[ad_1]

Snescher

investment thesis

Despite a healthy 7.4% yield and ample free cash flow coverage, Corus Entertainment (OTCPK:CJREF) is a name that long-term investors should avoid because of the high likelihood of future dividend cuts.long market recession Its core business of TV advertising faced weak demand from advertisers and increasing competition from the likes of streaming/FAST players and retail media platforms, accelerating the revenue decline.

While management has aggressively invested in its digital platforms and partnerships to leverage its programming rights and content, it has had limited success diversifying its revenue base within a relatively fixed cost structure. As the cord-cutting trend continues, there could be a fresh round of dividend cuts in the next few years, especially as business declines and leverage remains high.

business overview

Corus Entertainment is a Canadian media and entertainment company focused on the creation, production and distribution of media content. The company operates television networks, radio stations and digital media platforms, and owns content production studios.

Corus Entertainment’s television properties include a variety of specialty channels focused on children, lifestyle and news. Some of its television networks include Global TV, Food Network Canada, HGTV Canada and YTV. Corus Entertainment also operates a number of radio stations in Canada. Its content production companies, including Nelvana and Corus Studios, produce TV shows and movies. While there is content produced in-house, Corus relies heavily on broadcast deals with major broadcasters like Disney to produce programming.

key financial indicators

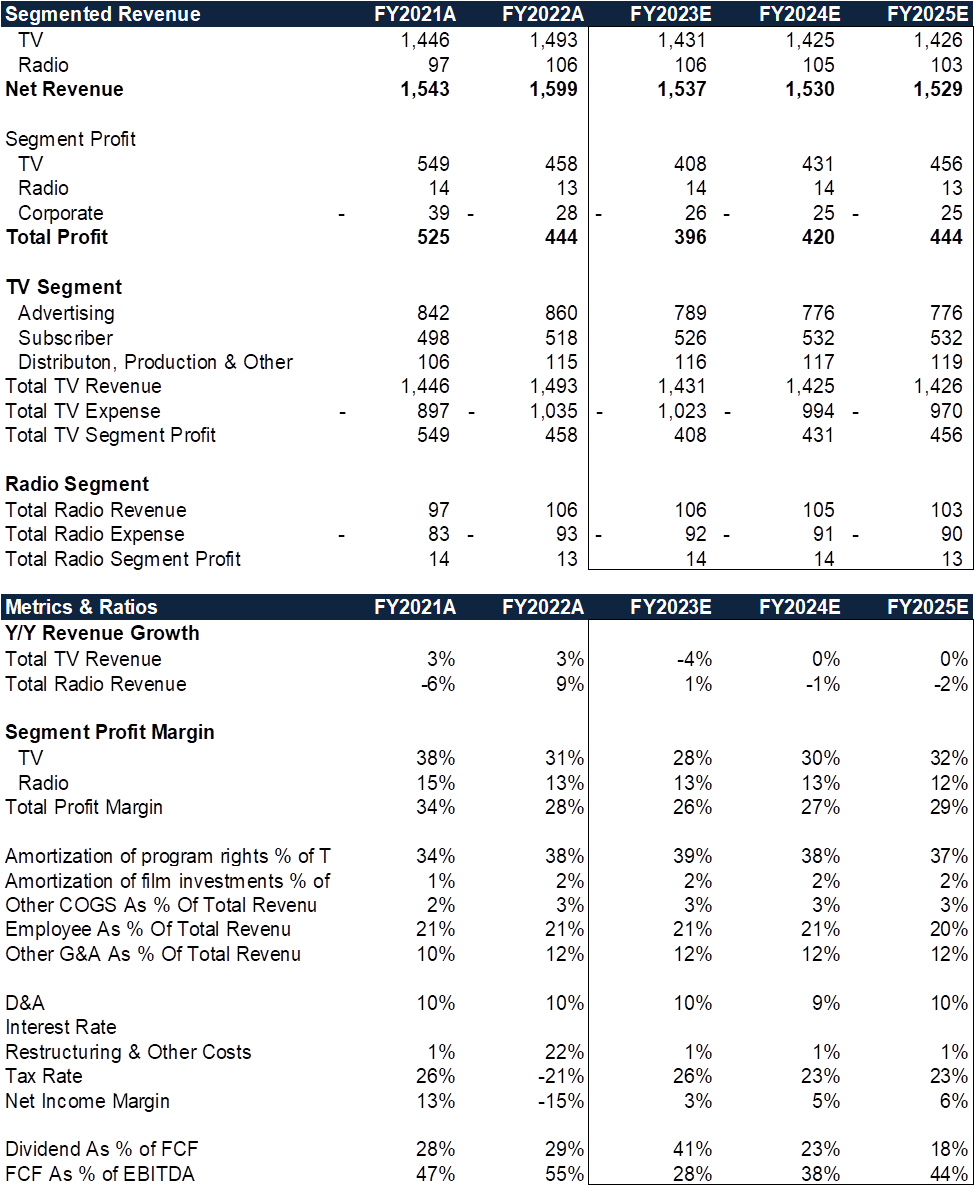

TV: 93% of LTM’s total revenue

Radio: 7% of total LTM revenue

LTM EBITDA margin profile: 25% at corporate level

Historical average free cash flow conversion to EBITDA: 50-55%

Corus Entertainment – Finance (author)

Why are we focusing on Corus now?

Given the large retail holdings of Corus Entertainment Class B shares (primarily for the attractive distribution yield), we took a deep dive into business quality, near-term cash flow generation, and dividend prospects. These quarters have been tough for Corus Entertainment. The company issued its first negative operating update on September 9, 2022, as its FQ4/22 revenue fell due to a deteriorating advertising market, sending shares down 8%. In January, following another quarter of double-digit Y/Y declines in advertising revenue, the Board of Directors announced that it was delaying its dividend decision until March 15, 2023.

