[ad_1]

Marcin_P_Jank

paper

Personally, I like investing in companies in the gambling industry because it’s an addictive product and the games are designed to give the casino an edge so they don’t lose money on the game. long-distance running. This leads to a way in which even bad management teams can achieve good results.

Unless the management team is downright incompetent, House Advantage should result in a business that generates strong and steady free cash flow. Caesar (Nasdaq:Czech Republic) is one of the biggest names in the industry with a lot of quality assets but is struggling with debt and poor capital allocation. So I would take a watch and wait approach to see if they can improve and turn the business around.

analyze

Caesars Entertainment First Quarter Results

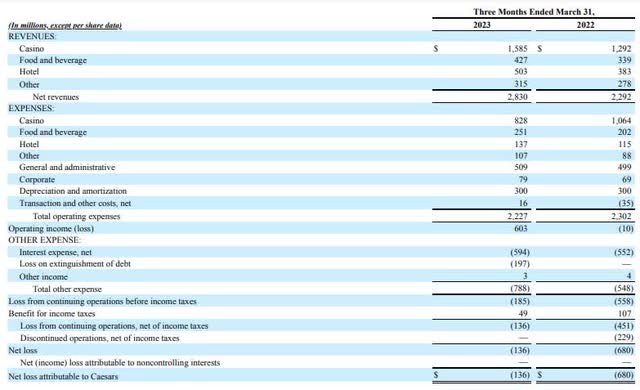

caesar posted its first quarter results They were very good last week. Net income increased by 23.5% year-on-year, and expenses decreased by 3.3% year-on-year.Revenue improved due to lifting of COVID restrictions and resulting impact high occupancy rate 95%, compared to 83% the previous year. Due to the high demand, hotels can attract higher value customers.

The drop in spending may seem good at first glance, but it’s mostly because digital businesses generated a lot of advertising costs in the first quarter of 2022, and those costs were down in the final quarter. So when we look at other non-casino spending, we’re seeing small increases almost everywhere, obviously also due to inflation.

Nonetheless, operating results for 2023 are positive, showing year-over-year improvement. But then comes interest expense, which is a problem and leads to a net loss. $552 million in 2022 and $594 million in 2023.

Caesars Entertainment First Quarter Results

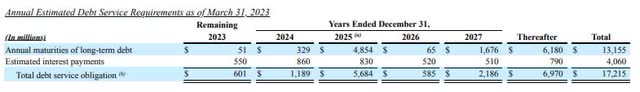

Interest payments are up because some debt is variable and therefore increases as interest rates rise, VICI leases are also based on CPI. In terms of long-term debt maturities, a significant portion is due in 2025. However, management is really focused on deleveraging, with a goal of reducing $1 billion in debt in 2023 and hoping to do the same in 2024 and 2025. So I think debt, being the most obvious issue, shouldn’t be a major issue as the company will likely return to a healthy net leverage ratio going forward.

Under normal circumstances, FCF should be sufficient to pay down debt quickly and, once the mission is complete, return cash to shareholders through buybacks or dividends. The digital division is also almost entirely self-funded, and the launch of the I-Casino app in Q3, as well as the digital division as a whole, should further boost FCF going forward.

growth opportunity

Overall, the company has many opportunities for future growth. Second-quarter expansions at Harah’s Hoosier Park and New Orleans, as well as temporary facilities in Danville and Columbus, should drive further growth. The digital segment and its sports betting and casino offerings also have plenty of room to grow.

However, it’s important to realize that the gaming market, especially digital, is highly competitive. Still, expansion should have a positive impact on revenue, and higher online gaming revenue does help improve margins going forward. Together, these two catalysts should lead to positive results in the coming quarters. The I-Casino app was also able to really improve business metrics in the third quarter and provide Caesars with a more favorable business outlook. After debt reduction, my first priority is to use capital as efficiently as possible.

