[ad_1]

Abu Dhabi Ports Company PJSC (ADX: ADPORTS) a strong earnings report failed to boost its stock market. Our analysis shows that shareholders have noticed something worrying in the numbers.

Check out our latest analysis for Abu Dhabi Ports Company PJSC

A closer look at the earnings of Abu Dhabi Ports Company PJSC

A key financial ratio used to measure how well a company converts profits into free cash flow (FCF) is Accrual ratioThe accrual ratio subtracts FCF from profits for a given period and divides the result by the company’s average operating assets for that period. This ratio shows us how much a company’s profits exceed its FCF.

So when a company has a negative accrual ratio, it’s actually considered a good thing, but if its accrual ratio is positive, it’s a bad thing. That doesn’t mean we should worry about positive accrual ratios, but it’s worth noting where accrual ratios are pretty high. This is because some academic studies have shown that high accrual ratios tend to lead to lower profits or lower profit growth.

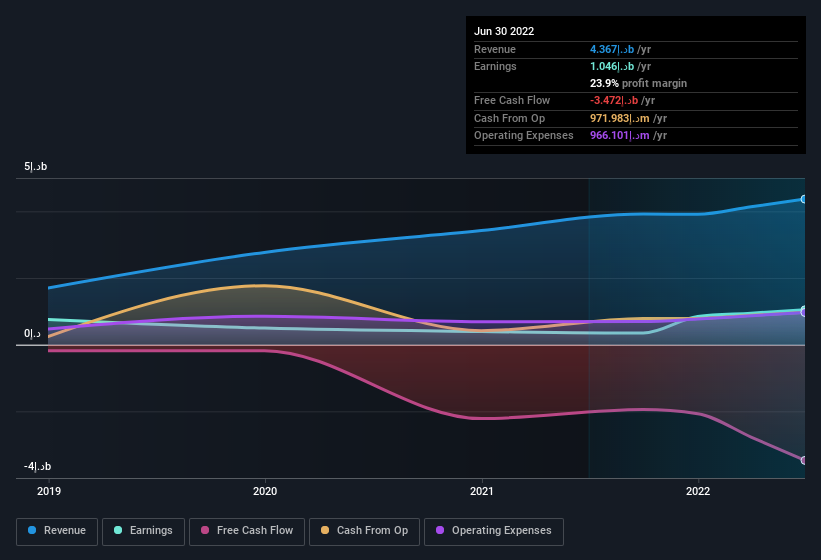

For the twelve months ended June 2022, Abu Dhabi Ports Company PJSC’s accrual ratio was 0.24. Unfortunately, that means its free cash flow is significantly lower than its reported profit. Even though it reported a profit of د.إ1.05b, looking at free cash flow shows that it actually burned د.إ3.5b in the last year. We also note that Abu Dhabi Ports Company PJSC’s free cash flow was also actually negative last year, so we can understand if shareholders are bothered by its د.إ3.5b outflow. However, there is more to consider than that. The accrual ratio reflects, at least in part, the impact of unusual items on statutory profits.

This might make you wonder what analysts are forecasting for future profitability.Fortunately, you can Click here to view the interactive chart Plot future profitability based on their estimates.

The impact of unusual items on profits

As it happens, when we look at the profits of Abu Dhabi Ports Company PJSC, there are a few different things to consider, the last one we want to mention is the د.إ 90 million gain is recorded as an unusual item. While we would like to see profits increase, we tend to be more cautious when unusual projects contribute significantly. We counted the majority of publicly traded companies around the world, and unusual projects are one-off in nature, which is common. Given the name, that’s not surprising. If Abu Dhabi Ports Company PJSC does not see a repeat of this contribution, other things being equal, we would expect its profits to decline in the current year.

Our view on the earnings performance of Abu Dhabi Ports Company PJSC

Abu Dhabi Ports Company PJSC’s accrual ratio was weaker, but its profits did get a boost from unusual items. For the reasons above, we think a glimpse at Abu Dhabi Ports Company PJSC’s statutory profits may make it look better than it really is. Given this, understanding the risks involved is critical if you want to do more analysis of your company.In Simple Wall Street, we find 1 warning sign for Abu Dhabi Ports Company PJSC We think they deserve your attention.

In this article, we examine a number of factors that can affect the utility of profit numbers, and we proceed with caution. But there are plenty of other ways to inform your opinion of the company. Some people think that a high return on equity is a good sign for a good business.So you might want to see this free A collection of companies with high returns on equityor This List of Stocks Insiders Are Buying.

Have feedback on this article? Care about content? keep in touch Contact us directly. Alternatively, email the editorial team at simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based solely on historical data and analyst forecasts using an unbiased methodology and our articles are not intended to provide financial advice. It does not constitute advice to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analytics driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Wall Street has no positions in any of the stocks mentioned.

Discounted Cash Flow Calculation per Stock

Simply Wall St does a detailed discounted cash flow calculation for every stock on the market every 6 hours, so if you want to find the intrinsic value of any company, just search here. free.

[ad_2]

Source link