[ad_1]

Editor’s note: Seeking Alpha is proud to welcome George Keiter as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also receive free access to SA Premium. click Learn more here »

Ivan Cushing

executive Summary

Pennsylvania Entertainment (Nasdaq:Payne) is a casino/entertainment company operating over 40 hotels. Most of their properties are located in the eastern half of the United States. PENN also owns and operates Barstool Sportsbook, their online sports betting app. This combination of online and brick-and-mortar properties puts them in an excellent position to not only maintain, but grow their market share as gambling regulations continue to change across the country. In addition to being near its 52-week low, Penn is one of the few profitable companies in the space, according to the financial summary table.For these reasons, I am highly It is recommended to buy stocks.

investment thesis

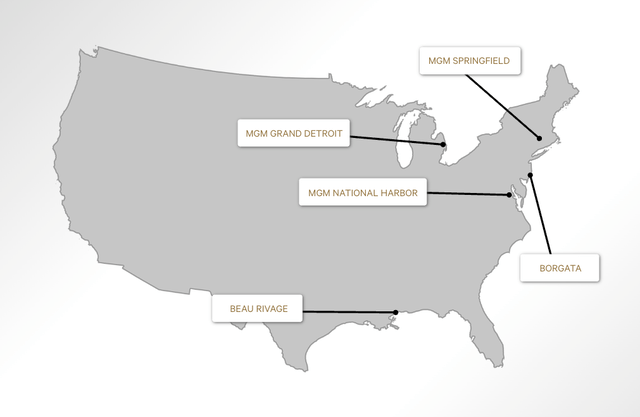

PENN doesn’t have the presence on the Las Vegas Strip that some other stocks in the sector have, but it’s entrenched in the eastern half of the United States. Compare PENN’s casino properties to MGM’s casino properties outside of Las Vegas:

MGM (US non-LV locations) – $15.27 billion market cap

MGM website

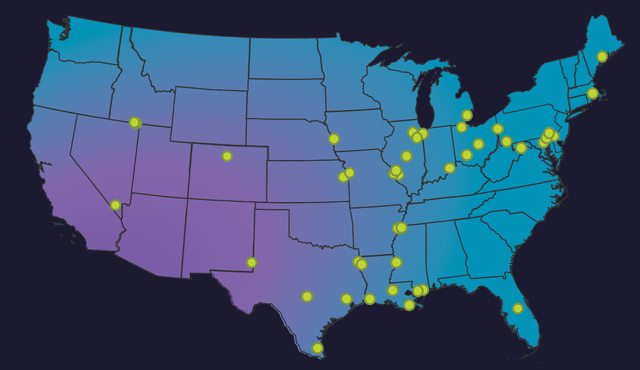

PENN (43 locations) – $3.8 billion market cap

Payne website

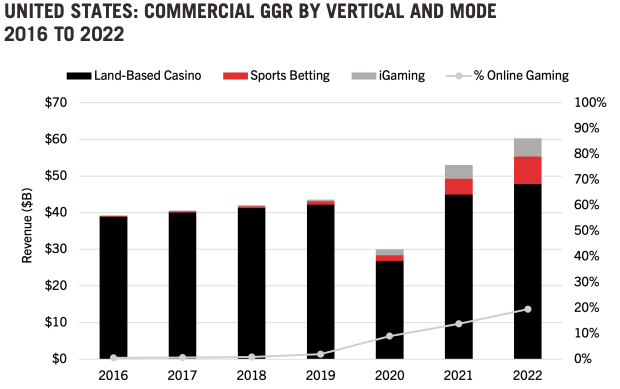

The crux of the proposal is that brick-and-mortar casinos are undervalued in a market rife with online gaming speculation. Take DraftKings (DKNG) For example, it has not been profitable for several years and has a very limited physical storefront. Their market capitalization is almost three times that of PENN. According to the American Game Association (“but”):

In-person gaming remains the mainstay of the industry, with online gaming taking a growing share. By 2022, brick-and-mortar casinos and retail sportsbooks will account for 80.5% of total gaming revenue, while mobile sportsbooks and online casinos will account for 19.5%.

