[ad_1]

AzmanJaka/E+ via Getty Images

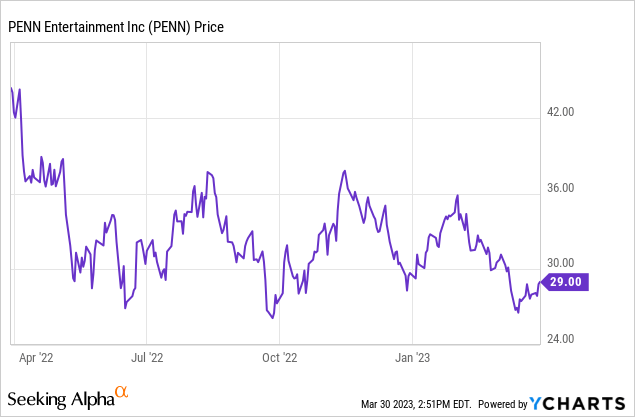

PENN Entertainment, Inc. (NASDAQ:PENN) is probably among the most undervalued stocks in the U.S. casino sector. In our view, it is a $50 stock hiding behind its current price of $29. Mr. Market and analysts alike have allowed the billowing winds of possible recession to divert their attention from a far more critical tailwind: there is a history of decision-making in this company that, to me, as an industry c-suite veteran – telegraphs this message: you want to be in business with these guys.

Above: In our view, a screaming buy at $29.

Having known and worked with PENN people back in the day from consumer-facing dealers to middle managers to c-suite decision makers across a diverse geography, the company is among the highest conviction stocks in my purview. PENN is in my model portfolio on my marketplace site: The House Edge.

The fundamental challenge of managing casinos in markets with dramatically different geography, climate, customer demos from a corporate center that neither buried local initiatives nor imposes shaky policies is tough. There is nothing more crucial to an investor than to have confidence in the management of companies he or she invests in. Quite simply, a company which knows when to hold them, and knows when to fold them, works. Above all, a management that appreciates the nuances of the markets in which it operates no matter the macro challenges makes good money and rich choices.

Google

Above: PENN’s geography balances variable impacts from both recessions and boom times because that’s how states historically absorb macro events.

The theme: How not to do it, as we learned from pre-El Dorado Caesars Entertainment, Inc. (CZR)

Let’s use the case history method of comparing an effective management with one that lives in a perpetual bubble at the corporate oversight levels.

Here are the signposts:

In 2003, Harrah Entertainment’s then-Chairman Phil Satre named Gary Loveman, a Harvard professor who had done consulting in analytics for CZR since 1997, as CEO. He created the Total Rewards program and, in the process, extended its portfolio to 54 casino hotels between the Vegas strip and states in which gaming was legal across the country. So far, so good.

Being an CZR alumni, I took a special interest in this rather puzzling appointment of a Harvard professor to head a gaming operation. It was not that Loveman was a certified, 30,000 feet up in the air, clueless observer of the gaming industry, but that he had little or no real on-the-ground experience in running places. His skill set was purely in creating a deeper than ever drill down into the analytics of each customer, bombard them with offers to create a circulatory system between the Vegas flagships as reward goals and the spate of regional casinos around the nation. It was a valuable exercise that resulted in a 55m database.

Then in 2008, in a colossal blunder just at the cusp of the financial meltdown, he sold the company to private equity operators Apollo Global and TPC for $30b. Loveman and his clutch of corporate c-suiters ran to the bank with lovely checks as shareholders scratched their heads.

In 2015, the band played goodnight ladies and CZR, along with its analytics and private equity owners, was forced into bankruptcy by a coven of noteholders who were on to the game and demanded a deal holding them haircut free. This ended in a deal where the private equity guys and the first-tier note holders came out clear, but the second-tier holders got what was by any measure, the shaft. Into court, they went and came out at the other side with a ruling the second-tier guys won. This effectively ended the Loveman reign and brought in a placeholder steward from Hertz.

The ultimate outcome was, of course, the creation of the team of Mr. Tom Reeg of El Dorado casino, a first-class operator, and Uncle Carl Icahn who knew more about how to make money in the casino sector than most anyone else on Wall Street. Icahn scooped up the shares around $9, brought in El Dorado, and started the company on a new birth of “freedom” from the corporate noose around which the Loveman contingent had pulled around the necks of regional managers.

