[ad_1]

gradyreese/iStock via Getty Images

The traditional value of price discovery in the stock market has been hammered by irrational players, both institutional and retail. In today’s investing scene, this has become an ugly fact of life.we thought we would We are full of madness about Robinhood Markets, Inc. (hood) GameStop Corporation (GME) crazy, but we don’t. Since then, case after case has proved that the knee-jerk mentality has broken the dams of patience and common sense and flooded the minds of investors, which is beyond the comprehension of rational players.

Shares of PENN Entertainment, Inc. (Nasdaq:Payne) come to mind

It’s not just the terrified retail bunnies among us with zero patience. It also limits the jurisdiction of hedge funds, and one would assume that more educated individuals preside over buy, sell or hold decisions.huge The mispricing of PENN Entertainment, Inc. stock, including my own expectations, is worth examining.

Regardless of Penn’s many recent positives 1Q23 Financial Report Release, the stock that started falling late last year fell another 10%.As I noted, I’ve been a big fan of PENN stock many SA articles. In fact, during the last conference call on March 20, I set a $50 price target (“PT”) on the stock. Penn’s price at time of writing is $29. My opinion is obviously wrong.

WSW

Above: The forward flat scenario is somewhat logical, but at odds with the upside the sector would see assuming there is no major recession ahead.

This is based on my insider opinion of the industry. Having been a top executive in the industry for decades, knowing many of the key people who run Penn, and having a vision for the revival of the casino space in regional America, I see real value being overlooked by Mr. Market. This fueled my greater enthusiasm for stocks. I was even considering raising my guide to $50+ before I took that PT.

So, the question that comes to my mind is, what downsides are there that I don’t see that other people do? Maybe I should recalculate the valuation based on facts I overlooked. I made a case for being a real loser from day one. Apologize.

Readers might consider my batting average despite this three-game, big-budget smack. I didn’t come here with the excuse of a wheelbarrow. Bad decisions are part of the game. However, here’s my batting average according to Tip Ranks:

Success rate: 60.69%

Average rate of return: 22.90%.

Global Rank for Financial Blogger/Analyst: 424 out of 24,866.

Unlike some baseball commentators, I’m not trying to use the “injured list” as an excuse to snub Payne. Tip Ranks ratings are not universally considered the gold standard. Overall, however, they provide pretty decent weighting over time. Your call about whether you think they are relatives. The point is, a breath is a breath, full stop.

I’m not running and dodging what is clearly Payne’s strikeout. I have it, not everyone does. So let’s move on and see what I may have missed, or equally Mr. Market still missed, to value PENN stock at its current screaming buy price.

Recession looming? Beyond that, of course, the potential position in a debt deal between the House and the ignorant residents of the Oval Office is starting to look like a dire prospect close to the edge of a cliff. In addition, it is believed that pent-up regional casino demand in the early post-COVID-19 period may have diminished and revenue growth is cooling. Payne, the biggest player in the field, didn’t make a big splash in Las Vegas.

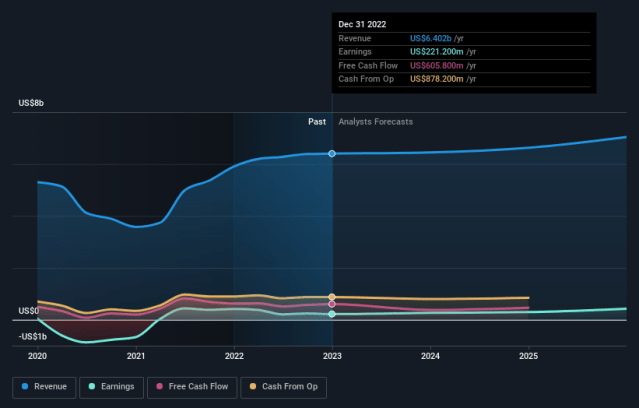

Penn’s 43 properties are spread across the best geographic footprint of its kind — excluding Las Vegas. Its 1Q23 results (if any) should look positive to holders and potential investors. Revenue rose 7% YoY to $1.67b. Adjusted EBITDA was $483, down 23.5% year-over-year primarily due to rebalancing of revenue streams as growth in the Northeast was offset by declines in South properties.

