[ad_1]

Abu Dhabi National Oil Company (ADNOC) has retained its position as UAE’s most valuable brand and second most valuable brand in the Middle East region with its brand value increasing 19% to US$12.8 billion.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes nearly 100 reports, ranking brands across all sectors and countries. The United Arab Emirates’ top 50 most valuable and strongest brands are included in the Brand Finance UAE 50 report, while the Middle East’s top 150 most valuable and strongest brands are included in the Brand Finance Middle East 150 report.

ADNOC is also the strongest Oil & Gas brand in the Middle East with a Brand Strength Index of 79.1 out of 100. ADNOC is one of a handful of brands in the sector to see its BSI score rise by +2.0 points, as a result of its stellar reputation and trust amongst international investors and stakeholders. ADNOC’s impressive performance was also reflected in being ranked 159th in the Brand Finance Global 500 2022 ranking.

With an eye on the future, and in line with the UAE leadership’s 2050 net zero strategy, ADNOC is also embracing the energy transition through several strategic initiatives including its global clean energy joint venture with TAQA and Mubadala on renewable energy and green hydrogen.

Andrew Campbell, Managing Director Brand Finance Middle East, commented

“ADNOC continues to be the principal enabler of UAE’s sustainable economic development goals. Since its successful transformation it has taken a leading role in the industry as evidenced by its successful partnerships with peers and international investors. ADNOC is leveraging is brand to be a key enabler of the energy transition as it strives to be at the forefront of energy solutions across the entire diversified energy landscape”

Etisalat retains title of strongest brand in UAE

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Certified by ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in more than 35 countries and across nearly 30 sectors. According to these criteria, Etisalat is UAE’s strongest brand, with a Brand Strength Index (BSI) score of 89.2 out of 100 and a corresponding AAA brand strength rating.

According to these criteria, Telecoms giant Etisalat is the strongest brand in UAE for the second year in a row, with a BSI score of 89.2 out of 100 and a corresponding AAA rating. Expo 2020 has offered Etisalat the platform to demonstrate itself as a strategic enabler of the UAE’s digital transformation. Etisalat’s focus on enhancing customer experience and living the ethos of “Together Matters” has helped the brand in increasing its BSI score by +1.8 points, as well as making it the #1 strongest telecoms brand globally.

In addition to the strong BSI performance, Etisalat is increasing its brand value from US$8.5 billion to US$10.1 billion. Etisalat Group also boasts the most valuable telecoms brand portfolio in the Middle East.

Recently, the group rebranded to ‘e&’ to embrace its role in digital transformation and information and Information and Communications Technology (ICT) strategy. The group now faces the challenge of transferring equity to the new brand over the course of 2022.

Dubai Financial Markets leads strong performance from finance brands

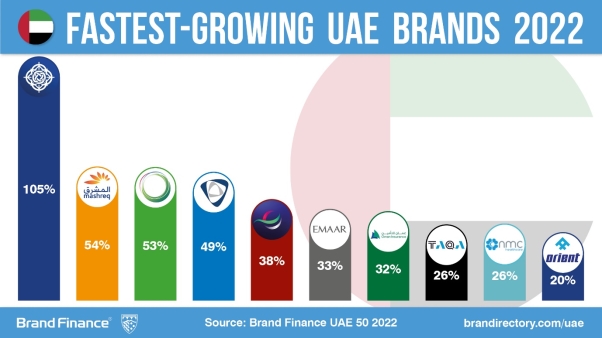

Dubai Financial Markets (brand value up 105% to US$86 million) is the UAE’s fastest growing brand and led a strong performance amongst financial brands. The DFM plans to launch a market-maker fund to boost trading, and has also announced a healthy pipeline of IPO’s ( 10 state and state-related firms) with an aim to double the financial markets size to over 3 trillion dirhams.

Other brands that primarily operate in the banking and exchanges sector in the UAE are ahead of the curve with impressive performance with regard to their brand strength.

While Emirates NBD is the strongest UAE brand in the finance sector with a Brand Strength Index (BSI) score of 79.9 out of 100 with a corresponding AAA- rating, Abu Dhabi Commercial Bank (ADCB) has recovered and surpassed its previous BSI score by 11.9 points, achieving a strong score of 75.4 out of 100. The growth can be attributed to an increase in its improvement in brand reputation and brand consideration based on the Brand Finance Global Brand Equity Monitor (GBEM).

DEWA, Emaar Properties, and Mashreq jump two spots in ranking

Utilities brand DEWA, Real estate brand Emaar Properties, and Banking brand Mashreq all moved up two ranks in the Brand Finance UAE 50 2022 ranking. All three brands are growing by more than 30% in brand value.

Utilities brand Dubai Electricity & Water Authority (DEWA) (brand value up 53.3% to US$806 million) has seen its Brand Strength Index improve to 72 with a AA rating. It remains the third most valuable utility brand in the Middle East behind TAQA and Saudi Electricity, although it has closed the gap to the top 2 in the last year.

DEWA is targeting a public listing in the first half of the year and the strength of the brand amongst stakeholders will be key to a successful listing. The utilities brand is emphasising sustainability and green energy priorities by setting goals for carbon neutrality and launching the Dubai Net Zero Emissions Strategy by 2050.

