[ad_1]

4FR/iStock via Getty Images

Caesars Entertainment Corp stock (Nasdaq:Czech RepublicThe company’s shares are down nearly 60% from their 2021 peak as recession fears combined with a high debt load have led investors to abandon the stock.However, even in a weak economic environment, I Believe that Caesars will see EBITDA and free cash flow grow while debt is reduced. I expect EBITDA and free cash flow growth to come from:

- Profitability rebounded in Las Vegas, driven by a recovery in international tourism and revenue from domestic corporate midweek meetings and conventions.

- Regional gaming profits are stable. Historically, regional gaming revenue has been resilient in recessions. In addition, Caesars will also benefit from new projects coming online.

- Changes in the profitability of online games. Caesars has invested heavily in sports betting/online gaming (via P&L) over the past few years.As costs fall and revenues continue to grow growth and I expect the segment to contribute to group profitability.

As free cash flow and EBITDA used to service debt grow, I expect Caesars’ net debt-to-EBITDA ratio to decline from 4x to below 2x by 2025. The combination of lower interest expense and EBITDA growth suggests that free cash flow per share should approach $7 by 2025, implying an attractive $49 valuation for the stock right now. I think Caesars is an attractive investment for contrarians.

Las Vegas – still room for improvement

While domestic leisure visitors to Las Vegas have rebounded strongly post-pandemic, both domestic business visitors (2022 meeting/conference attendance 30% below pre-pandemic levels) and international visitors are well below 2022 pre-pandemic levels level.lead to the whole Tourists to Las Vegas 9% below peak levels.

An increase in business/international tourists will be especially important to boost midweek occupancy/revenue, which will boost hotel revenue and EBITDA, offsetting any potential slowdown in domestic leisure travel. It’s also important to note that business and international tourists tend to spend more than domestic leisure tourists, as this rebound should have a meaningful impact on revenue and EBITDA.

Also, I look forward to new attractions such as the new 18,000-seat MSG SphereSPHR), will host U2 in-residence events starting in September (and running through December) to help attract leisure travelers in Q4 2023 and 2024. The Sphere is a truly unique purpose-built music venue with the potential to be a major attraction and driver of weekday and weekend occupancy and revenue.

regional gaming

The regional casino business is a major beneficiary of the post-COVID-19 entertainment spending boom, posting record results in 2022. While there is reason to expect results to be softer than the record levels in 2022, there are a few things to keep in mind:

- The area business will benefit from expansion/renovation projects coming online over the next two years, including Harrah’s Pompano, Horseshoe Lake Charles, Harrah’s Hoosier Park and of course the $430 million New Orleans project. All of this could generate over $200 million of incremental EBITDA in the regional business, which should offset any weakness.

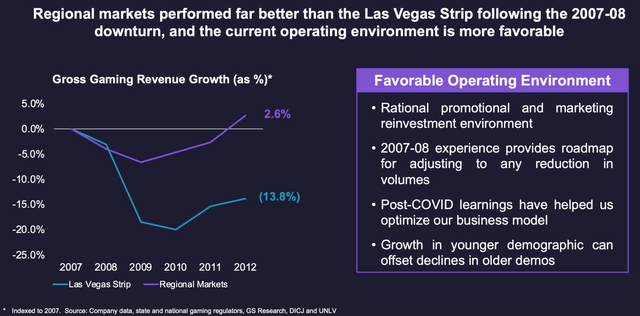

- Historically, even in (severe) recessions, the regional casino business has been remarkably resilient, as you can see below.

Regional Gaming Performance Post-GFC (Paine Entertainment Investor Presentation)

