[ad_1]

Due to the increase in exports and the surge in RDA, foreign exchange inflows may reach US$70 billion in 2021-22

Pakistan is expected to achieve a record US$32 billion in remittance inflows in the current 2021-22 fiscal year, as its over 9 million overseas workers remitted a record US$8.04 billion in remittances in the first quarter ended September 30.

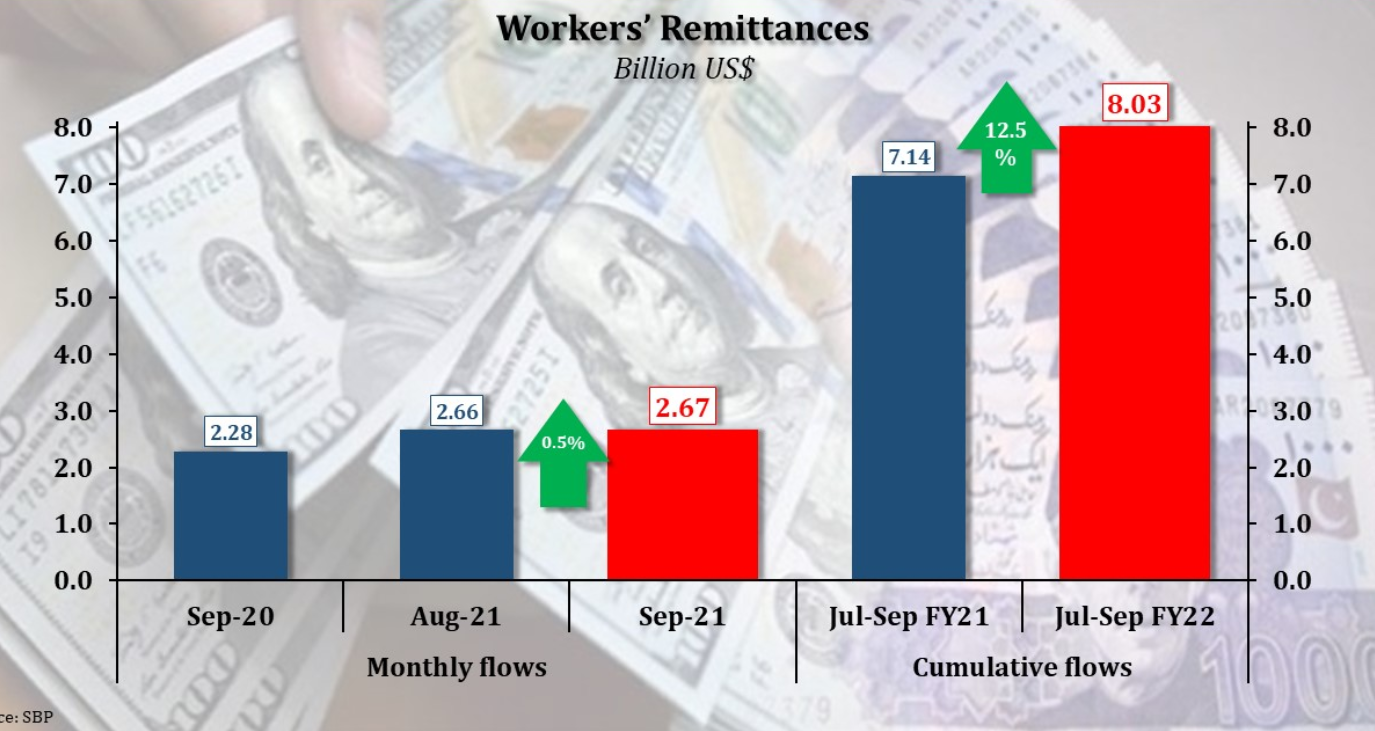

The latest data released by the central bank State Bank of Pakistan (SBP) shows that compared with the same period last year, non-resident Pakistani remittances to the country increased by 12.5% in the July-September quarter. This is the highest quarterly remittance the country has received in 75 years.

“If the trend in the first quarter continues, Pakistan’s remittances may reach 32 billion U.S. dollars in this fiscal year. This will greatly help cope with external pressures on the balance of payments,” said Trust Securities and Brokerage Co., Ltd.

