[ad_1]

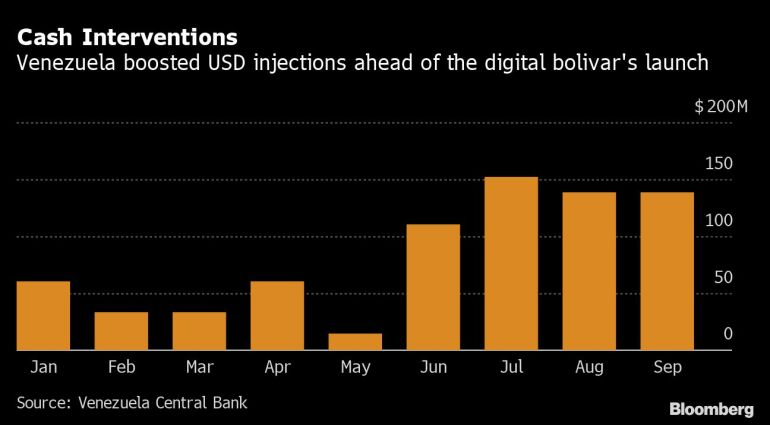

After the central bank of Venezuela launched the new version of the Bolivar, it injected approximately US$40 million into the trading market every week, a decrease of six zeros.

After launching a new version of the bolivar (a lack of six zeros caused the price to soar), Venezuela is taking action to support its national currency.

After introducing the so-called digital bolivar on October 1, the central bank injected approximately US$40 million into the exchange market every week. This is about twice the amount it usually sends to the bank.

So far, it has worked. The exchange rate on the street-known as the parallel market-was 4.1 bolivars per dollar on Tuesday. Before the introduction of the digital bolivar, the currency had depreciated to 5.2 per dollar due to Venezuelans’ eagerness to obtain the U.S. dollar.

Near the capital, Caracas, the launch of the new currency was accompanied by a sharp rise in prices. According to data from the Financial Observatory led by the political opposition, the cost of a package of eight basic products rose by 13.7% within a week of the currency’s launch, the second highest weekly increase this year. However, the founder of the observatory and opposition MP Angel Alvarado (Angel Alvarado) said that after the intervention of the central bank, basket prices returned to their pre-conversion levels.

“The question is whether the central bank has enough cash to support this policy, and therefore, is it worth it,” Alvarado said.

As of September, international reserves were at a 30-year low as the government dumped gold in exchange for much-needed cash. In the past month, the central bank increased its reserve level by US$5 billion, an amount in line with the borrowing rights allocated by the International Monetary Fund. However, Venezuela cannot obtain funding from the International Monetary Fund because the member states have not yet reached an agreement on who is the country’s legal leader.

Since 2017, Venezuelans have been fighting against hyperinflation. Although price increases have slowed this year, they are still very sensitive to exchange rate fluctuations. The value of Bolivar has been eroded to the point where the accounting system can no longer support long-term numbers.

The currency’s renaming-the third time since 2008-aims to make business transactions easier. The government introduced a series of new coins and banknotes, the largest being 100 bolivars, valued at about 24 U.S. dollars.

However, banks mainly supply lower denominations of 5 and 10 bolivars. The U.S. dollar still dominates most cash transactions, even in low-income sectors.

Worried about the volatility of the Bolivar, Adrian Vegas kept prices in US dollars in her small shop on the outskirts of Petare, a slum in Caracas.

“Imagine having to change the price of Bolivar every day,” she said.

Monday, October 4, 2021, a butcher shop in the Petare neighbourhood of Caracas, Venezuela, is priced in U.S. dollars [File: Bloomberg]

Monday, October 4, 2021, a butcher shop in the Petare neighbourhood of Caracas, Venezuela, is priced in U.S. dollars [File: Bloomberg]President Nicolas Maduro’s government has allowed the economy to slide into unofficial dollarization, and the Bolivar is now mainly used to pay for public transportation and gasoline subsidies.

“People see the price and they don’t even think about the digital bolivar. They think it’s dollars,” said Jose Estrada, the manager of a butcher shop. However, he said that the latest currency conversion is “easier” because even the most basic staple food costs millions of bolivars before the re-conversion.

However, this may be short-lived unless the government can control inflation, said Jose Manuel Puente, professor of economics at the Center for Public Policy at the Institute of Higher Education Administration (IESA).

“Currency exchange is a superficial measure and has no impact on income, expenditure or the macroeconomic environment,” he said. “You will regain the zeros you eliminated.”

[ad_2]

Source link