[ad_1]

Sheikh Tanun bin Zayed Al Nahyan Photo Illustration: 731; Emirates News Agency/AP Photo (1)

The Al Nahyan family own Manchester City Football Club, a dozen palaces and have invested heavily in SpaceX and Savage X Fenty.

In a region where affluence is on full display, Sheikh Tanun bin Zayed Al Nahyan Keeping a low profile belies his importance.

That hasn’t stopped rumors about the Abu Dhabi royal, who’s also the United Arab Emirates’ top spy chief: He’s actually in charge of a larger swath of the family fortune than anyone else in the world.

It’s no secret that the Al Nahyans are rich in the UAE, which holds around 6 percent of the world’s proven oil reserves and is known for its concentration of royal wealth.But investing in everything from Rihanna’s lingerie line and big data to fast food and Elon Muskof SpaceX The wealth of the family has been pushed to new heights.

They are now worth at least $300 billion, according to an analysis of their complex assets by the Bloomberg Billionaires Index, including regulatory filings, real estate records and company disclosures.That surpasses the $225 billion of the Walton family, long recognized as the richest family in the world thanks to walmartretail dominance.

Representatives for Al Nahyans did not respond to multiple requests for comment.

The exact amount of royal wealth is difficult to determine because the line between family and state is often blurred. In the case of the Al Nahyans, who have ruled the UAE since independence half a century ago, some assets are clearly private while others are intertwined with the government. These apparent personal fortunes mean their apparent wealth surpasses that of other Gulf clans, including the Saudi royal family.

Sheikh Tahnoon – Black Belt in Jiu-Jitsu – has both public and private activities. He is the head of Abu Dhabi wealth fund ADQ and head of First Abu Dhabi Bank, the country’s largest bank. Among the family’s personal holdings is an investment firm that has soared nearly 28,000% in value over the past five years. international holding company Domestic investors familiar with the company consider it too noble to fail, but too opaque for some international institutions to bet on.

Al Nahyans’ estate includes trophy assets such as Manchester City FC, a dozen palaces including the Chateau de Bayonne north of Paris, and much of London’s unique Berkeley Square.But the key to the rise of the family lies in royal group, a sprawling network of companies employing more than 27,000 people in fields ranging from finance to robotics. Over the past two decades, it has grown from a relatively small operation to assets worth nearly $300 billion, according to people familiar with its business. The person asked not to be identified because the information is confidential.

As the wealth of the Al Nahyans has grown, so has their influence in the region and around the world. Sheikh Tahnoon is recognized as the mastermind behind their growing business empire as well as an important political emissary.Investments in countries like Turkey and Egypt often support his brother’s efforts Sheikh Mohamed bin Zayedthe President of the UAE is called MBZ to expand the influence of the country.

Bani Fatima 6

Sheikh Mohamed bin Zayed Al Nahyan (MBZ) is the eldest of six sons of Sheikh Zayed bin Sultan’s most famous wife

Sheikh Tahnoon and MBZ are one of six brothers known as Bani Fatima. They are both the sons of the third and most illustrious wives of Sheikh Zayed bin Sultan Al Nahyan, the founder of the UAE. Sheikh Mansour – as deputy prime minister, chairman of the central bank and head of the federal wealth fund UAE Investment Authority – was another key figure, but both contributed to building the family fortune.

royal wealth

Al Nahyans controls a sprawling empire independent of state investment funds

Note: This analysis is based on regulatory filings, company disclosures, funding valuations and real estate records. Assets that were too opaque to be valued were excluded. Source: Bloomberg

The Royal Group acts as Sheikh Tahnoon’s command center, the people said. As well as investing in a range of companies, it hired world-class chefs to cook for the family and employed their personal bodyguards, they said.

The firm is “the most risk-tolerant” of Abu Dhabi’s major investment vehicles, Richard Clarke, a former White House official and longtime advisor to MBZ.Entities that manage funds on behalf of the emirate, such as mubadala investment co. and Abu Dhabi Investment Authority – With over $1.2 trillion in combined assets – more like a traditional, stability-focused sovereign wealth fund.

Sheikh Tahnoon’s superyachts – the family owns at least three, including world’s largest It is a key call point for those seeking to do business with the close-knit and elusive family, according to people familiar with the operations. Building relationships is an important step, and Wall Street moguls couldn’t wait to pay their respects.

The world’s largest private yacht “Azzam”. Photographer: Jaume Sellart/EPA/Shutterstock

Etihad Stadium in Manchester, UK. Photographer: Alexandre Simoes/Borussia Dortmund/Getty Images

“Why am I happy to meet Sheikh Tahnoon?” tom barracka private equity billionaire close to the former U.S. president donald trump, said in court testimony. “He’s one of the biggest businessmen in the world.”

During Barack’s trial – he was Acquitted Illegally lobbied on behalf of the UAE last month – the investor detailed his courtship of Sheikh Tahnoon, which included sending him a rare book on Arabian horses and taking a joint bike trip through the Moroccan desert in hopes of arguing for his company winning business company Colonial Capital LLC.

“He has every major businessman, sovereign wealth fund investor, operating partner through his parliament every night,” Barak said, referring to the meeting in the traditional Arab living room.Visitors include billionaires including US real estate moguls Samzelindian industrialist Gautam Adani and columbia banker Jaime Jilinski.

