[ad_1]

Since the business may be at a major milestone, we thought we should take a closer look Soul Entertainment’s Chicken Soup (Nasdaq: CSSE) prospect. Soul Entertainment’s Chicken Soup. The $123 million company lost $59 million in the most recent fiscal year and $74 million in the last 12 months, leading to a wider gap between the two. Losses and breakeven. Since the road to profitability is a chicken soup theme for Soul Entertainment investors, we decided to assess market sentiment. In this article, we discuss expectations for the company’s growth and when analysts expect earnings.

Check out our latest analysis for Soul Entertainment Chicken Soup

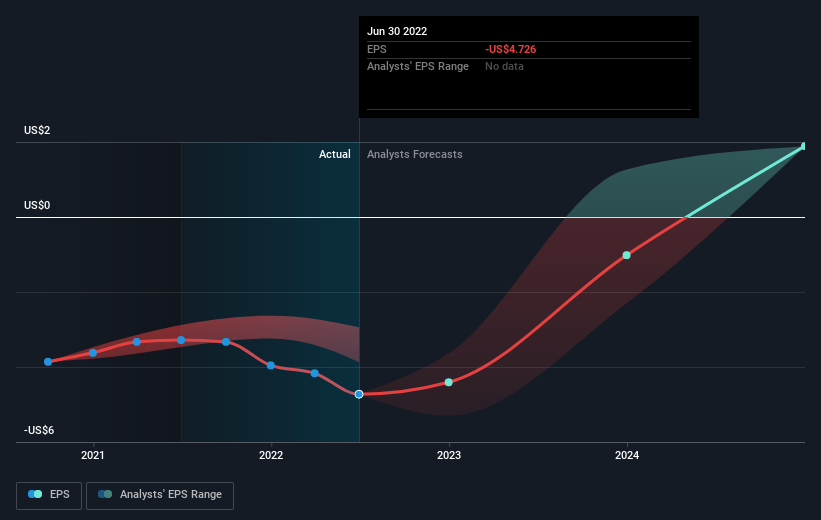

Soul Entertainment’s chicken soup is approaching breakeven, according to 7 US Entertainment analysts. They expect the company to generate a final loss in 2023, followed by a positive profit of $37 million in 2024. Therefore, the company is expected to break even in about 2 years. To meet this breakeven date, we calculated how fast the company must grow year over year. It turns out that the projected average annual growth rate of 70% is very optimistic. If that rate is too aggressive, the company’s earnings could come much later than analysts forecast.

Given that this is a high-level summary, we’re not going to detail company-specific developments as this is a high-level summary, but keep in mind that in general, high forecast growth rates are not uncommon for a company . Currently in the investment period.

One thing we want to bring to Soul Entertainment’s Chicken Soup is its 130% debt-to-equity ratio. Typically, debt should not exceed 40% of your equity, and companies have significantly exceeded that. Higher debt levels require stricter capital management, which increases the risk of investing in loss-making companies.

Next step:

This article is not intended to be a comprehensive analysis of Soul Entertainment’s Chicken Soup, so if you’re interested in learning more about the company, check out Chicken Soup from Soul Entertainment’s page on Simple Wall Street. We have also compiled a list of essential factors that you should research further:

- Valuation: How much is Chicken Soup for Soul Entertainment worth today? Is future growth potential already priced in?This Intrinsic value infographic from our free research report A chicken soup of soul entertainment that helps to visualize whether it is currently being mispriced by the market.

- management team: Experienced management team at the helm, boosting confidence in our business – see Who sits on Soul Entertainment’s board with chicken soup and the background of the CEO.

- Other outperforming stocks: Are there other stocks that offer better prospects and a solid track record?Explore our A free list of these great stocks is here.

Have feedback on this article? Care about content? keep in touch Contact us directly. Alternatively, email the editorial team at simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based solely on historical data and analyst forecasts using an unbiased methodology and our articles are not intended to provide financial advice. It does not constitute advice to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analytics driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Wall Street has no positions in any of the stocks mentioned.

Valuation is complicated, but we’re helping make it simple.

find out if Chicken Soup for the Soul Entertainment May be over or underestimated by viewing our comprehensive analysis, which includes Fair Value Estimates, Risks and Warnings, Dividends, Insider Trading and Financial Condition.

[ad_2]

Source link