[ad_1]

Kesu01/iStock via Getty Images

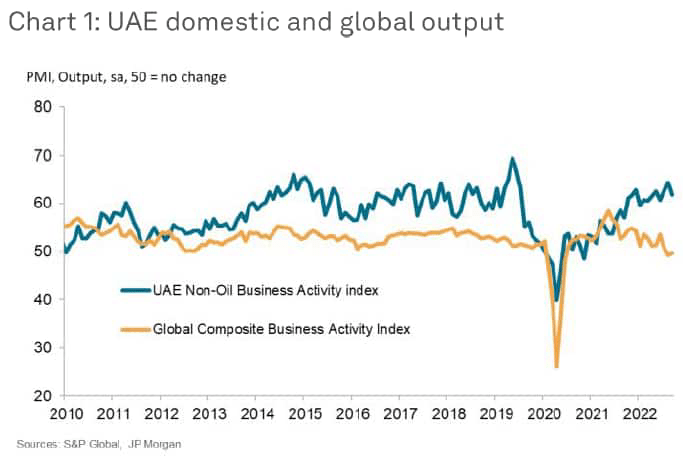

The non-oil economies of the United Arab Emirates appeared to be immune to some of the output drags observed in the global economy in the third quarter of 2022, and actually recorded some of the fastest output rates. Expansion over the past three years. By international standards, strong demand and relatively weak price pressures helped businesses boost activity and employment, in stark contrast to a slowing global economy.

UAE business activity growth in 2022 goes against global trends

Growth in business activity in the UAE’s non-oil sector has accelerated strongly since the peak of the COVID-19 pandemic. On an upward trend since early 2021, the pace of expansion reached its highest level in more than three years in August, with some 32% of survey respondents noting a pickup in output during the previous survey period.Although Expansion slows in Septemberremains evident overall, as companies report that strong demand levels often encourage them to ramp up activity further.

The strength of the upturn in 2022 so far is notable for two reasons. First, the most recent growth comes from Expo 2020 – October 2021 to March 2022 – which has a considerable impact on tourism and new business. The continued recovery suggests that businesses are still benefiting from increased investment and higher economic activity.

Second, growth in the non-oil sector contrasted sharply with a faltering global economy that contracted output in August amid headwinds such as inflation, the war in Ukraine and China’s zero-coronavirus policy. The UAE’s business activity index clearly outperformed the market in 2022 after 2021 was closer to global data, suggesting that the domestic non-oil sector is more resilient to external shocks than most other countries.

Significant growth in new orders

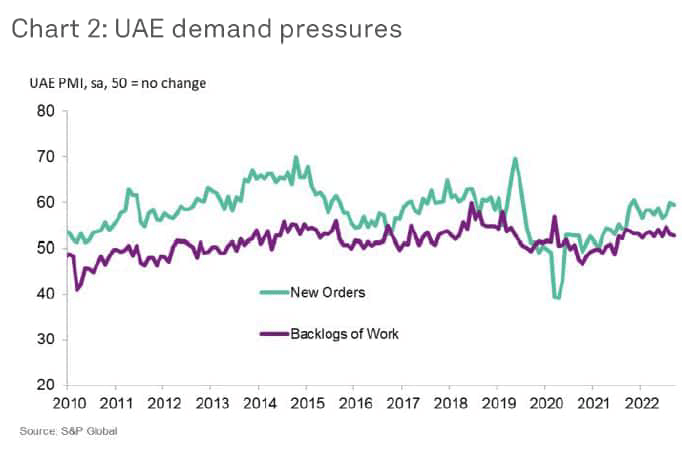

The improvement in business conditions in September was marked by another strong increase in new business volumes. Despite a slight pullback from a nine-month high in August, new orders have grown at a much faster rate than the trend observed since the survey began in August 2009. Businesses surveyed commented that improving market conditions and efforts to drive sales have resulted in affordable prices for customers.

