[ad_1]

The essence of investment is to earn some and lose some.no doubt Chicken Soup for the Soul Entertainment (NASDAQ: CSSE) stocks have had a very bad year. Shares plummeted 64% at the time. Returns were disappointing even over a three-year horizon, when shares were down 35%. Things have been tougher for shareholders lately, with shares down 25% in the past 90 days.

After falling 14% last week, it’s worth looking at the company’s fundamentals to see what we can extrapolate from past performance.

Check out our latest analysis for Chicken Soup for the Soul in Entertainment

With Chicken Soup for the Soul losing money in the past 12 months, we think the market may be more focused on revenue and revenue growth, at least for now. When a company is not profitable, we usually expect to see good revenue growth. As you can imagine, rapid revenue growth, if maintained, often leads to rapid profit growth.

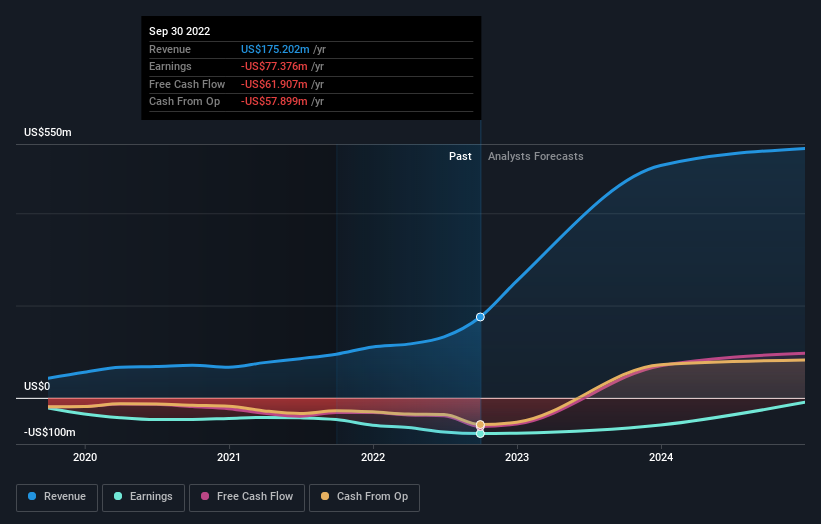

Chicken Soup for the Soul Entertainment’s revenue increased by 85% over last year. That’s an excellent result, better than most other loss-making companies. Shares, meanwhile, are down 64%. Typically, growth stocks like this are volatile, with some shareholders concerned about running a deficit (i.e., losing money) on the bottom line. Generally speaking, once a profit is made, investors will think that such stocks are less risky. But when do you think it will happen?

You can see in the graph below how income and earnings have changed over time (click the graph to see exact values).

We are pleased to report that this CEO is paid less than most CEOs at companies of similar capitalization. It’s always worth keeping an eye on CEO compensation, but the more important question is whether the company’s earnings will grow over the years.this free A report showing analyst forecasts Should help you form an opinion on Chicken Soup for the Soul

Different perspectives

We’re sorry to report that Soul Entertainment shareholders’ chicken soup is down 64% this year. Unfortunately, that was worse than the broader market’s 21% drop. That being said, in a falling market some stocks will inevitably become oversold. The key is to keep a close eye on fundamental developments. Unfortunately, last year’s performance may indicate unresolved challenges, as it was worse than the 7% annualized loss over the past five years. We realize that Baron Rothschild has said that investors should “buy when there is blood in the streets”, but we remind investors to first ensure that they are buying high-quality businesses. It’s always interesting to track stock price performance over time. But to better understand entertainment chicken soup for the soul, we need to consider many other factors. Consider, for example, the ever-present specter of investment risk. We have identified 2 warning signs Chicken Soup for the Soul understanding them should be part of your investing process.

If we see some big insider buying, we’d love chicken soup for the soul more.While we wait, check this out free List of growth companies with significant insider buying recently.

Note that the market returns quoted in this article reflect the market-weighted average return of stocks currently traded on U.S. exchanges.

What are the risks and opportunities Chicken Soup for the Soul?

Chicken Soup for the Soul Entertainment

award

Transaction price is 89.7% below our estimate of its fair value

Revenue expected to grow 64.17% annually

risk

Shareholders have been diluted in the past year

Has cash runway for less than 1 year

Have feedback on this article? Concerned about content? keep in touch Contact us directly. Alternatively, email the editorial team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only an unbiased methodology to provide reviews based on historical data and analyst forecasts, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no positions in any of the stocks mentioned.

[ad_2]

Source link