The developer of Burj Khalifa and Dubai Mall, Emaar Properties, is witnessing a strong recovery in brand value to pre-pandemic levels with a 33% increase in brand value year-on-year. The brand moved up the Brand Finance UAE 50 2022 ranking by two positions with a brand value of US$2.1 billion. The real estate industry took a hit during the pandemic, however, as economies reopen the industry is recovering to previous levels of activity.

Emaar Properties achieved property sales growth in 2021 due to the combined success of domestic development and international operations. Domestically, sales of villas and beachfront properties are particularly strong, as buyers are returning to the market seeking more outdoor space following periods of lockdown. Internationally, the brand is expanding its community impact and brand reach via projects such as the Emaar Square Mall in Turkey, and the Uptown Cairo Mall, which will be Egypt’s largest shopping centre.

Mashreq Bank experienced a 54.2% increase in brand value over the past year with a brand value of US$747 million. Following the launch of Mashreq Neo, the digital-only bank, back in 2017, Mashreq has quickly established the brand in this growing space, committing substantial funds for digital transformation of its banking model. Mashreq has been one of the first banks in the region to choose a predominantly digital model and digital acquisition has been growing substantially this year. This is increasing Mashreq’s customer base thanks to new technological additions such as the facial recognition technology and “neo credit”, which have both received strong market responses.

Another great step forward into further developing the banking eco-system is the launch of the Mashreq API Developer Portal, a clear reflection of Mashreq’s dedication to the fintech space. Mashreq will be the first bank in the region to have an active API platform that will enhance the user experience in innovative ways going forward.

Aldar has the fastest growing Brand Strength Index (BSI) in the Real Estate sector; up 15 points

Aldar’s brand value is up 20% to US$535 million. The brand has been built on the foundations of national economic growth, which has fueled local housing demand, as well as government-backed developments to fulfil national growth ambitions. Unlike its peers, Aldar’s brand value has remained stable over the past two years, as the brand was buoyed by government contracts in Abu Dhabi during 2020 and 2021.

At the beginning of 2021, Aldar launched a new operating model to decentralise governance and drive the next phase of company growth. The operating model distinguishes the development and investment businesses into two parts of the brand. Aldar Investment is expanding its international partnerships and taking on more asset management projects. At the same time, Aldar Development is building communities to support the economic and social fabric of Abu Dhabi.

New entrants in UAE ranking show promising growth

The three highest ranking new entrants in the UAE ranking are Abu Dhabi Ports, Majid Al Futtaim and Emirates Global Aluminium (EGA).

The logistics and maritime brand Abu Dhabi Ports is a part of ADQ’s portfolio which consists of a wide variety of brands across energy, healthcare, hospitality, financial services, and real estate. With a brand value of US$440 million, the brand is a key enabler to drive integrated global trade to the United Arab Emirates and Abu Dhabi.

The brand is well placed to ease the ongoing global supply chain woes by fostering strategic partnerships with shipping company CGA CGM to open a new terminal that will operate in the Middle East and the Indian subcontinent. The aim is to digitise and update supply chain infrastructure and global expansion to increase operations.

Following AD Ports, Mubadala Investment Corp’s and ICD’s jointly owned Emirates Global Aluminium (EGA) enters the ranking at the 25th position with a brand value of US$322 million. The brand is the world’s largest premium aluminium producer and a major player for the UAE economy after the oil and gas sector. It has the highest brand strength in the region amongst mining, metals and minerals brands at a brand rating of AA-.

Majid Al Futtaim is the third highest new entrant in the ranking valued at US$258 million. The conglomerate also operates businesses providing customer experiences with shopping malls, cinemas, retail, and lifestyle among others. The Majid Al Futtaim corporate brand acts as a common unifying thread amongst the operating brands; this helps build reputation and creditworthiness across the whole brand portfolio. The brand is a key enabler of the corporate strategy aims of being relevant to all stakeholders, stretching into new business areas and geographies and to have a long-term sustainable vision.

Airline brands regain standing

As travel restrictions reduce, low-cost carriers Air Arabia and Flydubai have witnessed an upturn in brand value. The former witnessed a 12% increase in brand value to US$148 million and the latter experienced a 7% increase to US$141 million.

At the same time, it is key to note that this recovery is fueled by an increase in domestic and regional travel with COVID restrictions reducing. Long haul travel is the mainstay of Emirates and Etihad. Emirates continues to be the premier airline brand globally with a Brand Strength Index (BSI) score of 80.1 out of 100 and a corresponding AAA-brand strength rating.

Abu Dhabi leads in value, Dubai leads in number of leading brands

24 of the brands in the top 50 in the Brand Finance UAE 50 2022 ranking are headquartered in Dubai, while 19 are in Abu Dhabi. However, in terms of value the Abu Dhabi based brands have a higher brand value at US$32 billion compared to the Dubai based brands at US$22 billion. The gap between the two is primarily attributed to two major players in Abu Dhabi: ADNOC and Etisalat.

View the full Brand Finance UAE 50 2022 ranking here

View the full Brand Finance Middle East 150 2022 report here

[ad_2]

Source link