[ad_1]

zhuzhu

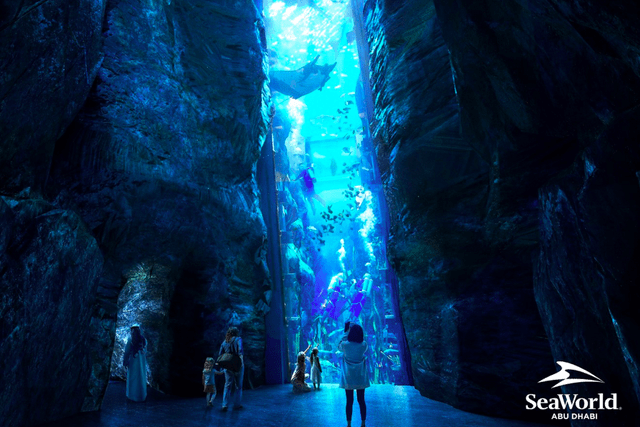

Sea World Entertainment (New York Stock Exchange:sea area) officially opened first international location in Abu Dhabi last month; management has yet to specify the financial impact this will have on the business.One thing is for sure, there will be a lot of positive feedback from enthusiastic visitors, many of whom list the park as The best aquarium in the world. For a company once inundated with negative press, it could have a positive effect on enthusiasm for new rides that have yet to open at its U.S. parks. This is despite the share price returning 42.02% to investors in the last year. The company still reported lower attendance, blaming in part bad weather, the timing of new rides and a lack of international visitors.

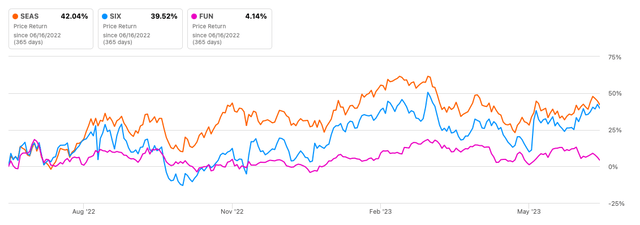

One Year Stock Trends (SeekingAlpha.com)

However, due to the increased Per capita consumption. Despite historically higher summer visitor numbers looming, SeaWorld has not provided convincing evidence that visitors are likely to return in large numbers. Plus, many of its parks still need more staff. While I’m enthusiastic about its international location and spending on new rides and park upgrades, I recommend a HOLD rating due to uncertainty over the return of international tourists and cautious consumer discretionary behavior trends in the market.

Company News

After eight years of construction, SeaWorld opens its first international sea life and theme park, SeaWorld Yas Island, in May 2023. It’s also the first new SeaWorld park to open in 30 years, and there’s a lot to look forward to, including the world’s largest single-tank aquarium.

Abu Dhabi Sea World (SeaWorld)

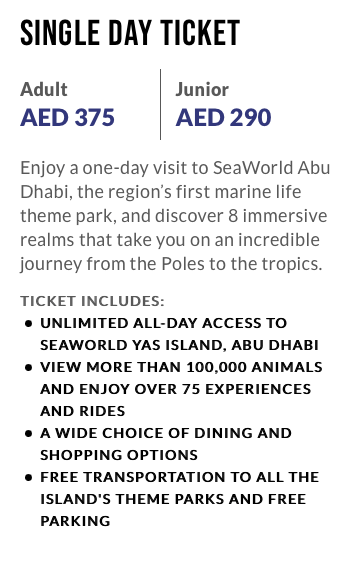

Single-day adult tickets cost just over $100 and give customers access to more than 75 rides, experiences, restaurants and parking lots. SeaWorld has a licensing agreement with its partners in Abu Dhabi, but has not disclosed the financial setup of the deal.During this period First Quarter 2023 Earnings Conference Callmanagement explained that the income statement will benefit from revenue and then a certain percentage of adjusted EBITDA, and expects it to be in the low to mid-single digits this year from an EBITDA standpoint, and according to Park’s increase in popularity.