it announces Amendments to its Credit Agreement With its bankers (dated Feb 17, 2023), raising its maximum total debt-to-cash flow ratio (temporarily through Nov 30, 2023) as a challenging advertising market dampens its revenue. What spooked the market (and the stock fell more than 12% the following Tuesday) was the negative covenant that would limit distributions if leverage exceeded a certain level. On March 6, 2023, Corus announced that its quarterly dividend would drop to $0.03 per Class B share, a 50% drop from the $0.06 level maintained since December 2018. But the market has already priced in a drop in dividend yields of close to 13%.

Corus’ share price performance has deviated significantly from its sub-sector average by more than 30%, and the stock is now down more than 68% from its 52-week high, posing a challenge for shareholders planning to hold on to the stock for the long term. We don’t think Corus stock is a good investment, despite its apparently high dividend yield (even if it looks risk-free given recent rate cuts).

The baseline business is in structural decline, and the growth strategy has had limited success in offsetting the decline in legacy business revenue. This is not a long-term growing dividend payment stream that stock investors should rely on, as newly set dividend levels could run into problems again in a few years. For nimble short-term investors, Corus could offer a potential recovery once the ad market unfreezes in late 2023 or early 2024. But we think the timing is too early and the recovery will depend heavily on the broader market recovering consumer demand, which we think is unlikely.

Industry Outlook

The linear TV market is going through a long-term decline, although the cutout is less severe in Canada than in the US. in Canada, Canadian Radio-television and Telecommunications Commission (OTCPK: CRTC) noted that the broadcast distribution business (BDU) industry will continue to see a 3.3% year-on-year decline in revenue in 2021, driven by subscriber loss. This is consistent with a 3-5% decline in TV subscriptions historically in Canada (highest was a 5.5% cord-cut in 2019).

On average, the trend of cord cutting is expected to continue in the low single digit range. In contrast, streaming services (paid and free formats) continue to gain traction, and free ad-supported television (quickly) has become a recent hotbed of activity. Corus is trying to keep pace with the times by expanding its FCF tail with its own content in new digital channels (website, app, streaming partners).

