[ad_1]

Did you know that there are some financial indicators that can give clues to potential multibaggers?First, we want to see a proven return Increased Capital Employed (ROCE), Second, Expansion according to capital employed. In short, these types of businesses are compound interest machines, meaning they continually reinvest earnings at higher rates of return.Speaking of which, we noticed some big changes always entertaining (Wall Street English: for) return on capital, let’s see.

What is Return on Capital Employed (ROCE)?

If you haven’t used ROCE before, it measures the “return” (profit before taxes) a company generates from the capital employed in its business. To calculate this metric for Forever Entertainment, use the following formula:

Return on Capital Employed = Earnings Before Interest and Taxes (EBIT) ÷ (Total Assets – Current Liabilities)

0.17 = zol7.3m ÷ (zol48m – zol4.0m) (Based on last twelve months to September 2022).

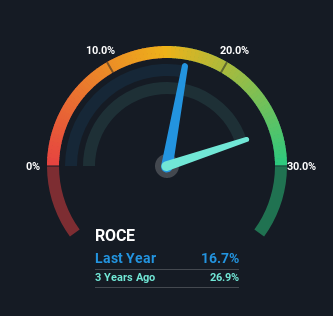

so, Forever Entertainment has an ROCE of 17%. That’s a pretty standard return in absolute terms, but compared to the entertainment industry average, it lags behind.

Check out our latest analysis for Forever Entertainment

Historical performance is a good starting point when researching stocks, so above you can see Forever Entertainment’s ROCE versus a measure of its prior returns.If you want an in-depth look at Forever Entertainment’s historical earnings, revenue and cash flow, check out these free chart here.

ROCE Trend

Forever Entertainment recently became profitable, so it appears their previous investments are paying off. Shareholders will no doubt be pleased that the company was losing money five years ago but is now generating a 17% return on capital. Unsurprisingly, like most companies trying to turn a profit, Forever Entertainment is using 445% more capital than it did five years ago. This can tell us that the company has many reinvestment opportunities that can generate higher returns.

key points

All in all, it’s great to see Forever Entertainment successfully turning around and continuing to reinvest in its business. The staggering 427% total return over the past five years tells us that investors expect more good things to come. So we think it’s worth your while to check whether these trends will continue.

Forever Entertainment does have some risks, we have found 1 warning sign from Forever Entertainment You might be interested.

If you want to search for reliable companies with good returns, check this out free List of companies with strong balance sheets and decent returns on equity.

Valuation is complicated, but we’re helping make it simple.

find out if entertainment forever It may be overvalued or undervalued by viewing our comprehensive analysis, which includes Fair value estimates, risks and caveats, dividends, insider trading and financial health.

Have feedback on this article? Concerned about content? keep in touch Contact us directly. Alternatively, email the editorial team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only an unbiased methodology to provide reviews based on historical data and analyst forecasts, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no positions in any of the stocks mentioned.

[ad_2]

Source link