[ad_1]

What underlying trends should we be looking for in businesses to find long stocks?First, we have to identify a growing return Employed capital (ROCE) according to capital used. Basically, this means that a company has a profitable plan that it can continue to reinvest, which is a hallmark of a compounding machine.However, after investigation Abu Dhabi Shipyard PJSC (ADX:ADSB), we believe current trends do not fit the pattern of multipackers.

Return on Employed Capital (ROCE): What is it?

For those who don’t know, ROCE is a measure of a company’s annual pre-tax profit (its return) relative to the capital employed in the business. To calculate this indicator for Abu Dhabi Ship Building PJSC, the formula is as follows:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

0.01 = d.إ12m ÷ (d.إ1.5b – d.إ348m) (Based on the past 12 months ending June 2022).

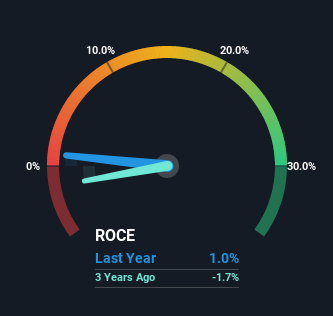

so, Abu Dhabi Ship Building PJSC has an ROCE of 1.0%. Ultimately, this is a low return, and it underperforms the aerospace and defense industry average of 6.6%.

Check out our latest analysis for Abu Dhabi Shipyards PJSC

Historical performance is a good starting point when researching stocks, so above you can see Abu Dhabi Ship Building PJSC’s ROCE compared to its previous returns.If you are interested in further investigating the past of Abu Dhabi Ship Building PJSC, please check this free Past earnings, income and cash flow graphs.

What the ROCE trend can tell us

As far as Abu Dhabi Shipyard PJSC’s historical ROCE movement is concerned, the trend is not ideal. About five years ago, returns on capital were 10%, but since then they have fallen to 1.0%. Although given the increase in both revenue and the number of assets used by the business, this may indicate that the company is investing in growth, and the additional capital results in a short-term reduction in ROCE. If the increased capital generates additional returns, the business and even shareholders will benefit in the long run.

On the other hand, Abu Dhabi Ship Building PJSC has done a good job of reducing its current liabilities to 23% of total assets. This could partly explain why ROCE dropped. What’s more, this reduces some aspects of business risk, as the company’s suppliers or short-term creditors are now less likely to fund their business. Since businesses are basically using their own funds to fund more of their operations, you might think this makes the business less efficient in generating ROCE.

ROCE Bottom Line at Abu Dhabi Shipyard PJSC

Despite a drop in return on capital in the short term, we found that Abu Dhabi Ship Building PJSC saw an increase in both revenue and capital employed. Over the past five years, the stock has followed suit, returning a meaningful 81% to shareholders. So while investors seem to have recognized these promising trends, we’ll be looking at this stock further to make sure other metrics can justify a positive view.

We found that Abu Dhabi Shipyard PJSC does have some risks 2 warning signs in our investment analysis, 1 of them was not so good for us…

If you are looking for a reliable company with good income, check this out free List of companies with good balance sheets and decent returns on equity.

Have feedback on this article? Care about content? keep in touch Contact us directly. Alternatively, email the editorial team at simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based solely on historical data and analyst forecasts using an unbiased methodology and our articles are not intended to provide financial advice. It does not constitute advice to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analytics driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Wall Street has no positions in any of the stocks mentioned.

Discounted Cash Flow Calculation per Stock

Wall Street simply does a detailed discounted cash flow calculation every 6 hours for every stock in the market, so if you want to find the intrinsic value of any company, just search here. free.

[ad_2]

Source link