Digital/Online Sports Betting

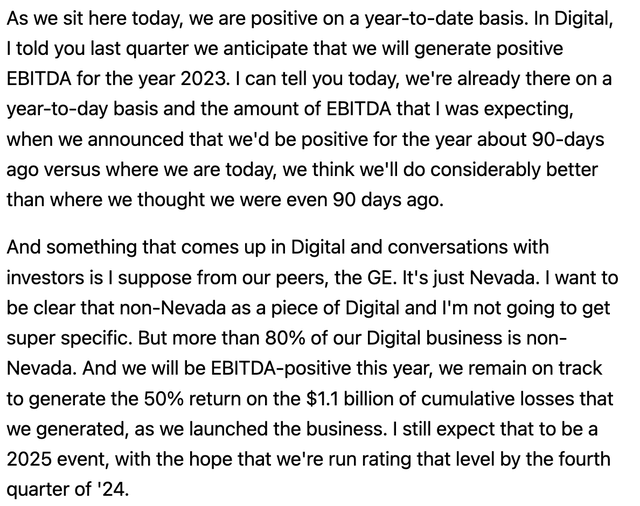

While the stock market cheered all sports betting in 2020-21, investors have grown impatient with digital losses over the past 12-18 months. While the digital business has accumulated losses of over $1 billion since inception (as shown below), management has guided for the business to be EBITDA positive in 2023 and over $500 million in 2025.

Management Comments on Digital Business (From Seeking Alpha’s Q1 2023 Earnings Call Transcript)

The $25-300 million reduction in marketing spend was the largest contributor to the improvement in digital business fortunes. Like its counterpart DraftKings (East Ken NG) and MGM (MGM), with online sports betting legalized in many states across the country, Caesars is investing heavily in marketing online sports betting starting in 2020-22.

balance sheet

While Caesars is currently trading at more than 4x net debt to TTM EBITDA, with the business generating over $1 billion in annual free cash flow (to pay down debt) and EBITDA growing as digital losses turn into profits, I expect Net debt to EBITDA will drop below 2x by the end of 2025. The sharp improvement in the balance sheet could attract new investors who might otherwise be attracted to Caesars but put off by its high financial leverage.

Valuation

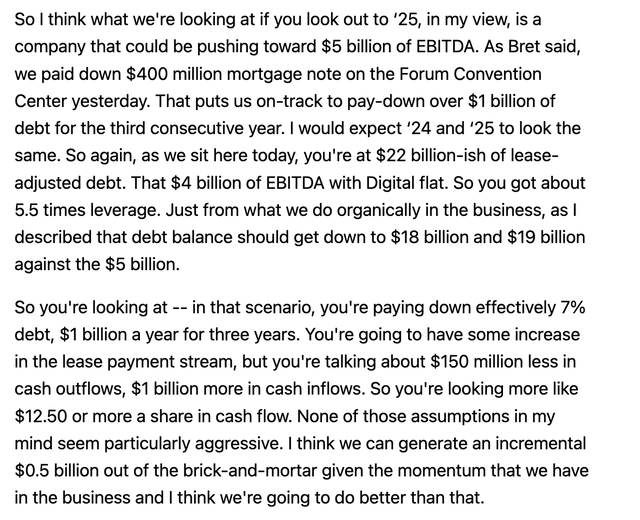

2025 Guidance (Q1 2023 Earnings Transcript from Seeking Alpha)

As you can see above, management recently raised its expectations for 2025. I’m being conservative – I assume Caesars’ 2025 EBITDAR (EBITDA before rent payments) of $4.6 billion is 8% below management’s $5 billion target. That leaves some slack in the economy, and it’s also possible that management won’t be able to fully realize the $500 million-plus digital profit.

On that basis, I deduct $1.35 billion in projected rent and assume interest expense of ~$800 million (in line with management’s guidance assuming debt repayment). I’m taking a more conservative approach to capex – while management guided for a figure of around $300 million, I used a figure of $550 million given the capital-intensive nature of the hotel and for comparison with other operators. Finally, while Caesars will likely have some residual gains in tax losses carried forward in 2025 (I expect this to be nearly exhausted in 2026), for illustration purposes I’m showing on a fully taxed (25%) basis FCF. This brings my free cash flow to $7/share, well below management’s guidance.

As mentioned in the balance sheet section above, the combination of debt repayment and EBITDA growth should make Caesars’ balance sheet position even stronger. Therefore, I expect investors to be willing to apply 10-14x to FCF by 2025, implying a fair value of $70-100 (40-100% upside).

in conclusion

Given the continued positive operating fundamentals, shifts in the digital business, expected risk reduction through debt repayments, and very low valuation (even using relatively conservative assumptions), I view Caesars as an asymmetric investment proposition and place a premium on the stock.

[ad_2]

Source link