Of course, a degree of guesswork is appropriate. The gaming industry remains largely a “Wild West” scene, with regulations that vary and change from state to state. Here’s what the AGA had to say when comparing the market share of online gaming to countries with more developed industries:

Compared to other major international markets such as the UK (65%), France (~30%), and Germany (~28%), the percentage of total US game revenue from online platforms remains low. However, at the state level, the online share of online sports betting and e-gambling averaged 40.7% in states that offer both brick-and-mortar and online betting options.

but

While the proportion of online games is expected to increase over time, physical games will remain a reliable source of revenue going forward.

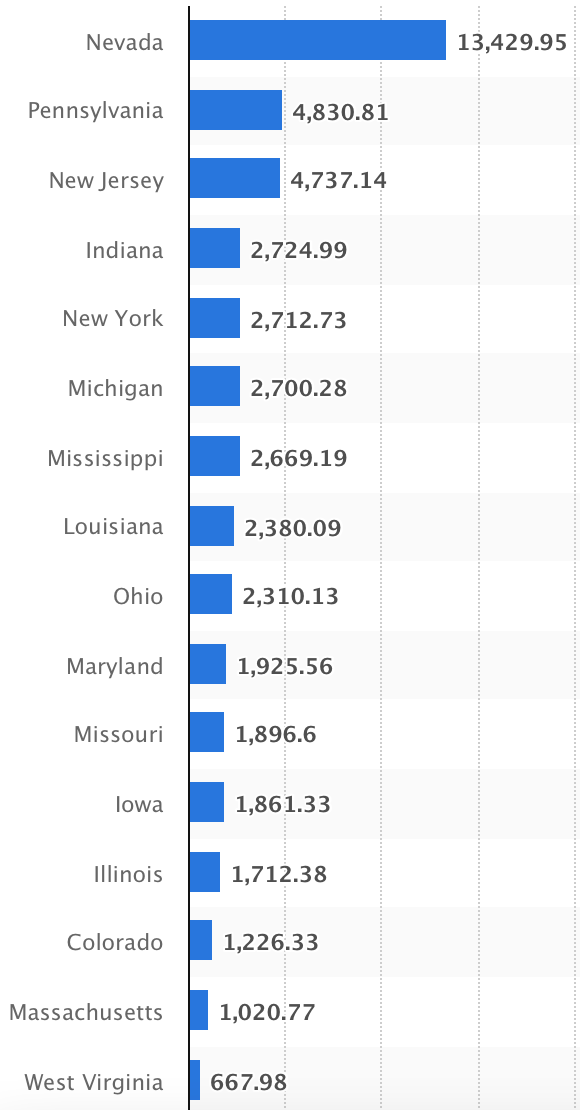

Gross Casino Gaming Revenue by State in the U.S. 2021 (Millions)

politician

The top and bottom charts from Statista depict in-person gaming revenue. While the data is somewhat outdated, the general idea here is that Nevada, along with Pennsylvania and New Jersey, have maximized to some extent from a revenue standpoint. Companies such as PENN and Boyd Gaming Corporation (BYD) has the ability to continue to grow brick-and-mortar revenues as more and more states legalize gambling.

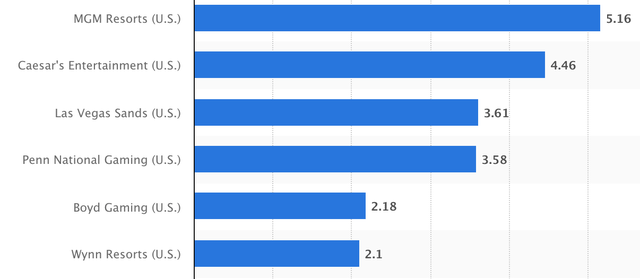

While MGM and Caesars currently have the most revenue, I believe PENN is in a better position as revenue distribution becomes more equitable across states. Of course, they control the strip, but PENN has demonstrated the infrastructure to expand and launch in 20 states.