TV CPM Given the cord-cutting, which has actually seen double-digit price inflation, the risk of lower CPMs could further exacerbate gains (depressing not only volume but pricing) if the ad recession persists. We’re cautious about Corus’ ability to manage its cable-related advertising. One thing to point out is that Corus has exposure to top-of-funnel marketing that focuses on brand awareness. This is at the opposite end of the spectrum from bottom-of-the-funnel markets that focus on sales generation, which tend to be more recession-resistant.

With a “no landing” scenario becoming more likely and recession fears growing, top-of-funnel ad channels could continue to weaken. The rise of retail media combined with the FAST channel has introduced new ad inventory, introducing an additional layer of supply risk not observed during previous downturns. For example, Standard Media Index Continue to track double-digit YoY decline in TV advertising in H2/22, while outdoor media investment is growing rapidly.

While the FAST pipeline is growing rapidly, it’s unclear how the economics will be split between US partners and Corus. The overall digital subscription business, while flat to single-digit growth year-over-year, depends on the conversion rate of trial subscribers. Budgets around paying for subscription services are likely to come under scrutiny as consumers continue to reduce discretionary spending.Consumers are currently spending 2.5 times more than estimated on subscriptions C+R Research, suggests a space for rationalization in difficult times. In this case, second-tier products can easily fall out of favor.

Assess leverage and debt covenants

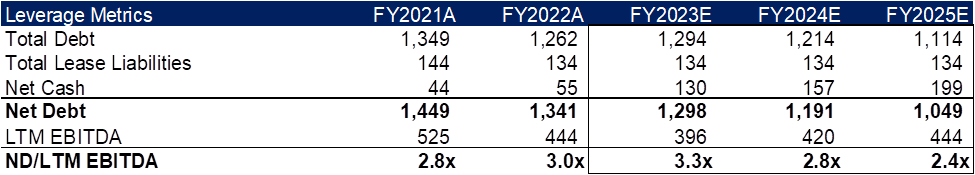

The revised credit facility covenant stipulates that the total debt-to-cash flow ratio will be capped at 4.5 times by September 2023 and reduced to 4.25 times from December 2023. Based on our calculations, we do not expect covenants to be triggered throughout the forecast period. Combined with the fact that the revised dividend is less than 40% generated by FCF, we believe the current capital structure and distribution strategy is fair with no significant near-term risks.

But according to our forecast, Corus’ leverage ratio will remain high (defined as above 2.5x) in FY2024 and will only fall below 2.5x in FY2025. That’s assuming the free cash flow tail doesn’t suffer any material decline from macroeconomic weakness or accelerated disconnection. Despite the reduced dividend payment, the structural decline in operating cash flow over the next few years suggests that despite management’s desire to deleverage, its hands are somewhat tied.

Corus Entertainment – Leverage (author)

risk

It’s important to understand the origin of Corus and its relationship to the Shaw family. In January 2016, Corus Entertainment acquired Shaw Media for $2.65B, in exchange for which Shaw Communications received a 39% stake in Corus. In September 2019, Shaw sold its entire stake (80.63 million Class B shares) through a secondary offering at $6.80. While the Shaw family is now gone, Corus may have a chance to be taken private given its large FCF generation. Furthermore, if there is a recovery in ad demand, Corus will benefit in the short term as a means of that recovery.

in conclusion

We think Corus Entertainment stock has the potential to cut its dividend again in a few years as the TV business continues to decline. While the underlying business is ostensibly generating ample cash flow, the decline in legacy business coupled with a relatively fixed cost base translates into negative operating leverage. For long-term investors looking for yield, there is still an imbalance in the risk-reward equation.

At a new adjusted DPS of $0.03 per quarter (7.4% dividend yield as of March 17, 2023), we estimate a conservative 38% FCF payout ratio is currently sustainable. The only question potential investors need to answer is how long they think the FCF tail will last.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link