[ad_1]

celebration may be for Abu Dhabi National Oil Distribution Company PJSC (ADX: ADNOCDIST) shareholders, analysts made a significant upgrade to the company’s statutory estimates. This year’s revenue forecast has undergone a revision, and analysts are now more optimistic about its sales pipeline. Investors were also quite optimistic about Abu Dhabi National Oil Company for Distribution PJSC, which rose 13% over the past week to $4.88. Will this upgrade be enough to push shares higher?

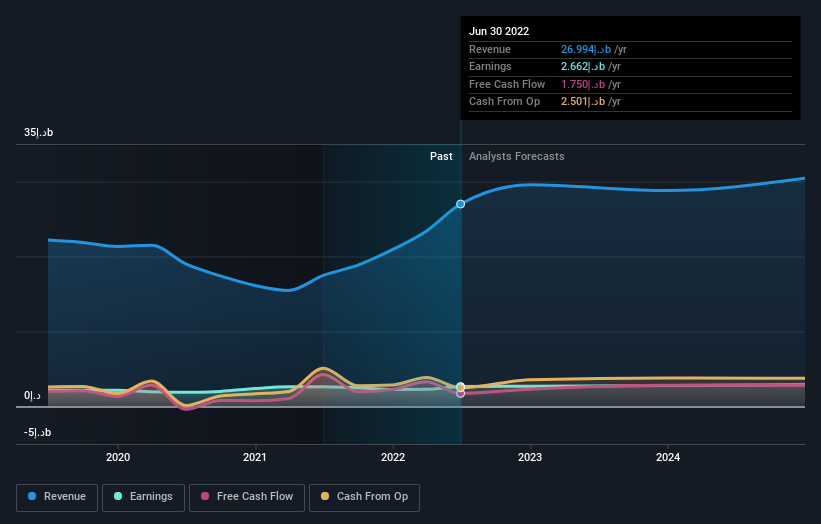

After the upgrade, the current consensus of seven analysts for Abu Dhabi National Oil Company’s distribution PJSC is for 2022 revenue of 30b, which, if met, would reflect a 9.5% increase in its trailing 12-month sales. Statutory earnings per share are expected to be 0.21 euros, roughly unchanged from the last 12 months. Before this latest update, analysts had been forecasting 2022 revenue of 25b and earnings per share (EPS) of 0.20. Sentiment appears to have improved recently, with steady revenue growth and higher EPS expectations.

Check out our latest analysis for Abu Dhabi National Oil Company Distribution PJSC

The consensus target price of 4.44 was unchanged even though analysts raised their earnings forecasts, suggesting that forecast performance won’t have a long-term impact on the company’s valuation. However, that’s not the only conclusion we can draw from this data, as some investors also like to consider estimated spreads when evaluating analyst price targets. The most bullish Abu Dhabi National Oil Company for Distribution PJSC analyst has a price target of د.إ4.90 per share, while the most bearish valuation is د.إ3.43. These price targets suggest that analysts do have some mixed views on the business, but the difference in estimates isn’t enough to suggest to us that some are betting on wild success or outright failure.

Another way we can look at these estimates is in a larger context, such as how the forecast compares to past performance and whether the forecast is more or less bullish relative to the rest of the industry. For example, we note that the growth rate of Abu Dhabi’s national oil distribution company PJSC is expected to accelerate significantly, with revenue expected to show an annual growth rate of 20% by the end of 2022. This is well above the historical decline of 0.07% per year over the past five years. In contrast, our data shows that the rest of the industry (as reported by analysts) expects its revenue to grow 11% annually. Not only is Abu Dhabi’s national oil distribution company PJSC poised for a boost in revenue, analysts seem to expect it to grow faster than the broader industry.

bottom line

The biggest takeaway for us from these new estimates is that analysts have raised their EPS estimates, expecting improved profitability this year. They also raised their revenue forecasts for the year, expecting sales to grow faster than the broader market. Now may be the right time to revisit Abu Dhabi National Oil Company’s distribution of PJSC, given that analysts appear to be anticipating a substantial improvement in the sales channel.

That being said, the long-term trajectory of the company’s earnings matters a lot more than next year.Here at Simply Wall St, our full analyst estimates for Abu Dhabi National Oil Company for Distribution PJSC to 2024, you can Check them out for free on our platform..

We also outline the remuneration and company tenure of the Abu Dhabi National Oil Company Distribution PJSC board and CEO, and whether insiders have been buying shares, here.

Have feedback on this article? Care about content? keep in touch Contact us directly. Alternatively, email the editorial team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based solely on historical data and analyst forecasts using an unbiased methodology and our articles are not intended to provide financial advice. It does not constitute advice to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analytics driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no positions in any of the stocks mentioned.

[ad_2]

Source link