[ad_1]

key insights

Institutions’ re-holding of Star Entertainment has a significant impact on the company’s stock price

The top 14 shareholders hold 51% of the shares

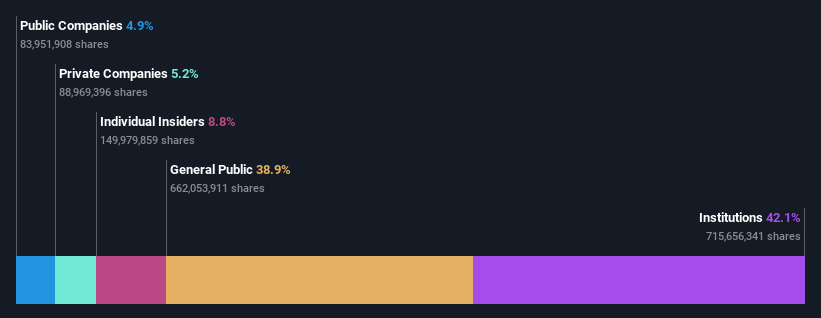

Find out who really controls Star Entertainment Group Ltd (ASX code: SGR), it is important to understand the ownership structure of the business. The group with the largest piece of the pie is the institution with 42% ownership. In other words, the group will gain the most (or lose the most) from their investment in the company.

Because institutions have access to large amounts of capital, their market movements tend to receive a lot of scrutiny from retail or individual investors. Therefore, large amounts of institutional money invested in companies is often seen as a positive attribute.

Let’s take a closer look at what different types of shareholders can tell us about Star Entertainment Group.

Check out our latest analysis for Star Entertainment Group

What does institutional ownership tell us about Star Entertainment Group?

Institutions typically measure themselves against benchmarks when reporting to their own investors, so they tend to be more enthusiastic about a stock once it’s included in a major index. We expect most companies to have some agency on the books, especially if they are growing.

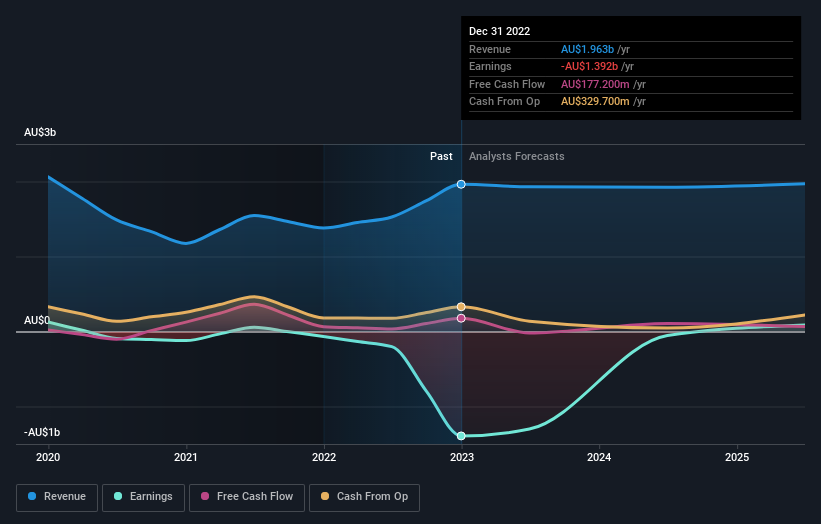

We can see that Star Entertainment Group does have institutional investors; they hold a large portion of the company’s stock. This shows that professional investors have some credibility. But we can’t just rely on that fact, because institutions sometimes make bad investments, just like everyone. When multiple institutions own a stock, they always run the risk of being in a “crowded trade”. When such a deal goes wrong, multiple parties can race to sell shares quickly. This risk is higher in companies without a history of growth. You can check out Star Entertainment Group’s historical earnings and revenue below, but remember there’s always more to the story.

Star Entertainment Group is not a hedge fund. State Street Global Advisors, Inc. is currently the company’s largest shareholder with 6.7% of the outstanding shares. Bruce Mathieson is the second largest shareholder with 5.6% of common shares, and Far East Consortium holds about 4.7% of the company’s shares.

Looking at the register of shareholders, we can see that 51% of the shareholding is controlled by the top 14 shareholders, meaning that no single shareholder has a majority stake.

While researching a company’s institutional ownership can add value to your research, it’s also good practice to research analysts’ recommendations to gain a deeper understanding of a stock’s expected performance. There are a fair number of analysts covering the stock, so it might be useful to know their overall view on the future.

Star Entertainment Group Insider Ownership

While the precise definition of an insider can be subjective, nearly everyone considers board members to be insiders. Company management runs the business, but the CEO will be accountable to the board, even if he or she is a member of the board.

I generally think insider ownership is a good thing. In some cases, however, it is more difficult for other shareholders to hold the board accountable for decisions.

We can see that insiders hold shares in Star Entertainment Group Ltd. Insiders hold significant stakes worth A$179 million. Most would consider this a real positive.If you want to explore the issue of insider alignment, you can Click here to see if insiders have been buying or selling.

General public ownership

With 39 percent ownership, the public, mostly individual investors, wields some sway over Star Entertainment Group. While ownership on this scale may not be enough to turn policy decisions in their favor, they can still have a collective influence on company policy.

private company ownership

We can see that private companies own 5.2% of the outstanding shares. Private companies may be related parties. Sometimes insiders hold an interest in a public company by owning a private company rather than in their personal capacity. While it is difficult to draw any general conclusions, it is worth noting that this is an area that requires further research.

Listed Company Ownership

The listed company currently owns a 4.9 percent stake in Star Entertainment Group. This may be a strategic interest and the two companies may have related commercial interests. Maybe they’ve gone their separate ways. This holding may merit further investigation.

Next step:

It is always worth considering the different groups that own shares in a company. But to understand Star Entertainment Group better, we need to consider many other factors. Consider, for example, the ever-present specter of investment risk. We have identified 2 warning signs Yuxing Entertainment Group understanding them should be part of your investing process.

If you’re anything like me, you’re probably wondering whether this company will grow or shrink.Fortunately, you can check This free report shows what analysts are forecasting for its future.

Note: Figures in this article are calculated using data from the trailing 12 months, which refers to the 12-month period ending on the last day of the month on which the financial statements are dated. This may not be consistent with the annual reported figures for the full year.

Have feedback on this article? Concerned about content? keep in touch Contact us directly. Alternatively, email the editorial team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only an unbiased methodology to provide reviews based on historical data and analyst forecasts, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no positions in any of the stocks mentioned.

Join Paid User Research Sessions

you will receive a $30 Amazon Gift Card Take 1 hour of your time while helping us build better investing tools for individual investors like you. register here

[ad_2]

Source link