[ad_1]

Warren Buffett famously said, “Volatility is far from being synonymous with risk.” When examining a company’s degree of risk, it is natural to consider a company’s balance sheet because when a business fails, there are usually debt. important, Maoyan Entertainment (Hong Kong: 1896) are indeed in debt. But is that debt a concern for shareholders?

When does debt become a problem?

Debt can help a business until the business is unable to pay it off with new capital or free cash flow. Ultimately, shareholders may get nothing if the company fails to meet its legal obligations to repay its debt. However, the more common (but still painful) scenario is that it has to raise new equity capital at a low price, permanently diluting shareholders. Of course, many companies have used debt to finance growth without any negative consequences. The first thing to do when considering how much debt a business uses is to look at both its cash and debt.

Check out our latest analysis for Maoyan Entertainment

What is Maoyan Entertainment’s net debt?

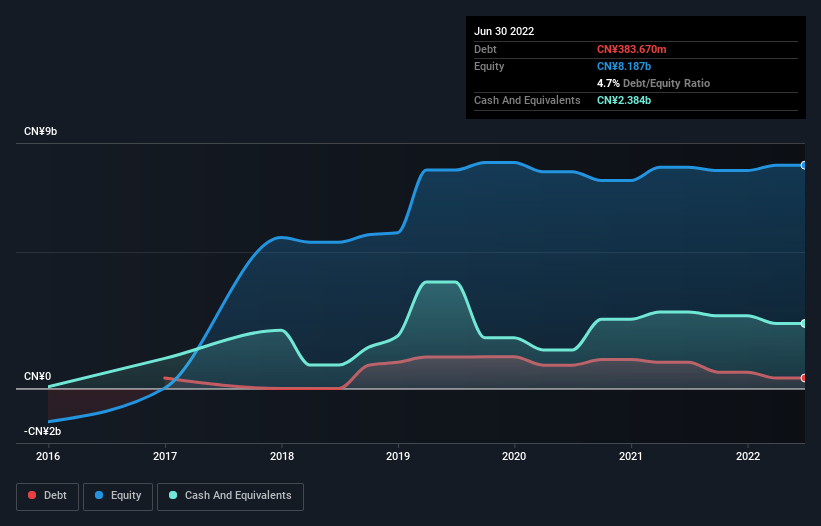

As shown in the chart below, as of June 2022, Maoyan Entertainment had RMB 383.7 million in debt, down from RMB 96.23 billion a year ago. But it also has 238 million yuan of cash to offset this, which means it has 200 million yuan of net cash.

How healthy is Maoyan Entertainment’s balance sheet?

Zooming in on the latest balance sheet data, we can see that Maoyan Entertainment has RMB 236 million in liabilities due within 12 months and RMB 119.8 million in liabilities due. As an offset, it has RMB 2.38 billion in cash and RMB 702 million in receivables due within 12 months.So it actually has 602.3 million RMB more Current assets are greater than total liabilities.

This short-term liquidity suggests Maoyan is likely to be able to easily repay its debt, as its balance sheet is far from strained. Simply put, the fact that Maoyan Entertainment has more cash than debt is arguably a good sign that it can safely manage its debt.

Fortunately, the burden of Maoyan Entertainment is not too heavy, and its EBIT has dropped by 26% compared with last year. When a company sees its earnings, it sometimes finds that its relationship with its lenders has soured. Without a doubt, the debt we know the most from the balance sheet. But the most important thing is that future earnings will determine whether Maoyan Entertainment can maintain a healthy balance sheet in the future.So if you follow the future, you can look at this free A report showing analyst profit forecasts.

In the end, a company can only pay its debts with cold hard cash, not accounting profits. Maoyan may have net cash on its balance sheet, but it will still be interesting to watch how the company converts earnings before interest and taxes (EBIT) into free cash flow, as this will affect its need and ability to manage debt. For the past two years, Maoyan Entertainment has generated free cash flow that has actually exceeded EBIT earnings. When the beat falls at a Daft Punk concert, this strong cash conversion has us as excited as the crowd.

add up

While it’s always wise to look into a company’s debt, in this case Maoyan Entertainment has RMB 2.00b in net cash and a balance sheet that looks good. On top of that, converting 117% of EBIT into free cash flow resulted in RMB 43 million in revenue. So we don’t have any problem with Maoyan Entertainment’s borrowing behavior.Share prices tend to follow earnings per share over time, so if you’re interested in Maoyan Entertainment, you might want to Click here to view an interactive chart of its EPS history.

If you are interested in investing in a business that can grow your profits without the debt load, check this out free List of growth companies with net cash on their balance sheets.

Valuation is complicated, but we’re helping make it simple.

find out if Maoyan Entertainment It may be overvalued or undervalued by viewing our comprehensive analysis, which includes Fair value estimates, risks and caveats, dividends, insider trading and financial health.

Have feedback on this article? Concerned about content? keep in touch Contact us directly. Alternatively, email the editorial team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only an unbiased methodology to provide reviews based on historical data and analyst forecasts, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no positions in any of the stocks mentioned.

[ad_2]

Source link