[ad_1]

As rising consumer prices threaten inflation expectations and economic recovery, the Bank of Mexico raised interest rates for the second time in a row.

go through Bloomberg

The Bank of Mexico raised borrowing costs for the second time in a row on Thursday, as consumer price increases have begun to affect inflation expectations.

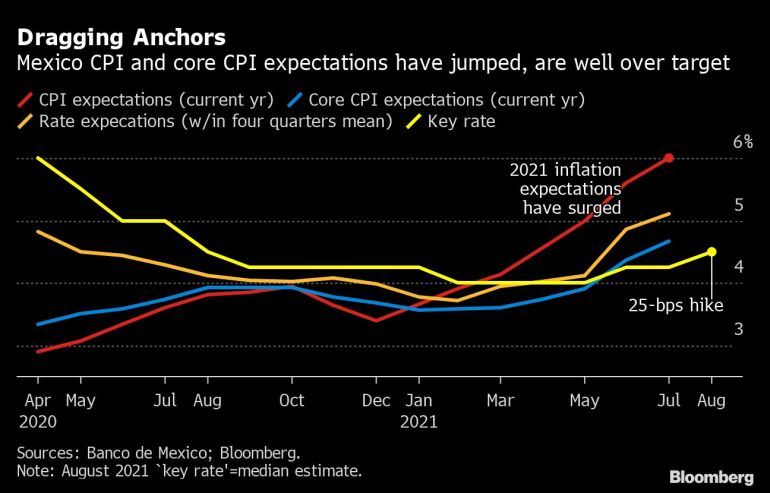

After an unexpected rate hike in June, the Bank of Mexico increased its key interest rate by 25 basis points to 4.5%, but it had little effect on curbing inflation and is currently almost twice the bank’s target. All 22 economists surveyed by Bloomberg predicted this growth.

Capitalist Macros Latin America economist Nikhil Sanghani said before the announcement of the central bank’s decision: “They have sent a strong signal that they want to tighten policy when inflation is much higher than the target.”

After the Mexican economy shrank by 8.2% last year, it has rebounded rapidly so far in 2021, marking its biggest decline in nearly a century. Economists surveyed by Citibanamex believe that the recovery of GDP growth of 6.2% is increasing inflationary pressures and helping to cause the central bank to begin tightening monetary policy earlier than most analysts expected.

Since April, the annual inflation rate has remained at around 6%, which puts the bank called Banxico under pressure after initially stating that the price spike will be temporary. Prices are driven by supply shocks, food and energy inflation, and a recovery in domestic demand.

Banxico’s target inflation rate is 3%, fluctuating by 1 percentage point. Prices rose by 5.8% in July, only slightly lower than the 6.1% in April.

What Bloomberg Economics Says

“Due to the weakening of the base effect, the overall inflation rate has declined, but it remains high, and with the rise of core prices, it has caused concerns. The results continue to show pressure from commodity prices, supply disruptions and changes in consumption habits.”

— Felipe Hernandez, Economist in Latin America

From India to Russia, inflation in emerging markets has accelerated recently as companies pass on higher commodity prices to consumers and demand rebounds before the supply chain fully recovers from the pandemic. Brazil and Chile are also tightening monetary policy, and Peruvian policymakers meeting later on Thursday will consider raising interest rates for the first time in five years. The Central Bank of Colombia indicated that it may soon join the trend of regional austerity.

In this context, Economy Minister Tatiana Clouthier said on Wednesday that the third wave of pandemic may affect economic growth. However, Capital Investment’s Sangani said that the threat must disrupt the central bank’s expectations of a change in direction in a major way.

“It is too early to say that the latest wave of the virus has disrupted Mexico’s economic recovery. At this stage, this is more like a bump,” Sangani said.

Before President Alejandro Diaz de Leon ends his term at the end of the year, Banxico still has three interest rate decisions. President Andres Manuel López Obrador has nominated his former Treasury Secretary Arturo Herrera to succeed him, and this change may lead to changes in the way banks respond to inflation.

– With the assistance of Rafael Gayol.

[ad_2]

Source link