[ad_1]

A Chinese owner blew himself up, and the stock prices of American social media and auction companies quickly plummeted. The chain reaction may explain the extreme height of global risk assets more than economic contagion.

Although it does not take much investigation to understand why commodities and banks are vacillating in the vortex surrounding Evergrande, the connection between the suffering of lenders and stocks such as Twitter Inc. or EBay Inc. is harder to see.

“You have a whole set of things to pay attention to-mixing up this title will make everything crooked. Therefore, there will be illogical and irrational de-risking,” said Art Hogan, chief strategist at National Securities. Evergrande said during the crisis. “Does it make sense to sell technology stocks? No, but with risk aversion, everything tends to sell—even cryptocurrencies.”

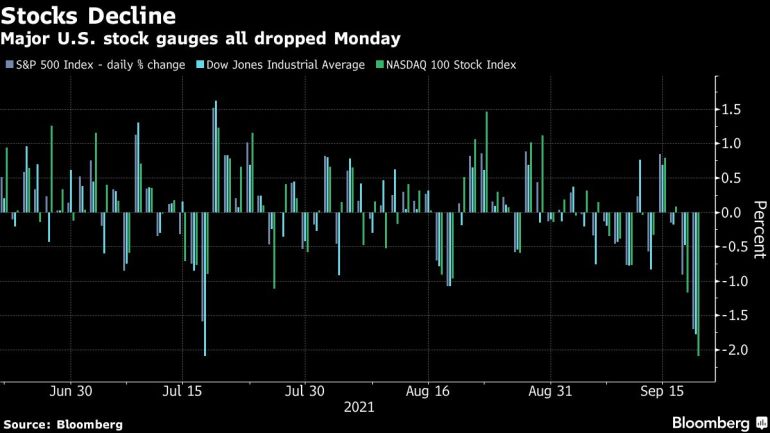

Although there may not be an obvious connection between some US technology stocks and China, this does not mean that the sell-off is meaningless. For months, high valuations have been the feed for the bears, and the Fed’s hawks are circling. Evergrande seems to be an untenable reason, but Monday’s plunge is similar to the scale of the other six market plunges in 2021, and it can be ignited without any news.

In fact, investors take this opportunity to sell in a perfectly priced market. Compared with the Standard & Poor’s 500 Index, the Russell 2000 Small Company Index is generally considered to be more US-oriented, with less international exposure, and leading the decline. It fell as much as 3.6% on Monday. The regional bank index, which consists of companies such as Bank of Hawaii and PacWest Bancorp, fell 3.9%.

The iShares MSCI Emerging Markets ex China ETF, which aims to exclude China, fell by more than 2%, while Twitter, which is not directly accessible in the country, fell by more than 4%. Companies operating only in the United States, such as the supermarket chain Kroger Co., also experienced a decline.

In other words, many assets are involved in the sell-off, “I don’t know if this is entirely appropriate,” Hogan said.

Nevertheless, due to the scale of Evergrande, the word “contagion” still exists. According to Bloomberg News, the Chinese real estate developer’s debt is worth about US$300 billion, more than any other real estate developer in the world, and accounts for about 16% of the outstanding bills in China’s high-yield US dollar bond market. Although concerns about the company’s ability to repay debt have continued for several weeks, these concerns have become the focus this week. The company’s 5-year USD bond that will mature on Thursday will carry approximately $83.5 million in interest.

But investors also face many other concerns: weakening earnings forecasts, slow changes in Fed policy, uncertainty in Washington, DC, and so on.

Katy Kaminski, chief research strategist and portfolio manager of AlphaSimplex Group, said in an interview with Bloomberg TV: “Due to the high valuation, the Federal Reserve meeting will be held tomorrow. We had a very difficult day today. It was a perfect one. The storm.” “For us, this is more of a potential problem that is more economical and universal in nature than a simple financial problem.”

Not all Monday’s plunge was unprovoked. Goldman Sachs’s basket of Russell 1000 companies, which have the highest sales exposure to China, fell 3.3% during the session, which was the worst day since mid-May, while another stock focused on serious exposure to China’s supply chain. The stock of the mouth-also tracked by the bank-fell 3.7% at its worst.

Jerry Braakman, chief investment officer of the First American Trust in Santa Ana, California, said the drop in the prices of commodities such as copper, iron ore and crude oil also makes sense.

“China is still a huge demand driver for basic commodities because they do all the manufacturing for us,” he said. Braakman also selected some technology giants, including Apple and Tesla, which have a lot of exposure in China. According to data compiled by Bloomberg, Apple credits about 15% of its revenue in China in 2020, while Tesla’s figure is 21%.

For Gene Tannuzzo, portfolio manager of Columbia Threadneedle, it is logical that names related to the Chinese real estate industry and related products will be hit, so he and his team are watching the plummeting iron ore prices. He said: “If other commodities (oil, copper) follow its decline, this is usually related to the weakening of returns from the United States,” and the latter still indicates that the risk of contagion is low. “Everything is a bit weak today, but these charts don’t look like iron ore.”

Sameer Samana, a senior global market strategist at Wells Fargo Investment Research Institute, is also studying high-yield spreads to understand whether contagious diseases are about to spread. For him, the sell-off in the US stock market is more about extreme positions and a relentless bargain-hunting buying mentality, which may have reduced the bystander cash normally used during retracements.

“Before the high-yield spreads in the United States widen further, this should be seen as an opportunity for the U.S. stock market,” he said.

[ad_2]

Source link