Competitive Advantage

I think Caesars has some competitive advantages in the brick-and-mortar casino space because of their brand and the fact that they have the largest loyalty program in the industry. This can also be very useful for their online marketplace as they can take advantage of this.

capital allocation

I think capital allocation is the biggest problem right now. The 5-year annualized ROI is only 2.84%, a clear indication of inefficient capital allocation in the past. And this problem existed before COVID. However, return on capital may increase a bit in the near future, and I could see them hitting a 5-year average in the 6-8% range over the next few years.

Some of their competitors have ROICs in excess of 20%, allowing them to reinvest capital more efficiently for faster growth and higher profits. Since I’m one of those people who believes that long-term returns follow capital returns, I’d say this is a bad situation for Caesars because they really need to improve ROIC. They have a lot of investment opportunities, but they need to get a decent return on them, and the ROIC of 2.84% is below the cost of capital. To create value, ROIC needs to be higher than the cost of capital. Even if they increase the ROC to 6-8%, this is only slightly above the cost of capital and would result in a very poor return on capital.

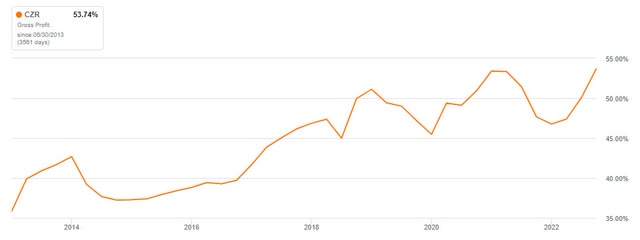

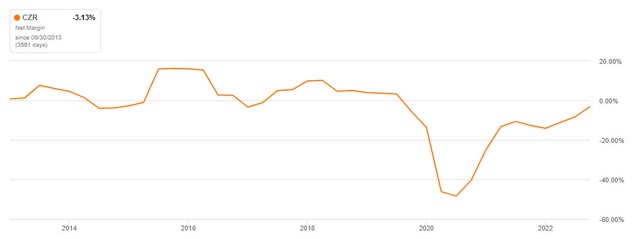

However, there are clear signs of improvement as gross margins have improved over the past 10 years. While net margins have been hit hard by COVID, this should be temporary as they are on an upward trend and should be in line with historical margins on a normalized basis.

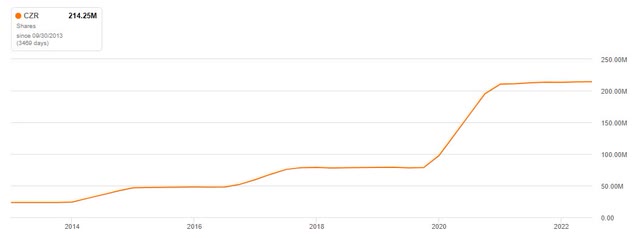

Another important issue is that the increase in outstanding shares leads to dilution of existing shareholders, so future buybacks are important for shareholders. But the first priority is to reduce debt.

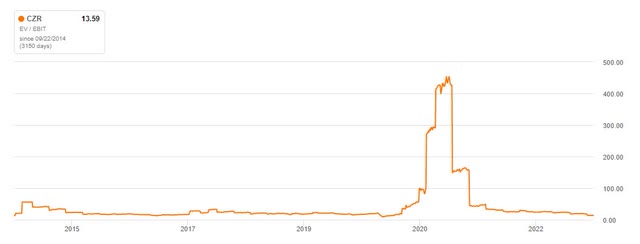

Since I believe EV/EBIT is a good measure of whether Caesars stock is overvalued or undervalued, I believe they are currently fairly valued at 13.59x, roughly in line with historical EV/EBIT.

in conclusion

Caesars, like most of its competitors, has been hit hard by COVID restrictions, so some industry players look like a turnaround story. But Caesars had all the ingredients for future success: a well-known brand and a highly addictive product in a market protected by barriers to entry. And I’d say their loyalty program is probably one of their best assets due to the sheer number of participants. Also, I think the debt issue will be temporary as they have enough cash flow to pay off most of their debt fairly quickly. But I think low return on capital will be a problem going forward. This is really something they need to improve on.

Efficient use of capital does improve future prospects, but based on current data, I think they are in the low single digits of future annual total returns over the long term.

[ad_2]

Source link