbers are small but growing and the sentiment is now considered “very negative”.

However, hedge funds are starting to pour in.them Increased holdings of 656,600 shares in the last quartersuggesting that hedge fund sentiment is turning “very positive.”

The raw data also gives Caesars a good performance. Revenue increased in three of the past four quarters, from $2.59 billion in December 2021 to $2.29 billion in March 2022.

It increased to $2.82 billion in June 2022 and then to $2.89 billion in the most recent quarter. The company’s adjusted EBITDA also rose significantly, reaching $1 billion in the most recent quarter.

Caesars’ debt levels have been fairly stable over the last year, when it held nearly $26 billion. Additionally, total liabilities have been declining for the past three quarters, from $33.49 billion in December 2021 to $32.96 billion in June 2022.

Overcoming adversity in a poor macroeconomic environment

Caesars did a great job; there are no two ways. Earnings and income are coming with victory, debt and liabilities are falling, and there is more to come.

For example, the report noted that Caesars’ digital gaming business turned a profit for the first time in the quarter. That’s actually a year ahead of when Caesars expected them to be profitable.

The company has been rapidly adding new locations where digital betting can work. Caesars just launched its sports betting app in Ohio about five days ago, although legal sports betting won’t begin until January 1, 2023.

Also, Caesars is sabotaging some of the sell-off plans. Previous plans to sell the Las Vegas Strip resort have been scrapped. Caesars CEO Tom Reeg noted that the market was “unfavorable” for the sell-off and that cash flow from relevant locations was improving. Reeg didn’t notice which properties in Caesars might have been for sale. Either way, it does a better job.

Conclusion: everything gets better

Adding all the available information together shows that Caesar’s situation is much better than expected. Its online business has improved to the point of turning a profit a year early. The planned sell-off was interrupted by the increase in volume. Debt is managed, liabilities are falling, and overall, Caesars has a bright future.

Of course, there is a shadow of macroeconomic doubts ahead. After all, inflation is still a nightmare, but we’ve had “nightmare”-level inflation for a few months now, and it doesn’t seem to slow Caesars down a bit.

Granted, things could get worse for Caesars—and if people start losing jobs in large numbers. The cash available to spend at the casino will then decrease accordingly.

However, the labor market is still considered “tight” in several respects. In this case, mass layoffs are almost absorbed by surpluses in other economies for a period of time.

That’s why I’ve turned neutral on Caesars and casino stocks. Even during the Great Depression, gambling remained a major industry. As it also becomes an increasingly legal industry, the dream of winning the jackpot may still drive earnings across the industry.

[ad_2]

Source link