[ad_1]

extreme photographer

Article paper

China Pure Electric Vehicle NIO Company (New York Stock Exchange:NIO) is receiving investment from Abu Dhabi-linked CYVN Holdings. This provides cash that can be used to fund the continued growth of NIO’s business.Sales are expected to grow significantly during the period Nio will return to impressive sales growth in the second half of the year, but profitability remains elusive.

what happened?

NIO Announce It will raise about $740 million in cash through the placement of 85 million new shares. The stake will be sold to CYVN Holdings, an investment vehicle mainly owned by the government of Abu Dhabi, which is a member of the United Arab Emirates.

increase in cash balance

The deal will naturally have multiple ramifications for NIO and its shareholder base. First, the deal will boost NIO’s cash balance. $740 million That’s a decent amount of cash for a company of Nio’s size and should help fund its temporary growth spending.

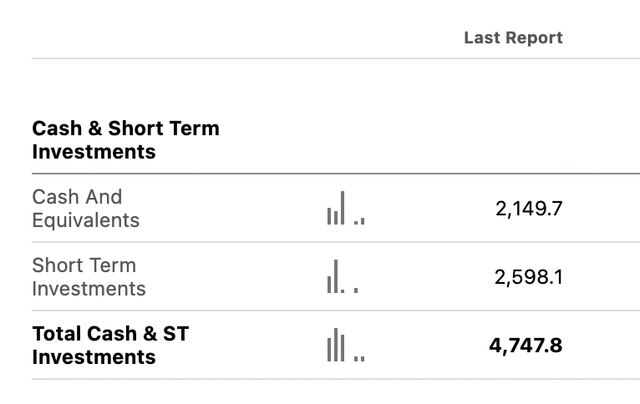

looking for alpha

In the graph above, we see that NIO’s cash position at the end of the most recent quarter and its short-term investments were very close to cash. Nio has a total of $4.7 billion in cash-like liquidity. This figure increased by $740 million, or about 15% of the total.

At the same time, it’s also important to look at NIO’s cash burn. The company, which is not yet profitable, is investing heavily in ramping up capacity to eventually reach enough scale to make it profitable. The fact that NIO is not yet profitable isn’t surprising — most EV makers, especially those that don’t have the scale of Tesla (tesla) or BYD (OTCPK: Will), unprofitable.

According to the data of Seeking Alpha, it can be known that hereNio burned through $560 million in cash last year, before capital expenditures. When we add last year’s capex of $1.01 billion, free cash flow is about -$1.7 billion. In other words, NIO is burning through just under $2 billion in cash annually, according to company figures from last year. Therefore, the current cash position is sufficient to cover approximately 2.5 years of cash burn before considering the recent share placement to CYVN Holdings. That deal alone added about five months of cash burn to NIO’s balance sheet — and overall, after this deal, NIO’s cash position should be sufficient for its next three years or so. Cash burn provides funding.

Of course, the cash burn rate won’t stay the same forever. Factors such as profit headwinds due to the ongoing price war in China’s EV market may increase the cash burn rate in the near term. Increasing production and opening new factories are also likely to increase the cash burn rate for the foreseeable future. On the other hand, as NIO scales up, its business should become more profitable and its cash burn per vehicle should drop significantly. Ultimately, NIO has to be profitable in order to fund its continued growth, but there’s no need to be profitable and cash flow positive in the short term — of course, being profitable as soon as possible is better.

Nio investors have been concerned about the company’s cash burn and balance sheet in recent times. While the funding environment has become tougher for unprofitable growth companies like Nio, the company doesn’t appear to be running out of cash anytime soon. Nio still has billions in cash on its balance sheet, and the recent deal with CYVN shows that deep-pocketed players are willing to invest in Nio — a good thing. The Saudi Arabian sovereign wealth fund has invested billions of dollars in Lucid Group, Inc. (LCID), sees an investment in the electric car maker as a good way to reduce reliance on oil and gas revenues. Abu Dhabi may have had similar ideas when it invested in NIO, and if so, NIO could issue additional shares in the future if the company needs additional funding.

