[ad_1]

Moyo Studio/E+ via Getty Images

ETF Characteristics and Track Record

iShares MSCI UAE ETF (Nasdaq:United Arab Emirates) has a listing history of over 9 years, AUM of US$39 million, covering 38 stocks that closely follow the Middle East market Second largest economy.With relatively negligible AUM at just under $40m, it’s understandable that the stock has an exceptionally low spread; in fact, the UAE’s 45-day average spread percentage sits at a respectable 0.37%; to put this figure together, please consider it over 12x Corresponding figures for iShares Emerging Markets ETF.

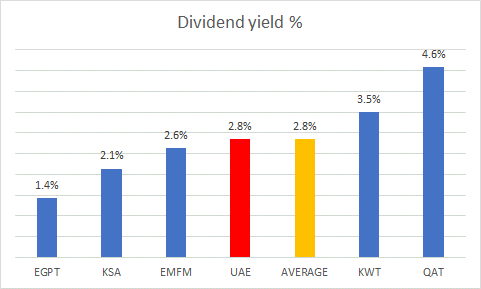

From an income perspective, the UAE ETF offers decent enough numbers below 3%, in line with the average if you consider other ETF options focused on comparable economies such as Egypt, Qatar, Saudi Arabia and Egypt.

Y chart

Investors should be aware that the UAE has a history of rebalancing its portfolio significantly each year; portfolio turnover topped 100% a few years ago and exceeded 100% last year. 50%meaning that one-half of the stocks are rotated (for context, most ETFs typically only rotate one-third of the stocks each year).

Y chart

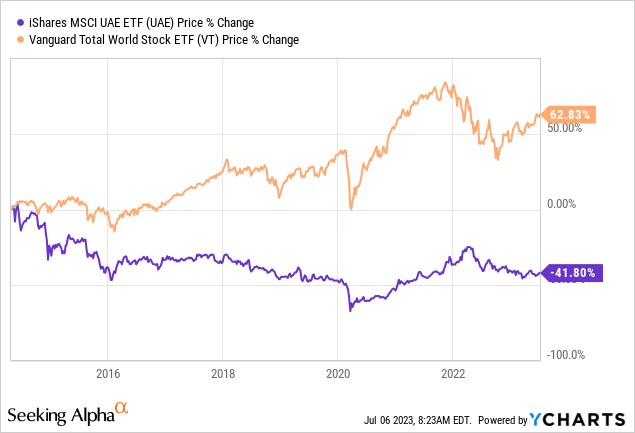

The UAE also has a long record of eroding wealth. It has lost 41% of its value since listing, so it has severely underperformed the Vanguard Total World Stock ETF.

Y chart

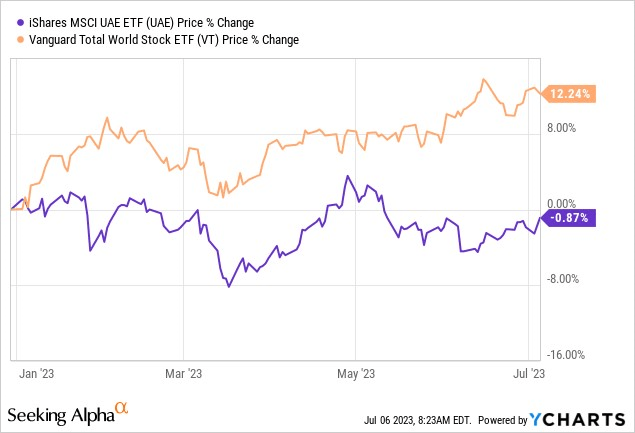

This year, despite VT’s 12% growth, the UAE’s performance has been lackluster, with mediocre returns. However, we think the second half of the year could be a better period for the UAE.

macro review

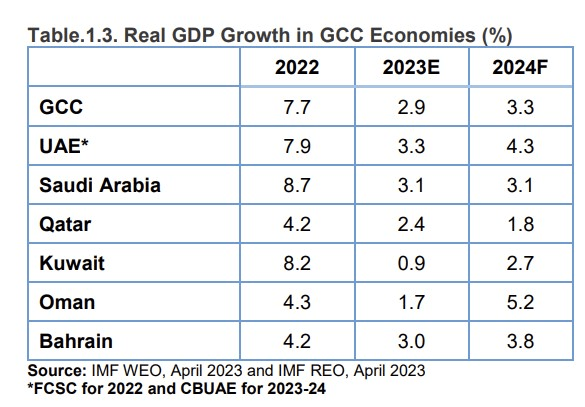

With real GDP growth at a solid 7.9% in 2022, growth will understandably slow this year.However, despite the much lower growth threshold, investors should note that the UAE is still likely to be the fastest growing region in the GCC, with figures projected at 3.3% (40 bps above GCC growth expectations).

