[ad_1]

Your maximum loss on any stock (assuming you don’t use leverage) is 100% of your capital. But on the bright side, if you buy shares of quality companies at the right price, you can earn gains of over 100%. E.g, world wrestling entertainment (NYSE: WWE) shares have soared 150% over the past five years. Most people will be very happy with this. It is down 2.2% over the past seven days.

So let’s evaluate the fundamentals over the past 5 years to see if they are in sync with shareholder returns.

Check out our latest analysis for World Wrestling Entertainment

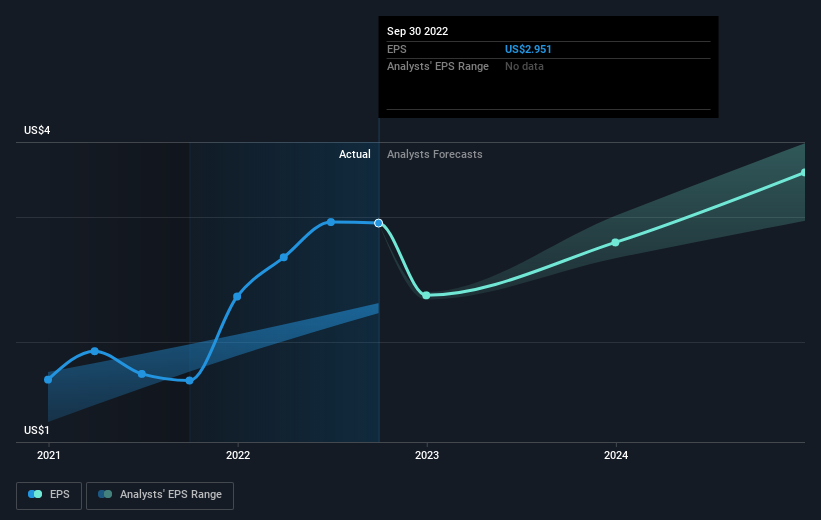

Admittedly, markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing changes in earnings per share (EPS) and stock price over time, we can see how investor attitudes toward companies change over time.

For more than five years, World Wrestling Entertainment’s earnings per share have grown 45% annually. This EPS growth is higher than the share price’s average annual increase of 20%. As a result, the market doesn’t appear to be all that enthusiastic about the stock these days.

You can see how EPS has changed over time in the graph below (click the graph to see exact values).

We are pleased to report that this CEO is paid less than most CEOs at companies of similar capitalization. It’s always worth keeping an eye on CEO compensation, but the more important question is whether the company’s earnings will grow over the years.Before buying or selling a stock, we always recommend double checking Historical growth trends, available here..

What about dividends?

It’s important to consider the total shareholder return as well as the share price return for any given stock. While share price returns reflect only changes in share price, TSR includes the value of dividends (assuming they are reinvested) and proceeds from any discounted financing or spin-offs. Arguably, the TSR more fully describes the return a stock generates. We note that World Wrestling Entertainment has a TSR of 160% over the past 5 years, which is better than the share price return mentioned above. This is mostly a result of its dividend!

Different perspectives

It’s good to see that World Wrestling Entertainment shareholders achieved a total shareholder return of 56% over the last year. Of course, this includes dividends. This gain outpaces the annual total shareholder return of 21% over five years. As such, the sentiment around the company seems to be positive lately. At best, this could hint at some real business momentum, suggesting that now might be a good time to dig deeper. It’s always interesting to track stock price performance over time. But to understand World Wrestling Entertainment better, we need to consider many other factors.For example, we have determined 1 World Wrestling Entertainment warning sign You should know.

If you’d rather look at another company – one with potentially better financials – then don’t miss this free List of companies that have proven to increase earnings.

Note that the market returns quoted in this article reflect the market-weighted average return of stocks currently traded on U.S. exchanges.

Valuation is complicated, but we’re helping make it simple.

find out if world wrestling entertainment It may be overvalued or undervalued by viewing our comprehensive analysis, which includes Fair value estimates, risks and caveats, dividends, insider trading and financial health.

Have feedback on this article? Concerned about content? keep in touch Contact us directly. Alternatively, email the editorial team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only an unbiased methodology to provide reviews based on historical data and analyst forecasts, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no positions in any of the stocks mentioned.

[ad_2]

Source link