[ad_1]

dave and buster entertainment (Nasdaq: Play) shareholders (or potential shareholders) will be pleased to see that Senior Vice President and Chief Technology and Information Officer Steven Klohn recently purchased a whopping $503,000 worth of stock for $35.18. That boosted their holdings by a full 87%, arguably suggesting the kind of confidence it takes for a shy, sweet-natured nerd to ask the most popular kid in school out on a date.

Check out our latest analysis for Dave & Buster’s Entertainment

Dave & Buster’s Last Year’s Entertainment Insider Deals

Chief executive and director Christopher Morris made the largest insider purchase in the past 12 months. This single transaction bought $1 million worth of stock at $30.54 per share. While we’d love to see insider buying, we’re noticing that this big buy is trading well below the recent price of $35.61. While it does indicate that insiders believe the stock is undervalued at the lower price, the deal tells us nothing about their opinion on the current price.

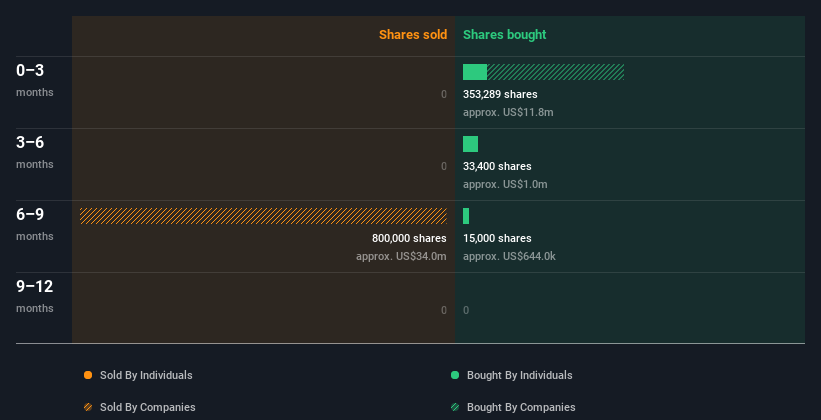

While Dave & Buster’s Entertainment insiders bought shares last year, they didn’t sell. Their average price is about $34.01. The deals show that insiders are confident putting their money in stocks, albeit at slightly lower prices than recent prices. The chart below shows insider trading by company and individual over the past year. If you click on the chart, you can see all individual trades including share price, individual and date!

Dave & Buster’s Entertainment isn’t the only stock insiders are buying.for those who like to find winning investment this free The list of growth companies recently bought by insiders may just be the ticket.

Does Dave & Buster’s Entertainment have high insider ownership?

I like to see how much stake insiders own in a company to help understand how aligned they are with insiders. In general, the higher the insider ownership, the more likely the insiders will be motivated to build the company over the long term. Dave & Buster’s Entertainment insiders appear to own 2.9 percent of the company, worth about $50 million. While this is a strong but not outstanding level of insider ownership, it is enough to suggest some alignment between management and minority shareholders.

What might Dave & Buster’s Entertainment’s insider trading tell us?

Nice to see recent purchases. And longer-term insider trading also gives us confidence. Given these deals (and the company’s significant insider ownership), insiders may see value in Dave & Buster’s Entertainment stock. So while it’s helpful to know what insiders are doing when it comes to buying and selling, it’s also helpful to know what risks a particular company faces.You are interested to know that we found 1 warning sign from Dave & Buster’s Entertainment We recommend you check it out.

But please note: Dave & Buster’s Entertainment Might Not Be the Best Stock. so look at this free List of interesting companies with high return on equity and low debt.

For the purposes of this article, an insider is an individual who reports their transactions to the relevant regulator. We currently consider open market transactions and private dispositions, but not derivatives transactions.

Valuation is complicated, but we’re helping make it simple.

find out if Dave and Buster’s Entertainment It may be overvalued or undervalued by viewing our comprehensive analysis, which includes Fair value estimates, risks and caveats, dividends, insider trading and financial health.

Have feedback on this article? Concerned about content? keep in touch Contact us directly. Alternatively, email the editorial team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only an unbiased methodology to provide reviews based on historical data and analyst forecasts, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no positions in any of the stocks mentioned.

[ad_2]

Source link