Park Day Pass (seaworldabudhabi.com)

In the US, SeaWorld has been increasing the park experience by investing in park upgrades, mobile apps and rides. At the same time, the company is investing in technology and capital to reduce costs, with the goal of reducing costs by as much as $50 million, mainly related to labor. SeaWorld opens in 2023 with a variety of new rides. However, severe weather events and a lack of international tourists have negatively impacted visitor numbers. In the first quarter of 2023, parks received 3.4 million visitors, 25,000 fewer than a year ago. Among its strengths is that its pricing strategy has increased spending per capita, and its mobile app has increased purchase orders; total revenue through the app is up 200% year-over-year. Additionally, SeaWorld said it will open its first hotel in 2025 and another in 2026. More information is needed on the financing of these initiatives.

Finance and Valuation

The company’s revenue continued to rise steadily. In the first quarter of 2023, total revenue rose 8.4% year-over-year to $293.3 million. While the company’s attendance continues to decline, its pricing strategy and increased spending opportunities have boosted gross revenue per capita to 9.2%. The company posted a loss of $16.5 million, compared with a loss of $9 million a year ago. Adjusted EBITDA increased year-over-year to $72.4 million.

Annual Revenue and Gross Profit (SeekingAlpha.com)

SeaWorld has a strong balance sheet that includes $54.8 million in cash, the company has $426.4 million in liquidity, and a gross leverage ratio of 2.7 times. The company’s cash generation peaked in the upcoming summer quarter, so that clearly positions the business for a historically higher revenue quarter. The company spent $69.8 million on capital expenditures in the first quarter of 2023 and expects to spend a further $25-270 million in capital expenditures in fiscal 2023.

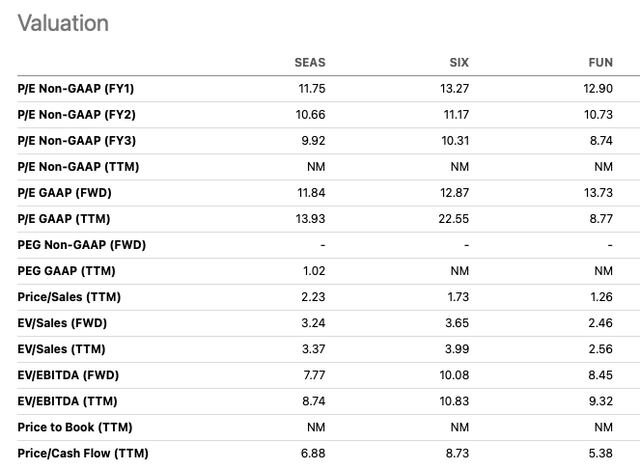

The stock is trading well below its average price target of $75.36 and has outperformed its peers in price return over the past year, returning 42.04%. In addition, compared with Six Flags, FWD’s P/E ratio is 11.84 times (six) at 12.87 and Cedar Fair (pleasure) was 13.73, indicating that the stock may still be undervalued. However, it has a strong price-to-sales ratio of 2.23, and even though the company has been investing heavily in its parks to increase attendance, we’re still seeing year-over-year declines in attendance.

One-Year Stock Returns Compared to Peers (SeekingAlpha.com) Relative Peer Valuation (SeekingAlpha.com)

risk

The amusement park industry still needs to recover to higher attendance; this is an industry-wide problem. Additionally, with an ongoing recession looming, unpredictable consumer discretionary spending behavior could impact the upcoming summer season, which the company traditionally sees high cash generation and peak traffic. An ongoing issue is the expense and labor required to run the business.The company has yet to find a solution to the labor shortage; it recently began looking 10,000 open positions In seasonal and permanent roles within its parks.

final thoughts

SeaWorld’s new international location has the potential for long-term interest and could open up future licensing opportunities, but it is too early to know the full financial benefits of the business. While revenues are rising, SeaWorld is facing high costs and fewer visitors. With uncertainty over consumer spending and international tourists not yet returning, I recommend holding rating until we gain more insight into historically strong summer quarters.

[ad_2]

Source link