Remittances from overseas Pakistanis#money transfer Sent home overseas #Pakistani The year-on-year appreciation was 16.89% to US$2.6697 billion. The month-on-month increase was 0.46%. Saudi Arabia remitted the highest amount again. #economy #Pakistan # KSE100 pic.twitter.com/vJrVbw1q2g

-Capital shares (@CapitalStake) October 8, 2021

UAE and Saudi Arabia lead

Overseas Pakistanis residing in the UAE and Saudi Arabia remit US$1.55 billion and US$2.03 billion, respectively, accounting for the major share of the total remittances. Remittances from the UAE to Pakistan increased by 9% year-on-year, while Saudi Arabia declined slightly by 3% during the quarter.

Remittances from the United States and the United Kingdom soared by 32% ($833 million) and 13% ($1.12 billion), respectively. Capital inflows from the European Union in the first quarter surged 48% to 889 million U.S. dollars from 601 million U.S. dollars in the same period last year.

“The active policy measures adopted by the government and SBP to encourage the use of formal channels, reduce cross-border travel in the face of Covid19, conduct selfless transfers to Pakistan during the pandemic, and orderly foreign exchange market conditions have contributed to the continuous improvement of remittance inflows. Actively contribute since last year,” SBP said.

Workers’ remittances recorded USD 2.7 billion on September 21; a year-on-year increase of 0.5% and a year-on-year increase of 16.9%. Remittances in the first quarter of fiscal year 22 totaled USD 8 billion; a significant year-on-year increase of 12.5%: https://t.co/7XBd4uNES4 pic.twitter.com/7kegibXSHM

-SBP (@StateBank_Pak) October 8, 2021

Record-breaking rally

Pakistan’s economy has received much-needed support and relief through the rising remittance trend since June 2020.

Since June 2020, remittances to Pakistan have remained above US$2 billion. According to the central bank, this is also the seventh consecutive month that inflows averaged approximately US$2.7 billion.

Pakistan received a record US$29.4 billion in remittances in the 2020-21 fiscal year, and received US$23 billion in the 2019-20 fiscal year.

The government expects remittances to reach US$31 billion in the 2021-22 fiscal year.

The head of Pakistan’s Kuwait Investment Research Department, Samiu La Tariq, said that due to the strong data in the first quarter, the country’s remittance target this year may exceed 31 billion U.S. dollars.

“Yes, I believe Pakistan should achieve its $31 billion remittance target in 2021-22,” Tariq told Khaleej Times on Saturday.

He attributed the increase in remittances to the measures of the government and central banks and the increasing awareness of terrorist financing and anti-money laundering. Most overseas workers now prefer to send money through official channels.

“The digital means of sending money abroad has also played an important role in facilitating remittances,” Tariq said.

Record foreign exchange inflows

Another analyst said that the country is expected to receive a record $70 billion in foreign exchange inflows this year, which will ease the pressure on the balance of payments and the rupee, which has depreciated more than 8.5% since June 2021.

He detailed that remittance inflows will lead by US$32 billion, followed by merchandise exports (30 billion US dollars), service exports (6 billion US dollars) and Roshan Digital Account (2 billion US dollars).

On Friday, the central bank stated that since its establishment in September 2020, the cumulative inflow under the Roshan Digital Account (RDA) reached US$2.411 billion.

SBP stated: “Of the US$2.411 billion deposited in the RDA, approximately US$1.66 billion, or more than 68%, has been invested in the Naya Pakistan Certificate.”

According to data from the Central Bank, during the 13-month period, 248,723 accounts from 175 countries have been opened.

Dear Chairman @ArifAlvi And the governor #SBP @rezabaqir Add luster to exclusive events #RoshanDigitalAccount with #RoshanApnaGhar Held in Dubai on October 9, 2021. The event will be broadcast live on the SBP Facebook page at 3:30 pm (UAE) and 4:30 pm (PKT). https://t.co/3SvaR9yXbJ pic.twitter.com/khqChL2lIM

-SBP (@StateBank_Pak) October 8, 2021

According to SBP data, “the number of accounts opened in September increased by 12.6% month-on-month, while the amount of inflows soared by 21% to $297 million.”

-muzaffarrizvi@khaleejtimes.com

[ad_2]

Source link