[ad_1]

although dave and buster entertainment (Nasdaq: Play) shareholders may be generally pleased that the stock hasn’t been doing particularly well lately, with shares down 18% in the last quarter. But that doesn’t change the fact that the past three years’ returns have been very strong. Shares have gone up in that time and are now 215% higher than they were before. It is not uncommon for stock prices to have a slight pullback after a sharp rise. If the business does well over the next few years, the recent decline could be an opportunity.

The past week has proven to be profitable for investors in Dave & Buster’s Entertainment, so let’s see if fundamentals are driving the company’s three-year performance.

Check out our latest analysis for Dave and Buster Entertainment

To paraphrase Benjamin Graham: In the short run, the market is a voting machine, but in the long run it is a weighing machine. One way to examine how market sentiment changes over time is to look at the interaction between a company’s stock price and its earnings per share (EPS).

During the three years in which the stock price rose, Dave & Buster’s Entertainment’s earnings per share (EPS) actually fell 1.9% per year.

Based on these numbers, we believe that the decline in EPS may not reflect well how the business has changed over the years. Therefore, it makes sense to study other indicators.

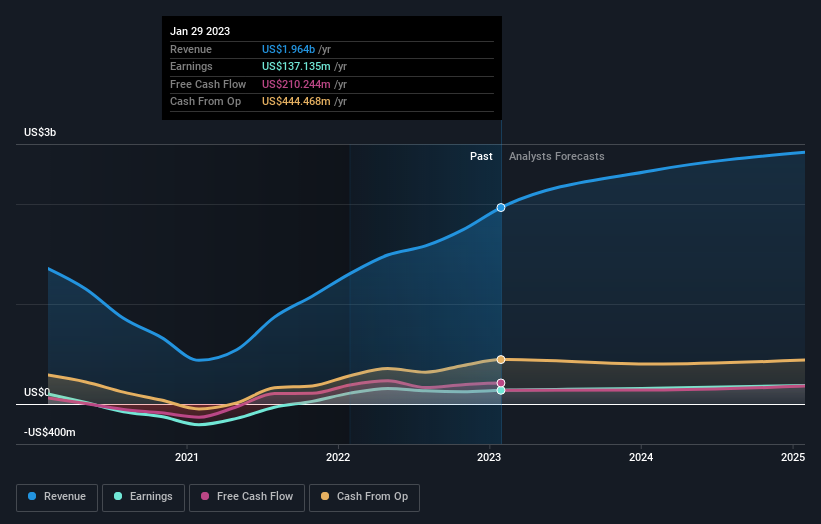

Annual revenue growth of 27% might be seen as evidence that Dave & Buster’s Entertainment is growing. If the company is managed for the long-term benefit, today’s shareholders may be right to own the stock.

You can see in the graph below how income and earnings have changed over time (click the graph to see exact values).

We like that insiders have been buying shares over the past twelve months. Even so, future earnings are more important to whether current shareholders make money.So we recommend checking this free A report showing consensus forecasts

Different perspectives

While the broader market has lost about 0.02% over the 12-month period, Dave & Buster’s entertainment shareholders fared even worse, down 23%. However, this could simply be the share price being affected by broader market panic. Might be worth keeping an eye on the fundamentals in case there’s a good opportunity. Unfortunately, last year’s performance may indicate unresolved challenges, as it was worse than the 3% annualized loss over the past five years. Generally speaking, long-term stock price weakness can be a bad sign, although contrarian investors may want to research stocks for a turnaround. I find it very interesting to look at long-term stock prices as a proxy for business performance. But to really gain insight, we need to consider other information as well. For example, consider risk.Every company has it, we found 1 warning sign from Dave & Buster’s Entertainment You should know.

There are plenty of other companies that have insiders buying stock.you may no want to miss this free A list of growth companies that insiders are buying.

Note that the market returns quoted in this article reflect the market-weighted average return of stocks currently traded on U.S. exchanges.

Have feedback on this article? Concerned about content? keep in touch Contact us directly. Alternatively, email the editorial team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only an unbiased methodology to provide reviews based on historical data and analyst forecasts, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no positions in any of the stocks mentioned.

Join Paid User Research Sessions

you will receive a $30 Amazon Gift Card Take 1 hour of your time while helping us build better investing tools for individual investors like you. register here

[ad_2]

Source link