Therein lies our tale. I spent a month in contact with former colleagues, executives and operations people throughout the chain. The overall conclusion was this: Loveman had moved so many functions in marketing, operations, customer service, floor coverage, entertainment, etc. to the corporate decision level that the ground troops were confused, constricted, and praying for a savior. Example: Many key hosts and customer development people I had mentored complained of a casino floor shift in coverage. Not really recognized was the enduring fact that in casino management, your cheapest and most productive marketing occurred on the casino floor.

That was where your contingent of hosts and development executives worked the floor, cutting into customers, asking if they needed anything, generating a connection by introducing themselves. They were there on the spot to introduce them to floor people and pit managers, write comps, take care of complaints, point out directions, engendering a warm attitude.

During the Loveman era, this all was changed. So-called service desks were set up at the apron of casino floors. The desks were staffed by hosts. If you had a beef, needed help, wanted to check your points available or wangle tickets to a hot show, you had to be a supplicant. There were, at times, lines waiting to get action on various questions. In addition, many marketing programs generated by staff meetings at the property level were now mandated to be uploaded to corporate for final okays. Precious time was lost.

Once the El Dorado group was able to integrate its people and policies that had created its home Reno success, attitudes changed. Employees we talked with by and large – not all, mind you – were able to voice their opinions and ideas.

PENN skill sets began at the customer level from jump street

Below: CEO Snowden began at the front desk, climbed the ladder over many years, stopped off at Harvard and an MBA, but gets the ground rooting skills that can’t be learned anywhere but on the firing line.

PENN Archives

PENN policies in general have always invested general managers and their staffs with as much power as they needed that made marketing and financial sense at the local level. This is a material strength of a casino operation. Bureaucracy is a component of casino management as it is with all companies with wide spans of control over vast geographies. The danger is when timid top managements are so insecure, so they tend to pile up one set of approval trials after another.

The result confused policies, delayed responses, poor communications with customers. To survive in these kind of heavy at-the-top managements, requires either consummate policy skills – or at times infighting. Or well-honed people skills almost always learned at the customer-facing jobs at the early stage of gaming careers. Such is the experience of PENN’s CEO, Jay Snowden.

Snowden, 47, began life in the industry manning the front desk at Harrah’s and later working up the ladder at Caesars. His depth of experience led him to the CEO post at PENN in 2014. In between, Snowden got his BA at Harvard and MBA at Washington University in St. Louis. His prism provides facets that arm him and his key people with a combination of experience literally from the customer-facing functions up to the c-suite. And that is why the company has led in the integration of digital and friction-free operation of PENN’s 43 properties in 20 states as well as sports betting platforms in 15 states under the Barstool brand.

The intense focus on omnichannel customer development/analytics may seem at odds with the personal touch coverage I have noted above. Yet PENN has managed its way around these imperatives that have showed in its results. What has happened is that in the implementation of its “3-cs” program, cashless, cardless, and contactless – key customer-facing employees are liberated to give more personal time to customers rather than focusing on processing of requests. The 3 Cs program is already in 20 properties and moving toward total implementation in the entire portfolio within a year.

PENN bought control of Barstool Sports in 2020 for $388m and subsequently bought the entire equity last year. The key to the acquisition on the surface was the 52m “stoolies” in the Barstool database plus the sports/entertainment content and persona of its owner Dave Portnoy. But the deeper reasoning was this: relative to the burgeoning valuations of the entire sports betting sector that were commanding huge marketing spend, Penn entered the business with cheaper and easy access to a huge sports-crazy customer base.

Google

Above: Dave Portnoy, a loose cannon at times, a laser-sharp appraiser of how the psychology of millennial sports lovers’ minds work.

Moreover, from the beginning, PENN broke away from the conventional wisdom of sports betting entries: start a site from scratch using a live sports book or daily fantasy sports business and spend tons in marketing to convert the customers. The theory being this: at some point rapidly growing q/q sales increases in double and triple-digits would eventually overcome costs and produce fat margins and be wildly accretive to EBITDA. As it has worked out, that process is still underway and operators in the sector are still bleeding billions in losses.