The change in net income growth was a function of the lackluster performance of regions with higher real estate taxes in the Northeast and lower gaming taxes in the South. This, along with the lawsuit settlement, was the main reason for the below-consensus performance. Overall, analysts’ reaction to the 1Q23 results was slightly bearish, which apparently may have sparked some selling sentiment that has yet to resume.

Then there’s the funny clown, but very serious one, where the repercussions of the event send lightning bolts of fear in corporate boardrooms, and the fear has little or no impact on the grand scheme of things that could cause massive numbers of customers to leave.

One such incident occurred earlier this month in Pennsylvania.A presenter from its Barstool Sports section opined that lyric rap It’s fun to include words that are clearly offensive. The reaction was quick and he was fired.But Barstool’s PR team statement is logicaltreating us as we are, warts and all. Penn founder Dave Portnoy certainly doesn’t approve of this misstep, but thinks that’s what Barstool’s business is — and its audience understands it.

The tumult apparently led to negative sentiment that continued to hit stocks, and still does. It’s an indisputable fact that fear of the rabbit mentality makes companies jump subconsciously these days — irrespective of their real-world outcomes. The rap incident undoubtedly exposed a case of bad judgment. But it contributed to a sharply bearish outlook for the stock that went beyond the brink of madness.

The University of Pennsylvania knew when it bought Barstool for $501 million that its head, Dave Portnoy, was both a media genius unmatched in his field and a periodic loose cannon. He still has 20 months left on his contract, and there’s a feeling within the company that he might decide to take a hike and spend his time cutting those fabulous coupons on his $100 million in cash.

On the day the rapper’s fiasco was made public, Penn’s stock was trading at $30.35. The aftermath sent PENN shares down $5.15 in 24 hours. This reveals how fragile market valuations are in a knee-jerk world. No one approves of bad taste – let’s rule it out. This is the sound deafness of the Barstool host. But even more unsettling to serious holders of Penn stock is the nail-biting and trembling of the company’s PR department that could see a stock hit $5 for a few cheesy words.

Here’s a bet: Guess how many Pennsylvania casino patrons and sports bettors voiced their distaste for that statement and canceled their loyalty cards? Out of 22,000 people, I guess no one. My guess, too, is that hardly anyone cared about Penn’s reaction to the tone-deaf rapper. Incidentally, Payne reports In the first quarter of 2023, the company added 350,000 new loyalty members. My guess is that this process will continue to grow because Penn’s revenue growth has two engines.

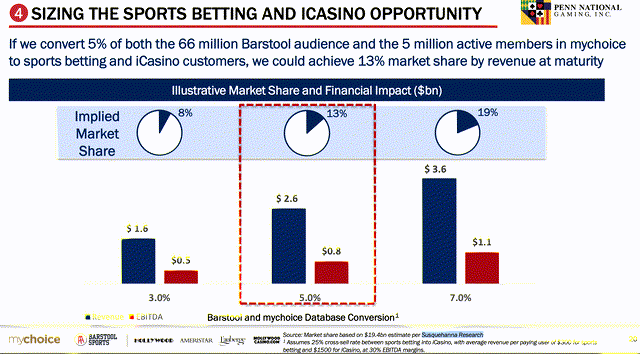

the firstthe post-covid return of a valuable old presentation in the slot machine business. second, Millennial contributions to the database via the Barstool Sports Portal are growing rapidly. Barstool Sports’ sleek loose cannon style is part of its DNA. That’s part of the reason its sports betting business hit nearly $275 million in the quarter, posting small losses compared with its other Tier 3 peers. We think Barstool Sports is on track to be profitable by the third quarter of 2023.

In my opinion, the 1Q23 results were not severe enough to make the outlook for PENN stock bearish, and certainly not enough to disappoint analysts to the extent that they could.

However, management guided for revenue of $6.81b and EBITDAR to be neutral for the year, with guidance of $1.875b to $2b. Penn repurchased 50 million shares at an average price of $30.36.