Additionally, PENN was not a player in the online space prior to its acquisition and launch of Barstool Sportsbook in the third quarter of 2020. Barstool Sportsbook has done a pretty good job of gaining market share through its unique advertising method. As of now, they are the fifth most popular digital sportsbook and I believe they have the potential to challenge industry leaders FanDuel and DKNG.

Top Casino Companies 2020 (Billions)

politician

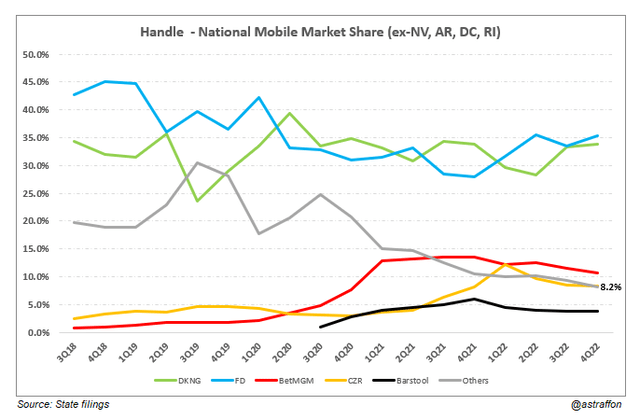

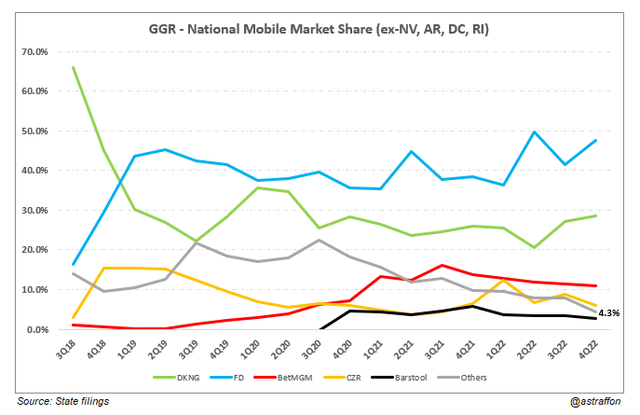

For Alphonso Strafon go sportshandle.comBarstool currently has 4-5% of Online Sports Betting Market Share. FanDuel leads with around 45-50%, DraftKings is at around 30% of its own, and MGM/CZR are both slightly ahead of Barstool at less than 10%. All the other companies combined would also be in this tier.

Alfonso Strafon

Alfonso Strafon

Right now, Barstool Sportsbook isn’t a big name. Their odds/interface are provided by Kambi Group Plc., a B2B sports betting provider. However, despite being late to market with an inferior product, they managed to capture a 5% market share, while European giants such as bet365 struggled to make any impact even after the Aaron Paul commercial. That’s the beauty of the Barstool acquisition.

While other companies pay members of the sports media exorbitant endorsement fees (Pat McAfee and Dan Le Batard come to mind), the acquisition of Barstool provided PENN with an in-house marketing department for indirect advertising. Instead of paying members of the media to vouch for their product, they are vertically integrated in a very unique way, using their media personality to promote their sports betting app. The Barstool demographic for men ages 21-44 is exactly the same as the sports betting demographic. What separates Barstool Sportsbook from its competitors is Barstool’s cult fan base. For example, Fox News has a more loyal fan base than MSNBC. Barstool, and by extension PENN, is the only company in the industry with true brand loyalty. FanDuel may have the best product today, and DraftKings may offer the biggest bonuses, but Barstool has a loyalty and fan base that can’t be bought through endorsement deals or celebrity ads.