However, strong customer demand and a backlog of projects meant companies continued to face capacity pressure, resulting in a modest rise in backlogs. Capacity constraints have occurred in each of the past 15 months, a sign that companies are struggling to match demand with output levels.

A positive consequence of this capacity strain is increased recruitment activity. Data for August and September showed employment at non-oil companies in the United Arab Emirates posted two of the fastest increases in more than five years, a sign that companies want to rebuild their workforces as new jobs are added.

UAE companies shake off significant cost pressures

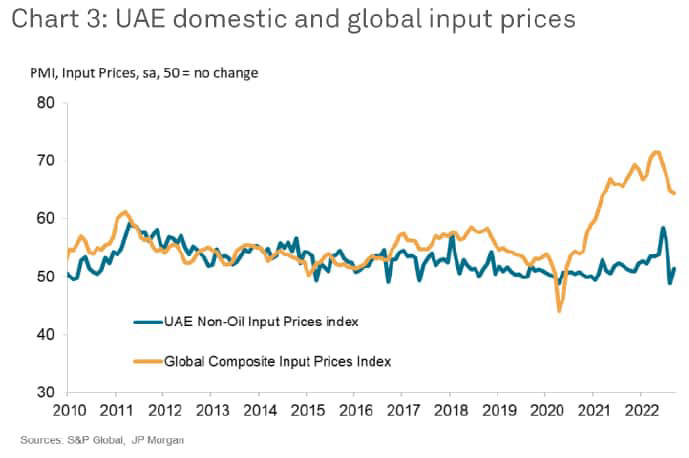

Survey indicators on price pressures also point to a much calmer situation for UAE businesses compared to global trends. Figure 3 shows domestic and global input price indices, showing that input cost inflation in the UAE’s non-oil sector has remained below the global average during 2021 and 2022. In fact, August data showed that business spending fell again, aided by weaker fuel prices, while September data showed only a modest rise in costs.

Relatively modest input price inflation has helped companies aiming to keep prices low – in fact, fees have fallen in the UAE in 13 of the past 14 months, according to the Purchasing Managers’ Index – which in turn has encouraged more growth. strong demand. These findings suggest that UAE companies have been able to escape significant cost pressures in materials, energy and labour, contributing in part to the strong activity growth rate observed this year.

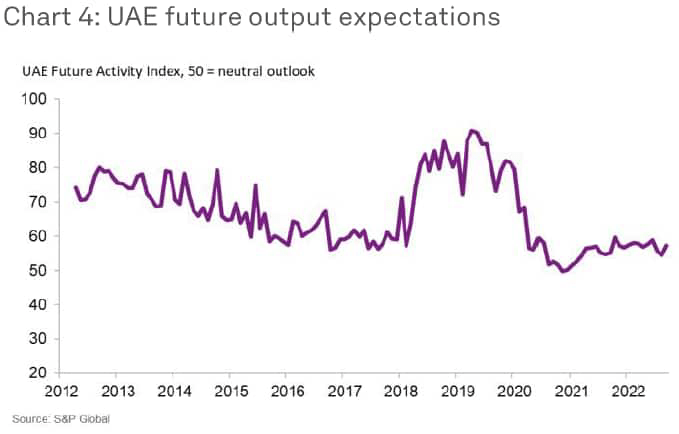

Still, if the global situation worsens, the industry could still face a broader demand shock, so sales growth will slow in the coming months. These concerns are reflected in companies’ reactions to future output forecasts. Figure 4 shows that despite activity growth returning to normal pace, business confidence remained subdued in the period following the onset of the COVID-19 pandemic, with fewer respondents predicting output growth in the next 12 months compared to the longer term running average. Also, market sentiment fell to a 17-month low in August as some companies worried that global weakness could spill over to the domestic economy.

Editor’s Note: The summary bullet for this article was chosen by Seeking Alpha editors.

[ad_2]

Source link