[ad_1]

JHVE Photos

Canadian media and entertainment company Corus Entertainment’s (OTCPK:CJREF) before the most recent fourth quarter renew Surprisingly, headwinds from a macroeconomic slowdown and lingering post-COVID-19 fallout led to a larger-than-expected downward revision in TV ad revenue.also Corus’ channel business is also facing long-term competitive pressure from streaming players to move into the ad-supported tier amid near-term pressures in the ad market. It also doesn’t factor in a recession (increasingly likely after this week’s Fed meeting), which will almost certainly drive another revision to consensus estimates for fiscal year 23/24.

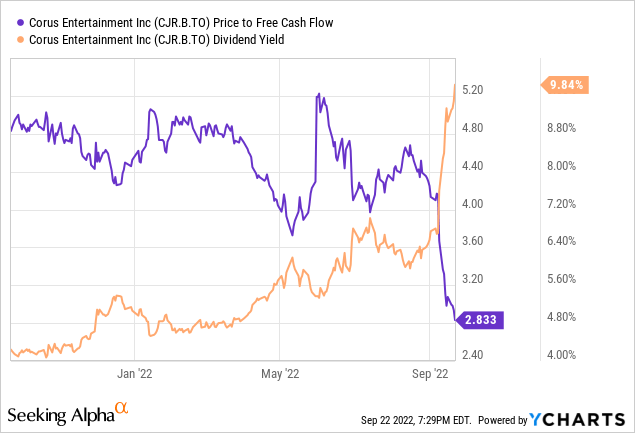

In conclusion, challenged fundamentals mean this is a cheap stock. However, the valuation case may be too strong to ignore, with its FCF yield (as a % of market cap) currently over 40%. Additionally, management has been aggressively investing in capital returns, implementing an aggressive buyback program and a high single-digit dividend yield (backed by a low 20-25% payout ratio). While there are few upside catalysts on the horizon, patient, long-term-oriented investors willing to hang on should do well over time.

Negative update points to challenging quarter ahead

Corus recently disclosed a negative operational update, citing a complex macro environment and the lingering impact of the COVID-19 pandemic. “Meaning year-on-year softness” in its fourth-quarter TV ad revenue. Consistent with previous comments, spending in the automotive, health and beauty, and travel end markets remained the main sources of weakness.

While the nature of the current headwinds isn’t surprising, the magnitude of the latest downward revision is surprising, especially given previous attempts to revise expectations lower. The recent macroeconomic slowdown and the prospect of a recession appear to have had a more severe impact on the fourth-quarter numbers than previously expected, especially on the advertising side of the business. It makes sense to me — in times of economic weakness, marketing budgets are often the go-to area for spending cuts. The earlier-than-expected pullback also poses a significant downside risk to guidance beyond the fourth quarter, so the near-term outlook for fundamentals is unconvincing.

Think about the profit and loss impact

The flow-through effect of advertising revenue on profit and loss, especially in brand advertising (versus performance advertising), can be very significant. Down from a high of $967 million in fiscal 2019, TV ad revenue has lagged pre-COVID-19 levels and looks set to slip further from an already low FY22 base. While the recent rebound in travel and ad spending, especially as supply chain issues on the automotive side ease, may bring some relief, visibility into these improvements is limited. It’s also unlikely to make up for a pullback in advertising budgets.

With little leverage on the revenue side, management may need to rely on cost adjustments, primarily on the programming side, to mitigate some of the EBITDA impact. That will take time, though, and in the near term, it is unlikely that there will be enough flexibility to adequately protect margins. Additionally, mid- to long-term threats from large streaming players such as Netflix (NFLX) and Disney (DIS) roll out Ad-supported layer That will need to be addressed (possibly by strengthening content investments and digital offerings), which could further impact P&L.

Cash generation and capital return potential across the cycle offers a silver lining

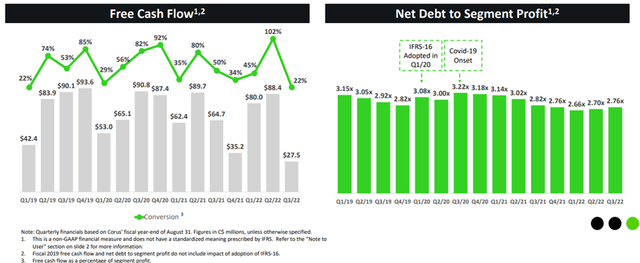

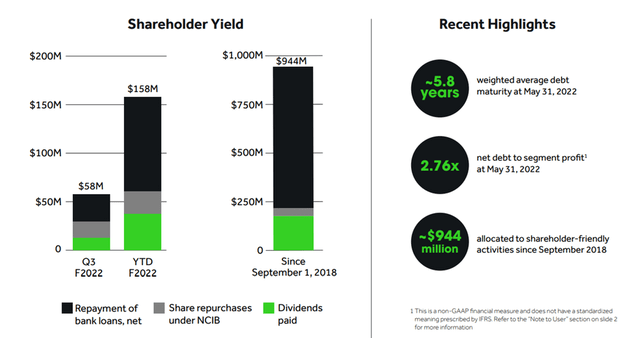

While the near-term outlook for fundamentals is bleak, and there are few upside catalysts to trigger a meaningful recovery in the share price, Corus has plenty of room to grow in terms of valuation. Its cash generation has been generally strong throughout the cycle, driving an improved balance sheet position, with FCF yields in excess of 40% following the most recent drawdown.

The added capacity allows for more buyback activity, and management’s decision to stick to an aggressive buyback program underscores its belief that the stock is undervalued. If the stock continues to weaken and enter a potential recession, my base case is for management to further strengthen buybacks. In addition to repurchases and debt repayments through FCF, Corus maintains an attractive dividend (now yielding >9%). Since dividend payments are also in the 20%-25% range, yields are likely to be sustainable under most economic scenarios; in my opinion, the company has enough cost leverage to sustain even in a worst-case scenario required free cash flow.

Attractive valuation case outweighs near-term headwinds

Corus’ latest guidance reset could be a harbinger of what’s to come. Due to current macro challenges (inflation and rising interest rates), advertisers are cutting spending and end consumer demand is weakening. In the near term, it’s hard to see an upward revision here, while long-term fundamentals depend on management’s ability to navigate a rapidly changing media environment to achieve its sustained year-over-year revenue growth goals. I’m not particularly bullish on the latter, but neither is the market — Corus stock is currently yielding over 40% FCF. Also, the high single-digit dividend yield (low payout ratio) is attractive even as interest rates rise. Combined with aggressive buybacks, total shareholder returns are about the same as Corus shareholders. At this juncture, investors will need a high pain threshold to own the name, but those willing to stick with it should do well over time.

[ad_2]

Source link