On the topic of acquisitions, PENN acquired digital sports betting/media company theScore in 2021. Another excellent decision in terms of vertical integration. theScore has a great product in their app for tracking exercise. It is a direct competitor to the ESPN app. Additionally, their betting interface was a key asset for the internal migration of their betting products. The current plan is to complete digital integration by the start of the football season in the third quarter of 2023, followed by brick-and-mortar casino integration in early 2024. This new product is likely to be a major improvement over Kambi’s product and will help increase the market share of Barstool fans who prefer the interface of other sports betting APIs.

risk

The benefits of working with Barstool are huge, but there are also some risks, since it’s a highly controversial media company. In a highly regulated market, you can never be too careful as losing a license can be devastating to their business model. We saw this with the recent firing of blogger/media personality Ben Mintz for accidentally swearing during a live broadcast. It’s a polarizing decision. Also, Barstool founder Dave Portnoy is a highly controversial figure. This can be a double-edged sword, since he’s a huge part of what makes Barstool what it is. He is very useful for business in the sense that all media is good media. At the same time, he could be dangerous, depending on the comments he makes and whether gaming industry regulators take issue with them.

Most of PENN’s physical stores are owned by Gaming and Leisure Properties (GLPI). GLPI is a real estate trust that was spun off from PENN in 2013 and still maintains a strong relationship with its parent company. The idea of leasing the property gives PENN flexibility with cash flow, but is certainly something to be aware of.

Also, the buy recommendation here is primarily in comparison to other gaming stocks. If the industry as a whole is underperforming, it’s hard to say with confidence that PENN will buck the trend. However, if the industry continues to grow and more states legalize gaming, they will be very well positioned to maintain and expand their in-person and digital market share.

financial analysis

As of Friday, May 12, at the end of the day:

(Data provided by Yahoo Finance)

Yahoo Finance

As can be seen from the table above, although PENN has a presence in the online and offline gaming market, it has a lower market capitalization compared to its peers. Furthermore, its strategic acquisitions leave it with plenty of room to expand in both areas. The company is currently profitable, which is more than many in the space can say. It’s also at the low end of its 52-week range, while its competitors are trading near their respective peaks. For these reasons, I highly recommend buying PENN for $24.64. Beyond the physical space, I see no reason why it can’t rival CZR and MGM in terms of dominance in the digital sports betting space.

If PENN has about 2/3 of the casino revenue, and about 2/3 of the digital market share compared to CZR/MGM, then a reasonable market cap assumption is at least $7-8 billion, in line with Needham’s $44 price target. Additionally, PENN’s profitability metrics rival any company in the space. They are much healthier than DKNG, which has consistently posted a net loss despite its strong market share.

Then, considering PENN’s ability to grow individually and regionally, they could rival CZR/MGM. Meeting in the middle, the market cap would be around $12 billion. That would triple the stock price to $75 a share. I believe this is a likely price point in late 2024, after theScore integration happens and boosts Barstool Sportsbook’s market share for the upcoming football season.

in terms of debt, PENN is not mature until 2026, most of which will expire in 2027 and beyond. Additionally, $977.5 million of its $1 billion revised revolving credit facility is available as of December 31, 2022. According to its 2022 annual report, Penn has $2.8 billion in outstanding debt, while Yahoo lists $11.66 billion in debt.This difference may be due to the implementation of Ascending 842, a new accounting policy that requires long-term leases to be listed under a company’s assets and liabilities. PENN’s capital structure does not incorporate the substantial risks associated with recent debt refinancings, and its available liquidity remains high.

in conclusion

From the first few years of legal sports betting in the US, we’ve seen nothing but popularity. in England, bet365 has a 28% market share But in the U.S. there is hardly any impact. I don’t see why Barstool’s rabid fan base and improved product integration with theScore wouldn’t allow Barstool to overtake MGM and Caesars in terms of mobile gaming market share.

Also, while MGM, Wynn and Caesars dominate the Las Vegas Strip, as other states begin to legalize live gambling, whether it be sports betting or general casino games like slots and table games, Pennsylvania States are more capable of expanding. PENN is here to stay. Their balance sheet is strong and the upside is huge.

[ad_2]

Source link