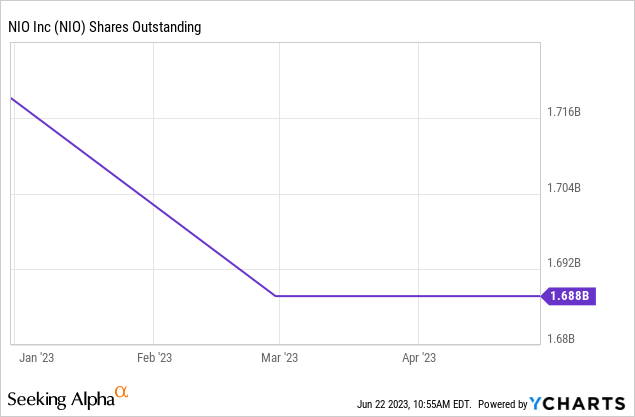

Of course, while Nio’s additional funding is a positive, it comes at a price: dilution. When Nio issues new shares to boost the cash on its balance sheet, the percentage of shares owned by existing shareholders falls. In this case, 85 million new shares were issued, equivalent to about 5% of NIO’s current share count, as shown in the following chart:

While a 5% dilution isn’t huge, it still makes sense. But this is something that has to be expected when investing in growth companies that are not yet profitable. The share counts of most of these companies are increasing. Even Tesla, the most valuable electric car company, which is already quite profitable, continues to dilute its shareholders by issuing shares to employees and management.

NIO: Expect substantial growth

NIO is mainly active in China, the world’s most important market for electric vehicles. However, China has struggled in recent quarters due to weaker-than-expected economic growth and the lingering effects of its massive lockdown, which lasted much longer than other countries. While the market environment has not been easy for Nio, the company has also encountered some company-specific issues in the past few months, such as consumers not liking its sedans and higher prices for most of Nio’s product line. So sales in the first five months of the year are not particularly attractive given the major growth tailwinds experienced by the EV industry in general.

In the first five months of this year, NIO sold a total of 44,000 vehicles, a year-on-year increase of 16%. While growth rates in the mid-teens are good for most companies, EV companies are expected to have higher growth rates, so it’s not particularly dramatic. That being said, the company expects deliveries to increase significantly in the second half of the year.

Several factors could contribute to this outcome, including changes to the model lineup that will make Nio more competitive. NIO will release the ET5 Touring, which according to management will be an important addition to the ET5 sedan, which also recently launched the all-new ES6. As an SUV, the new ES6 has already received a large number of orders.Elektrek Report Nio received about 30,000 pre-orders in just three days, or about 10,000 per day. Of course, booking velocity won’t stay that high, as orders are likely to be filled in large numbers ahead of schedule. Also, not every preorder results in a sale. Still, the data suggests that demand for Nio’s new vehicles is high, with many Chinese consumers willing to pay the above-average prices Nio demands.

Nio’s management Guidance for Deliveries in June were around 10,000 vehicles, which would be well above the pace seen in the first five months of the year. Even better, Weilai also claimed that the average monthly sales in the second half of the year will be around 20,000 vehicles. All told, this year’s car sales will reach about 175,000 units, about two-thirds of which will be in the second half of the year. If NIO hits that mark, it will end the year with annual sales of around 250,000 vehicles, which would make it one of the largest electric car companies in the world. Of course, there’s no guarantee Nio will hit that mark, as its execution has sometimes been underwhelming.

Still, even if NIO sells only 15,000 vehicles per month in the second half, that would be a huge improvement over the first half. By increasing scale, profit margins also improve over time.

final thoughts

Shares of NIO had a rough run last year — as has been the case for many electric car companies. Execution has been lackluster at times, but a recent agreement with the Abu Dhabi government provides access to additional funding that should help the company expand its business.

With an improved product lineup, the second half of the year is likely to be much stronger than the first half, although the company is likely to continue to lose money in the coming quarters.

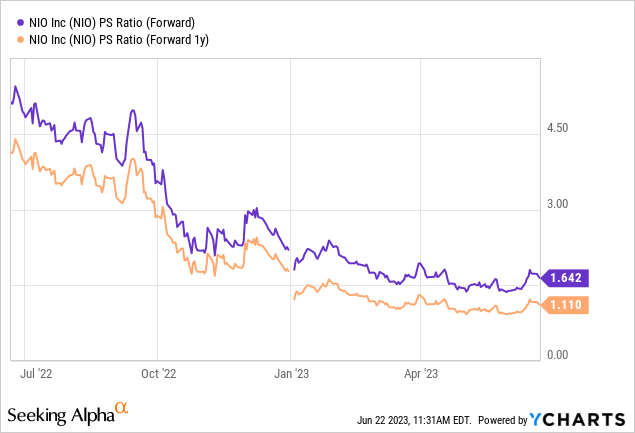

Nio’s price-to-sales ratio in 2023 is 1.6 times, and the price-to-sales ratio in 2024 is only 1.1 times, which is not expensive for an electric car company. NIO is not a low-risk stock due to its current unprofitability, uncertainty about future industry margins, and China-centric macro risks. Still, with a fairly low valuation and decent expected growth, it could be interesting for those looking for EV investments.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link