Central Bank of the United Arab Emirates

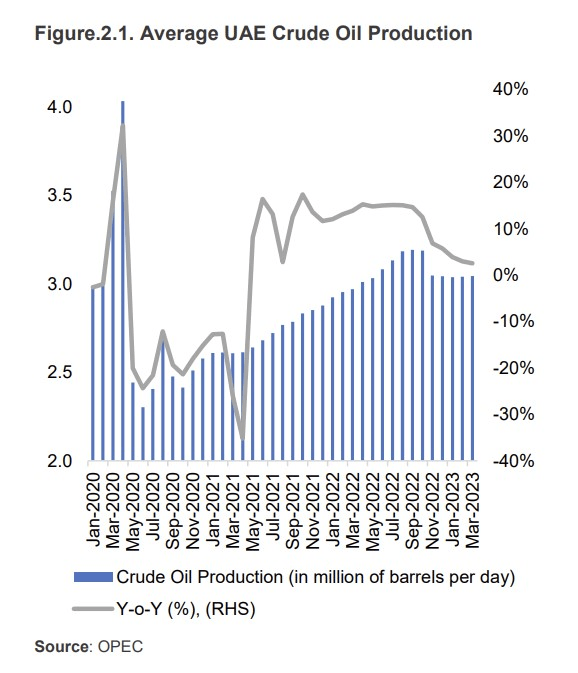

Last year, the UAE was of course able to take advantage of the sun to dry the hay, producing an average of 3.1 million barrels per day; however, oil-related GDP will drop significantly this year, bringing OPEC-induced production cuts to nearly 150,000 barrels per day since May.

OPEC

All told, oil-related GDP grew 9.5% in FY2022 and will contract -0.3% this year.We think the drop could be even steeper as Saudi Arabia and Russia announce further production cuts, but the latest Report Indicative of the reluctance of the UAE finance ministry to join the ranks.

Needless to say, the onus this year will likely fall on the non-oil sector (including travel and tourism), which fortunately is expected to remain resilient enough (albeit not as strong as last year; 4.5% expected (last year’s 7.2%).

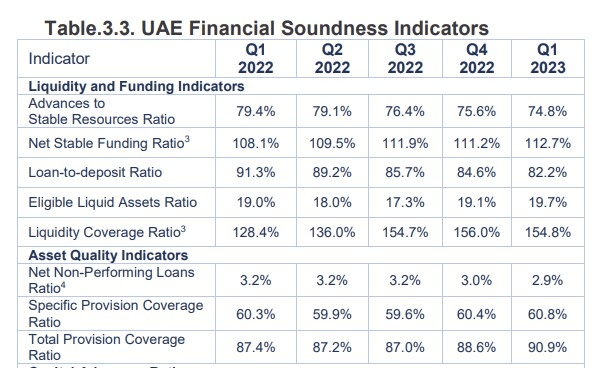

If the UAE ETF is to thrive, a lot is likely to depend on the performance of its bank stocks, as they make up the lion’s share of the portfolio. 40%.UAE central bank appears to be taking cue from Fed reserves and is poised to raise rates againwe believe the NIM trajectory for UAE banks should remain healthy.

So far, steeper interest rates have not changed banks’ asset quality. On the contrary, the net non-performing loan ratio actually showed a downward trend in the first quarter, falling to a level of 2.9%. We don’t think this trend will last for long, but from where it stands, the banks there are already doing well, with the PCR (provision coverage ratio) breaking the 90% mark recently.

Central Bank of the United Arab Emirates

Loan growth typically slows in the face of rising interest rates, and we have seen this play out in the first quarter (total credit growth was only 3.5%) but investors should also recognize that according to The impact of loan growth in H2-22 is already fairly low, so these trends will not necessarily persist in H2-23.

Conclusion: Valuation and Technical Considerations

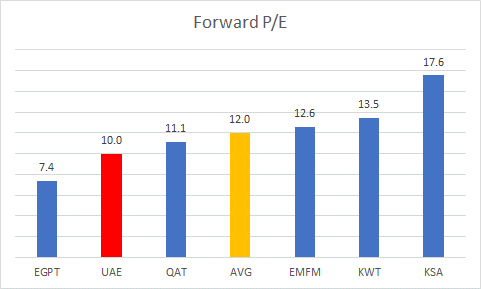

In terms of valuation, UAE stocks currently appear to offer better value than stocks in most other comparable regions.According to YCharts data, UAE constituents are currently trading at 10 times Forward P/E (only the VanEck Vectors Egypt ETF has a lower P/E), equates to a 17% discount to the peer average.

Y chart

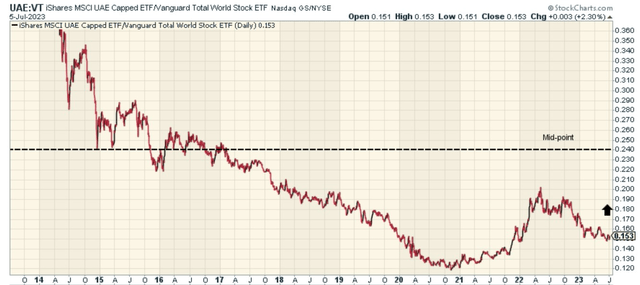

On the chart, we think the UAE is in a much better place now than it was a little over a year ago.

The UAE weekly chart shows that the ETF has been trending lower since last April descending wedge pattern. We see the end of this pattern when the UAE breaks above the upper wedge in early April 2023. After several weeks of an uptrend, we saw the ETF complete two pullbacks and now appears to be retesting the April highs first, starting to move higher.

The UAE is likely to continue to benefit from the bullish momentum, as investors looking for rotation opportunities around the world may view this ETF as an ideal investment opportunity. To elaborate on this, note that the relative strength of the UAE relative to global equities (as represented by the VT ETF) is currently 36% below the midpoint of the long-term range, likely due to catch-up.

[ad_2]

Source link