[ad_1]

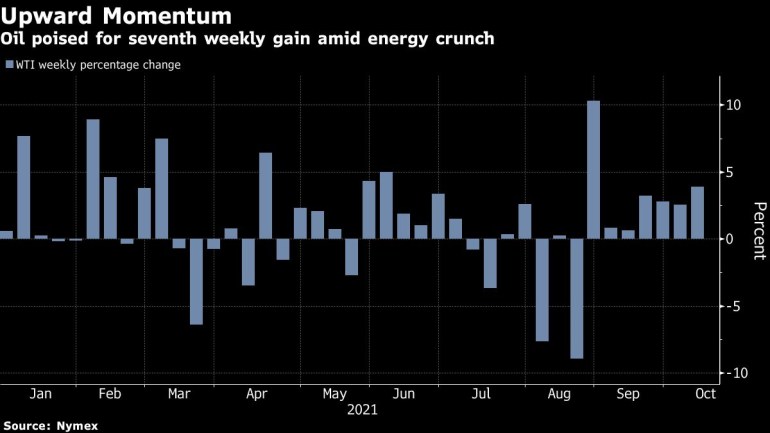

New York futures rose 2.3% on Friday and are expected to rise for the seventh consecutive week amid tight supply.

go through Bloomberg

US crude oil futures exceeded US$80 per barrel for the first time since November 2014, as the global energy crisis boosted demand while OPEC+ oil-producing countries maintained tight supply.

New York futures rose 2.3% on Friday and are expected to rise for the seventh consecutive week. This is the longest gain since December last year. Due to lower-than-expected labor market data in the United States, a weaker U.S. dollar also boosted the attractiveness of dollar-denominated commodities.

There are many signs this week that supply will continue to be restricted: Saudi Aramco said that global gas shortages have driven oil demand for power generation and heating, and the U.S. Department of Energy said it “currently” has no plans to use the country’s energy. Oil reserves.

Saudi Arabia and its partners chose to increase production only moderately in November. As the surge in natural gas prices seems to lead to a further surge in oil demand this winter, many analysts had expected OPEC+ to achieve even greater interest rate hikes.

The economic recovery in the pandemic and the supply disruption in the U.S. Gulf of Mexico after Hurricane Ida have tightened the market, and then rising natural gas prices have stimulated additional demand for petroleum products such as diesel and fuel oil.

At the same time, various basic indicators of the oil market also showed signs of strengthening. The closest contract for West Texas Intermediate crude oil is 47 cents premium to the second-month futures, the largest since August, indicating rising demand and tight supply. As more and more people in the world try to replace natural gas with fuel oil as soon as possible, the so-called prompts have been increasing.

Bob Yager, head of the US futures department of Mizuho Securities, said: “They don’t need to buy one month from now, they need it yesterday.” “This is a panic buyer situation.”

price

- At 11:50 am New York time, West Texas Intermediate crude for delivery in November rose by US$1.50 to US$79.80 per barrel

- Brent crude oil’s December settlement price rose by US$1.14 to US$83.09 per barrel

- At the same time, China is still facing power outages, and Beijing has ordered its state-owned enterprises to ensure winter energy supply at all costs. Chinese fuel oil futures rose nearly 10% on Friday as the local market recovered after the week-long National Day holiday.

Other market news:

- Due to the rebound in domestic consumption and the energy crunch, Indian refineries are increasing their operating rates to full capacity, which together stimulate demand for diesel. According to people familiar with the matter, most state-owned companies now plan to run their refineries at near full capacity this month.

- FGE stated that, driven by high natural gas prices in Europe and Asia, the conversion of natural gas to oil is boosting demand for middle distillates, and three of the five major trading centers have stocks.

- At the end of last month, during the panic buying period that triggered a nationwide fuel crisis, fuel sales in the UK were more than double the normal level.

[ad_2]

Source link