[ad_1]

Despite a large number of products issued this year, the wealth of Saudi IPOs has not yet been revealed to global banks.

go through Bloomberg

Facts have proved that the latest batch of newcomers to the market in Saudi Arabia are equally thrifty in paying investment bankers.

Although the IPO of Saudi Telecom’s Internet Services Division attracted investors’ orders of US$125 billion, banks including Morgan Stanley and HSBC Holdings will share approximately US$12 million in expenses, Arab Internet and Communications Service company., also known as solution by stc, stated in its prospectus.

This accounts for only 1.3% of the issuance value, while the average US or European IPO is about 5% or more. In UiPath Inc.’s $1.54 billion IPO in April, Morgan Stanley alone got a bigger payday, incurring a total of $67 million in expenses.

The funds for the Saudi transaction are also divided up by local banks, auditors and legal advisers-and will even be used to pay for the printing of the prospectus.

Despite hot stock sales this year, global banks have yet to make profits through IPOs. Wall Street heavyweights such as JPMorgan Chase, Goldman Sachs and Citigroup are still flocking to recruit teams and send executives to influence local officials in order to win advisory positions.

Even in the record-setting issue of Saudi Aramco in 2019, the financial return was negligible. The company raised nearly US$30 billion, but paid a little more than US$100 million-shared by more than 20 banks, most of which cost in Foreign investors who later flowed to Saudi Arabia did not participate in the transaction.

If anything, this is an improvement from the 2014 IPO of Saudi Arabia’s largest bank, when advisers including HSBC received US$6.7 million in fees, which was only 0.1% of the US$6 billion issuance.

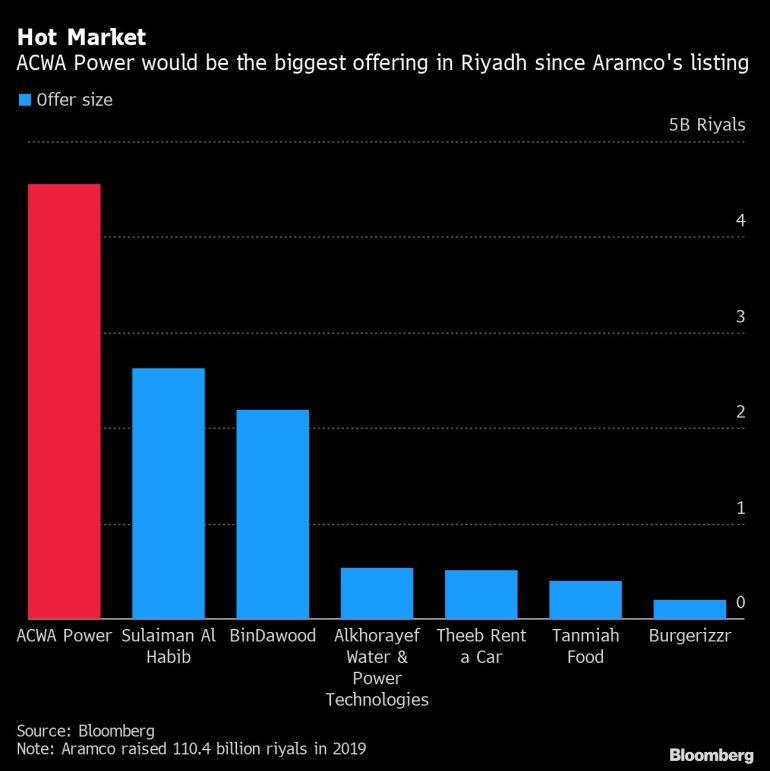

A bigger payday awaits investment banks’ participation in Saudi Arabia’s first $1 billion IPO since Saudi Aramco-but there is a caveat.

Lenders and advisors, including JPMorgan Chase and Citigroup, will share the $42 million cost of ACWA Power’s IPO, which was launched shortly after the issuance of the STC solution.

Although this accounts for about 3.5% of the $1.2 billion transaction size, the bank was authorized more than three years ago, which means that over time, the return is modest at best.

[ad_2]

Source link