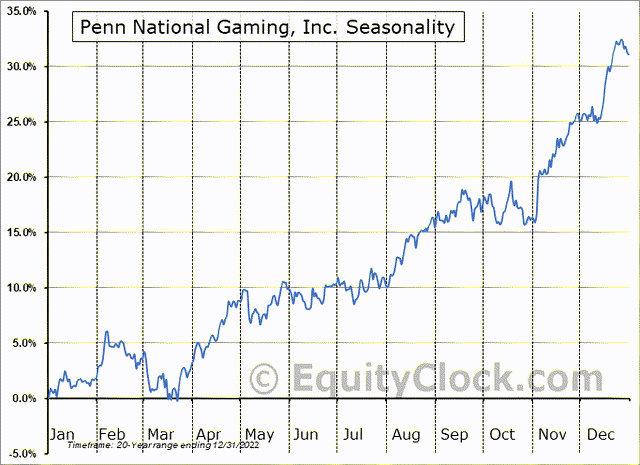

Above: Historically, income levels in most of Penn’s geographic footprint areas have only just begun their peak season.

Hedging may function as a buy-hold-sell strategy in the short term. It is part of the DNA of many people.

The composition of the holders of Penn’s shares shows that 8 institutions hold 52% of the outstanding shares, and many of them are hedge funds. So what we’re seeing here may have gathered bearish steam from hedgers who looked at stocks and saw value, only to have their earnings growth estimates – like mine – turned out to be wrong , they start to quit all at once.

Of Penn’s institutional holders, 11% are hedge funds. Intermediate round-trip strategies are common.In my view, these stocks have a long-term margin of safety because it balance sheet Always a plus.

Short interest averaged 15,197,460 shares today, the highest in about a year. I think this reflects strategy rather than pure disappointment with the 1Q23 earnings results. The stock traded at a high of $37 last August. The short interest at that time was 8,600,000 shares. As a result, short positions on the stock have doubled since then, while overall operating results point to a strong post-pandemic recovery. In addition, Barstool Sports and the University of Pennsylvania’s acquisition of the Ontario sports betting site theScore.com’s digital prospects are increasingly optimistic.

We looked at discounted cash flow (“DCF”) values based on several formulas that we referenced in the process of deriving our own formulas as a sensitivity test of our future estimates.

DCF value: $48.88 per share, indicating that PENN is 76% undervalued.

Alpha Spread indicates an intrinsic value of $59.85, slightly above our March $50 call PT.

Our own formula yields the same value as our March guidance of $50, somewhere in between the above two mentioned by other sites.

in conclusion

What I think we see but I clearly don’t see, or at least take into account, is that PENN Entertainment, Inc. stock may represent what hedge fund investors consider a fairly safe hedged short position in Penn stock, with a good margin of safety. You think retail investors who have seen a bull case for stocks would get into stocks based on real-world fundamentals – not me saying this – but based on 8 facts about the company:

- The largest and most established national gaming operator in the space itself does not have a Las Vegas footprint.

- A casino operator employs a smart strategy of using sportsbooks to expand its casino database among young presenters.

- Clear returns to a large base of veteran sim slot players across its entire 43 portfolio.

- Strong balance sheet.

- Close to profitability as a Tier 3 sports betting operator.

- The property’s innovative no-contact service policy.

- A savvy management has proven it can generate solid operating margins over time. Cash on hand: $1.31b Long-term debt: $11.66b. (This is clearly a factor in some bearish outlooks, but it doesn’t signal anything close to a long-term problem.)

- Current Ratio: 1.38 is in a comfort zone and we think the ratio is a good margin of safety for the balance of the stock this year and next.

I’m sure the PENN factor can be cited to offset these eight positives across all stocks. I’m not just stubborn about giving up on my direction because I believe in PENN Entertainment, Inc. and its future. So what I see is that if the debt deal fails, or more specifically if we have a deep recession, as some believe, the entire market will face the same threat of macro headwinds.

[ad_2]

Source link