By contrast, PENN has eschewed the volume chase with overheated marketing, especially as new states legalized. Instead, it saw sports betting as having two collateral values. First, sheer volume and dominant market share came last. First was moving volume sensibly to reach profitability as quickly as possible. With a lower cost per new customer acquisition based on aiming at profitability asap.

But underlying that was the savvy realization that the demo of the average sports bettor, particularly the stoolie contingent, hit hard in the age 21 to 44-year-old cohort. That is precisely where historically casino customers have worked hardest to replace their traditional customer base of average age 46-55 demo. What PENN has seen is that its new, younger sports betting customers have migrated to their live sports books on property, and more importantly, to the blackjack tables. So, in effect, PENN’s Barstool move was a marketing initiative buried in the expansion of developing an omnichannel customer base.

The results: The diverse outlook has produced 1.3m new-rated customers to the PENN database. More to the point, over 60% of the new customers were migrators from the sports betting offering. Even further proof of a savvy marketing approach is the fact that 18.5% of the theoretical win had come from the 21-44 age demo.

Sports betting volume leaders have run up revenues to the $1b to $3b level for 2022. All are moving cautiously to reduce marketing spend. Some, such as FanDuel of Flutter Entertainment (OTCPK:PDYPY) and DraftKings (DKNG), are looking to turn profitable by year’s end, if not early 2024. PENN, having chosen a different path, ran up revenues of over $600m (including tax gross up of $82.9m) and generated a positive EBITDA of $5.2m. That’s the chump change range without a doubt given the overall $7.5b win all 14 active platforms produced for 2022. But little fell to the bottom line.

What’s more, if you bake in the value of Barstool’s customer migration to the casino floors of the 15 states where sports betting is legal you have the tangential value PENN saw in the Barstool deal. The growth has been across all its revenue lines.

A similar scenario will apply in PENN’s Canadian online company the ScoreBet.

The geographic breakdown tells another bullish tale

2022 Revenues by segment:

Northeast (14): $2,022 $2,695b vs. $2.552b y/y 2021

South (9): 2022: 1.314b vs. 1.322b.

West: (5): $581m vs. 521.45m for 2021 (Note: The West has been a weak link primarily because PENN does not own or run a major strip operation but does lease the old Tropicana. It is expected to devote capex to upgrade the property.

Midwest: (9): $1.159b vs. 1.102b

Interactive: 2022: $663m vs. 2021: 432m.

2022 total revenues: $6.4b vs. 5.905b

Total Adj. EBITDAR: $1.939b vs. 2021: $1,994.4b.

The tell here is this: despite periodic headwinds related to extreme weather in given geography and lingering covid concerns that inhibit some visitation among older demos, the overall performance of this company has been strong primarily because its grasp on the variables in local markets is sure. Its efforts to broaden customer spend between all its verticals are at a marketing cost that meets margin realities.

PENN’s margin of safety in our view is further enhanced by its strong liquidity and balance sheet fundamentals.

Cash and equivalents at 12.22 $1.64b

Net debt: $1.075.

Current ratio: 1.75

Stock repurchases

The company’s board has authorized an additional $750m share repurchase program set to expire by 12.25 and is incremental to the existing $750m share repurchase program authorized in February of 2022.

The average price paid for the buyback ranged ~$31 a share. It is seen as an alternate to dividends to support a commitment to unlock shareholder value. Given the perceived threat of recession that lingers over the trading range of the stock, what we see here is management buying at or below market. However, in discussions with associates who have done considerable financing programs in the gaming field, the consensus is that repurchases may still be considered by some investors as less desirable than dividends. But prudence at this point in the economy probably dictates the use of repurchases to express confidence in the future and reward investors.

Conclusion

Our bet is based on what we have seen, experienced, and in practice. We found the differences between effective casino managements and those whose c-suites are occupied by stewards leaning far too heavily on failed shibboleths and policy initiatives, poor asset allocation, and bad employee relations. In the final analysis, we have reviewed prospects for PENN Entertainment, Inc. under the assumption that, recession or not, inflation moderating or ticking up, the basic product portfolio and management skill set of PENN demands more positive buy sentiment from the investor.

In comparison with industry peers, prospects, and exposure to a rapidly improving U.S. gaming market post-pandemic surge, we are putting our own price target of $50 by Q2 202323 on the shares of PENN Entertainment, Inc.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link