[ad_1]

if Flutter Entertainment (London: FLTR) shareholders failed to notice that chief financial officer and executive director Jonathan Hill recently sold £197,000 worth of shares at £114 each. In particular, we note that a sale equates to a 100% reduction in its position size, which doesn’t exactly boost confidence.

Check Opportunities and Risks In the GB hospitality industry.

Flutter Entertainment’s insider trades over the past year

Senior independent director Andrew Higginson (Andrew Higginson) has made the largest insider transaction in the past 12 months. The single transaction bought shares worth £293,000 at £87.65 each. We do want to see a purchase, but this one is well below its current price of £118. Because it’s happening at a lower valuation, it doesn’t tell us whether insiders would find today’s price attractive.

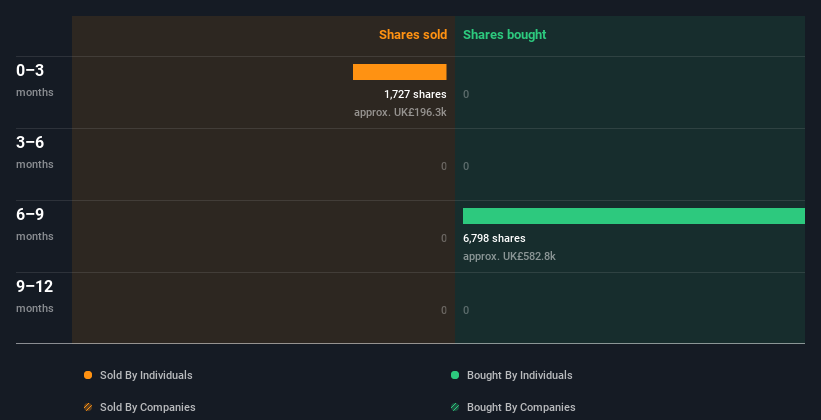

Over the past year, we can see insiders buying 6.8 million shares worth £591,000. But insiders sold 1.73k shares worth £197,000. Overall, Flutter Entertainment insiders were net buyers last year. The chart below shows insider trading by company and individual over the past year. By clicking on the image below, you can see the exact details of each insider transaction!

There are plenty of other companies that have insiders buying stock.you may no want to miss this free A list of growth companies that insiders are buying.

Internal Ownership of Flutter Entertainment

Another way to test the alignment between a company’s leaders and other shareholders is to look at how many shares they own. We generally like to see fairly high levels of insider ownership. Flutter Entertainment insiders appear to own 0.06% of the company, worth around £13m. We’ve certainly seen higher levels of insider ownership elsewhere, but these are enough to indicate alignment between insiders and other shareholders.

So what does this data tell Flutter Entertainment insiders?

One insider has not bought Flutter Entertainment stock in the past three months, but there has been some selling. But we pick ourselves up from previous deals. Insiders do own shares. So the recent sell-off doesn’t worry us too much. While we want to know about insider ownership and trading, it is also important to consider the risks to a stock before making any investment decisions.While doing our analysis, we found that Flutter Entertainment has 1 warning sign It would be unwise to ignore it.

If you’d rather look at another company – one with potentially better financials – then don’t miss this free List of interesting companies with high return on equity and low debt.

For the purposes of this article, an insider is an individual who reports their transactions to the relevant regulator. We currently consider open market transactions and private dispositions, but not derivatives transactions.

Valuation is complicated, but we’re helping make it simple.

find out if flutter entertainment It may be overvalued or undervalued by viewing our comprehensive analysis, which includes Fair value estimates, risks and caveats, dividends, insider trading and financial health.

Have feedback on this article? Concerned about content? keep in touch Contact us directly. Alternatively, email the editorial team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only an unbiased methodology to provide reviews based on historical data and analyst forecasts, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no positions in any of the stocks mentioned.

[ad_2]

Source link