[ad_1]

Hasbro Entertainment (NASDAQ: HAS), the maker of a variety of toys and games has been hit hard so far in today’s trading session. Hasbro downgrades Bank of America twice (NYSE: BAC) securities, the news behind it casts serious doubt on the company’s prospects.analyst Jason Haas CFA Hasbro, which had previously been rated a Buy, was downgraded to “Underperform” following its latest results. Haas said Bank of America “did a lot of research” on the company and noticed potentially serious issues with its “Magic” franchise.

Haas noted that, according to collectors, dealers, game stores and distributors, Hasbro has been overproducing Magic for profit. Reasonable enough, but Haas noted that the move could “destroy the long-term value of the brand.” Therefore, Haas issued a double relegation.

Haas may be right about Hasbro extracting value from its properties. However, I’m not that pessimistic about the overall impact. I am neutral on Hasbro right now. While Hasbro may be killing its golden goose, it’s not the only one Hasbro has on hand.

Is HAS Stock a Buy, According to Wall Street?

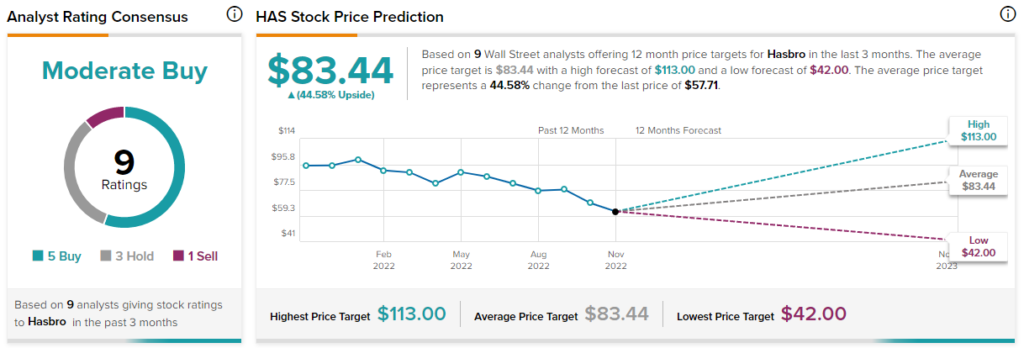

Speaking of Wall Street, Hasbro has a Moderate Buy consensus rating. That’s based on five Buys, three Holds, and one Sell assigned over the past three months. Hasbro’s $83.44 average price target implies an upside potential of 44.6%. Analysts’ price targets range from a low of $42 a share to a high of $113 a share.

at the same time, Hasbro Has a Smart Score of a “Perfect 10” On TipRanks. Having reached the absolute high point of its size, Hasbro is considered almost certain to do better than the broader market.

However, this is not a generally supported view. Insider Trading at Hasbro It was tepid at best, with only one insider transaction between May 2022 and October 2022. Retail Investors with Portfolios on TipRanks Generally neutral.

Other Hasbro Financial Data It didn’t exactly inspire confidence, either. Its cash on hand has been declining over the past three quarters, from $1.02 billion in March 2022 to $545.5 million in September 2022.

On the bright side, assets rose slightly to $9.63 billion from $9.5 billion in June 2022. However, net debt has been increasing over the past three quarters, from $2.98 billion in March 2022 to $3.46 billion in September 2022.

There’s a lot less magic in overprint parties

Magic: The Gathering has been around for quite some time – long enough that I can personally remember a buoyant secondary market for cards. Players often buy used cards to enhance their decks with all the cards that make their strategy the most effective.

However, various changes over the years have made the secondary market less efficient. Reprints and various banned cards make it harder and harder to trade in old material. Magic itself now has multiple levels of play, from Standard to Modern to Retro, each with its own set of rules.

So yes, it’s entirely possible for Hasbro to exaggerate its hand. Making new editions, printing in large numbers, and producing surprisingly few truly rare cards could be a problem for the company down the road.

The real question, however, is how big it is.

Even assuming the worst, this is only the beginning of Hasbro’s intellectual property portfolio. As of November 9, 2022, Hasbro owns 818 individual trademarks. Some of the lists are a bit redundant or outright repetitive, but the lists are there, and the marks have their own projects going on.

For example, the new Dicelings toy line will be released in March 2023.it is set with Dungeons & Dragons: Rogue’s Honor Movie. A collection of retro-inspired retro Star Wars figures is in the works.

Granted, Magic: The Gathering is a big part of Hasbro’s bottom line. It generates about 15% of Hasbro’s revenue and more than a third of its EBITDA figure, the report noted. So the loss is felt especially strongly there. Some Hasbro trademarks are also weaker than others. Don’t look for “Pax, My Poopin’ Pup” to save the loss of Magic.

Conclusion: One Dead, Hundreds Dead

Of course, most Hasbro investors would have preferred to see Hasbro not toss out the entire logo in an attempt to squeeze every penny out of it. It would be dire news if Hasbro did end up killing the life of Magic, but it might survive.

Hasbro may be killing the mojo, but there are plenty of other properties poised to take its place. That’s why I’m neutral on Hasbro. How much Hasbro lost by overprinting Magic remains to be seen.

[ad_2]

Source link