[ad_1]

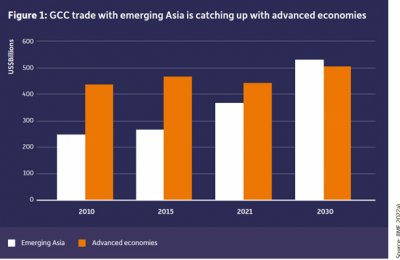

The GCC’s pivot to Asia will continue to gain momentum, with bilateral trade between the GCC and emerging Asian markets growing at an annual rate of nearly 6 percent over the next decade to reach approximately $578 billion by 2030.

Trade between the two economies will exceed GCC trade with developed economies by 2028, according to a study by British think tank Asia House, which was discussed at an event organized by Gulf Capital, the Gulf Capital is one of the largest and most active private equity firms investing in companies from the GCC to Southeast Asia and Asia House.

Speakers at the event included Thomas Lembong, former Minister of Trade of Indonesia and now Director of the Consilience Policy Institute; Abdulla Al Hashmi, Chief Operating Officer, Parks and Regions, DP World UAE; Eric Robertson, Global Head of Research and Chief Strategist, Standard Chartered Bank; Senior Managing Director, Gulf Capital Richard Dallas with Freddie Neve, Senior Partner, Middle East, Asia House and author of the report “Middle East Pivot to Asia 2022”.

global transfer

“The rapidly expanding links between the Gulf region and Asia are triggering a fundamental global shift that will have far-reaching implications for international trade, business and politics,” said Neve. Investment corridors are moving in both directions, spanning industries including oil and non-oil sector.

“In particular, economic diversification in the Gulf region is growing at breakneck speed, attracting Asian investment into emerging economic sectors in the GCC, such as construction, renewable energy and technology. As we transition away from hydrocarbons in the coming decades, cooperation on sustainable development will become increasingly important.”

According to the report, the GCC’s trade with emerging Asian markets will rise from the current 30.83 percent to approximately 36.41 percent of the GCC’s total trade.

fastest growing economic corridor

Dr. Karim El Solh, co-founder and CEO of Gulf Capital, said: “We operate in the fastest growing economic corridor in the world today, one that is geopolitically neutral and enjoys demographic and economic fundamentals. Just spotted this trend and for the past 14 years we have been looking east to grow companies from the GCC.

“Having our local portfolio companies through this corridor has helped us build global champions, which have become a prize for strategic buyers looking to acquire multinational platforms to grow their businesses. Our direct presence through our Singapore office will also help us Now growing the company from Southeast Asia to the GCC.”

Richard Dallas, Senior Managing Director at Gulf Capital, said: “Our journey east has helped many of our portfolio companies grow exponentially and exit strategic buyers across many industries, including with Metito water and sustainability at Destination of the World, B2B travel with Destination of the World and healthcare with ART Fertility. We revisited our blueprint and created a blueprint for success: investing in Led by a team of established companies operating in future industries and expanding their operations eastward into Asian growth markets with comparable fundamentals; leadership vision, urban expansion, middle class growth, tech-savvy young population and projected economic growth.

face to the future

“Tracking trends and preparing our companies in the areas of institutionalization, digitalization, sustainability and ESG makes them highly sought after in their respective industries and improves their exit chances. Our vision aligns with the GCC It is completely consistent with its vision to pivot to Asia.”

Neve added: “We expect the relationship to develop over the next 10 years with a growing middle class in ASEAN and good growth prospects for both regions. There are also natural synergies between the economic growth visions of ASEAN and the Gulf , governments in both regions are investing in digitalisation, e-commerce and healthcare to boost exports. We also expect GCC-Asia cooperation on sustainable development and renewable energy to pick up pace in the future, driving a pivot to Asia and encouraging the Gulf Economic diversification.

“As the Gulf countries transition away from fossil fuels, GCC-Asia cooperation in this area will gradually be replaced by investments in sustainability, renewable energy and the development of alternative energy sources such as hydrogen. Investments in technology, fintech, digital assets, construction and ports have also increased GCC trade with non-oil sectors in Asia.”

Sovereign Wealth Fund Interest

Interest in Asia by GCC sovereign wealth funds (SWFs) will also “continue to grow and will be a key trend in the Middle East’s pivot to Asia over the next decade,” according to the report. Gulf sovereign wealth funds control more than $2.5 trillion in assets. assets, which means that changes in its investment strategy can have a considerable impact on global finance.

Gulf sovereign wealth funds are looking for ways to increase their exposure to Asian markets and are increasingly investing in them. As of July 2022, they were involved in $28.6 billion worth of acquisitions outside the Middle East and Africa, a 45% increase from 2021, with investment flowing to China, India and Singapore.

“Despite global economic uncertainty, the Middle East’s pivot to Asia exceeded expectations last year and is likely to accelerate over the next decade, heralding a profound shift in global trade and cross-border investment that will affect growth, business and geopolitics.” husband concluded. trade arab news agency

[ad_2]

Source link