[ad_1]

While this may not be enough for some shareholders, we think it’s good to see dave and buster entertainment (Nasdaq: Play) shares rose 16% in a single quarter. But that doesn’t change the fact that the past five years’ returns have been subpar. After all, shares were down 20% at the time, significantly underperforming the market.

While the stock is up 6.0% over the past week, long-term shareholders are still in the red, so let’s see what the fundamentals tell us.

Check out our latest analysis for Dave & Buster’s Entertainment

To paraphrase Benjamin Graham: In the short run, the market is a voting machine, but in the long run it is a weighing machine. A flawed but reasonable way to assess how company sentiment is changing is to compare earnings per share (EPS) to the stock price.

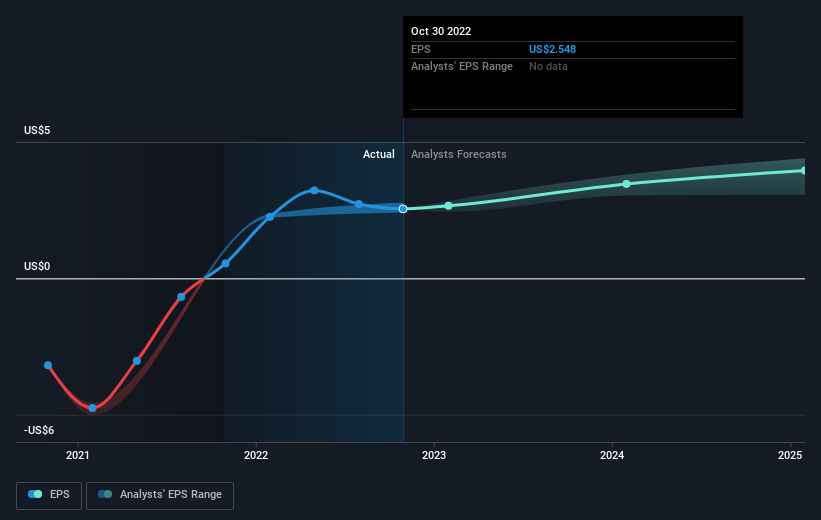

Dave & Buster’s Entertainment’s earnings per share (EPS) have declined 1.1% per year over the five years the stock has fallen. The decline in earnings per share was less than the 4% annual decline in the stock price. So the market seemed to be overconfident about this business in the past.

The company’s EPS (over time) is shown in the chart below (click to see exact figures).

It’s probably worth noting that we saw a lot of insider buying last quarter, which we think is a positive. On the other hand, we believe that revenue and earnings trends are more meaningful metrics for measuring the business.Before buying or selling a stock, we always recommend double checking Historical growth trends, available here..

Different perspectives

While losses are never a good thing, Dave & Buster’s Entertainment shareholders can rest assured that their trailing 12-month loss of 3.0% isn’t as bad as a market drop of around 20%. Even more depressing, investors have suffered losses of 3% per year for the past five years. This share price action isn’t particularly encouraging, but at least losses are slowing. It’s always interesting to track stock price performance over time. But there are many other factors we need to consider to understand Dave & Buster’s Entertainment better.Even so, please note Dave & Buster’s Entertainment is showing 1 warning sign in our investment analysis ,You should know…

There are plenty of other companies that have insiders buying stock.you may no want to miss this free A list of growth companies that insiders are buying.

Note that the market returns quoted in this article reflect the market-weighted average return of stocks currently traded on U.S. exchanges.

Valuation is complicated, but we’re helping make it simple.

find out if Dave and Buster’s Entertainment It may be overvalued or undervalued by viewing our comprehensive analysis, which includes Fair value estimates, risks and caveats, dividends, insider trading and financial health.

Have feedback on this article? Concerned about content? keep in touch Contact us directly. Alternatively, email the editorial team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only an unbiased methodology to provide reviews based on historical data and analyst forecasts, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no positions in any of the stocks mentioned.

[ad_2]

Source link