As Sheikh Tahnoon shuttled diplomacy throughout the Middle East, he delegated key responsibilities within his business empire to several trusted advisors. One of the key figures is Sofia Abdellatif Lasky, a Moroccan-born financier who worked with Sheikh Tahnoon for two decades. She is one of the few prominent expats in Abu Dhabi.

“I’ve had access to a lot of people in senior government positions around the world,” said Zell, who has known the royal family for about 20 years. “The Abu Dhabi crew, including Sheikh Tahnoon and Sofia, were at the top of the list.”

In recent years, some of the Royal Group’s investments have increased in value dramatically. IHC — also known as International Holdings — topped the list, outpacing any company in the world with a market cap of more than $1 billion over the past five years, according to data compiled by Bloomberg.

sudden emergence

IHC’s stock has soared nearly 28,000% over the past five years

In the process, Royal Group-controlled IHC has catapulted from a little-known investor focused on fish farming to the UAE’s most valuable listed company. It is worth more than blue chips such as McDonald’s, Nike and Blackstone.

But that size has not attracted international investors, some of whom have privately expressed concerns about the lack of transparency. IHC is also not included in the global MSCI indices, nor is it covered by any of the equity analysts tracked by Bloomberg.

In its latest annual report on the company’s accounts, Ernst & Young reiterated that IHC’s financial statements were subject to “significantly less extensive” scrutiny than audits conducted by international standards.

While Royal Group has been a popular client, most international banks have largely avoided dealing with IHC due to concerns about inflated market values, people familiar with the matter said. The company, which relies almost entirely on local funding, trades at almost 18 times book value, compared with Warren Buffett’s P/E ratio of about 1.5 Berkshire Hathaway.

The family’s overlapping interests – including controlling brokerage leading the Abu Dhabi deal and ADQ’s ownership of the emirate’s exchange – help secure support for IHC.

In late November, the company issued shares to another Abu Dhabi conglomerate in exchange for a stake in Alfa Dhabi Holdingsthe third most valuable company in the UAE and another listed part of the family empire.

IHC did not respond to a request for comment.

The investment firm’s meteoric rise is emblematic of the growing power of Al Nahyans and Abu Dhabi. While Dubai has long enjoyed international attention, the oil-rich emirate cemented its status as a major player in the UAE after bailing out its flashy neighbor for $20 billion after the financial crisis.

Al Nahyans has since added tourist destinations, including the Ferrari World indoor theme park, a local outpost of the Louvre museum in Paris and a Formula 1 circuit.

The UAE, Saudi Arabia and Qatar are all trying to diversify their economies before the end of the fossil fuel era and are well positioned to take advantage of openings, especially as the US and Europe face higher financing costs and China struggles with Covid .

IHC embodies Abu Dhabi’s global ambitions.CEO Saiba Shashub august says interview The company plans to invest billions of dollars in markets including Indonesia, Turkey and India, targeting industries such as food, infrastructure and healthcare.

As in most countries in the developing world, investment and politics go hand in hand, and Al Nahyans has been an active practitioner.

Under MBZ, the UAE has shown more of its foreign policy strength.The country backs Libyan rebel generals Khalifa Haftar, which joined Qatar’s embargo in 2017 and has become embroiled in a Saudi-Iranian proxy war in Yemen. More recently, however, the UAE has shifted toward reducing tensions in the region, a stance consistent with efforts to expand soft power through deals.

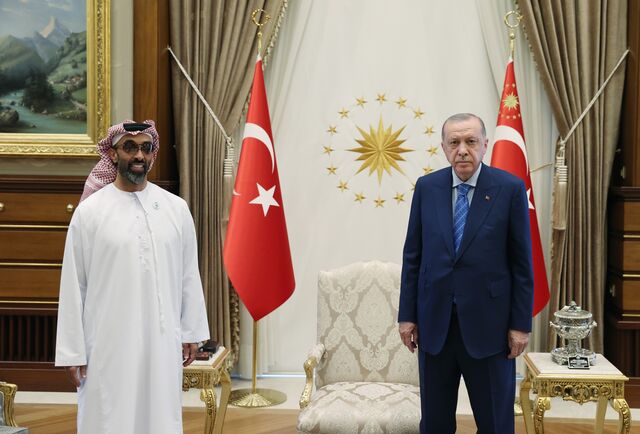

Sheikh Tahnoon and Recep Tayyip Erdogan in Ankara in 2021. Photographer: Mustafa Kamaci/Anadolu Agency/Getty Images

After Sheikh Tahnoon meets Turkish President Recep Tayyip Erdogan Last year, IHC purchase 50% stake in a Turkish renewable energy company. It also invested nearly $2 billion in three companies owned by Indian billionaire Adani after the two countries signed a trade deal, while ADQ snapped up stakes in major Egyptian companies to help shore up the battered economy.

Group 42 is perhaps the most direct link between business and power in Abu Dhabi. The AI firm, chaired by Sheikh Tahnoon, became the first Emirati company to open an office there after the UAE and Israel normalized relations, and has since traded with state-owned Rafael Advanced Defense Systems.

Abu Dhabi Skyline in April 2022. Photographer: Christopher Pike/Bloomberg

“Sheikh Tahnoon has become a security assistant in every difficult task,” said ahm kamal, head of the Eurasia Group, a London-based Middle East and North Africa risk consulting firm. “His success has made him a very useful player for MBZ and Abu Dhabi as a whole.”

More about Bloomberg

[ad_2]

Source link