[ad_1]

black cat

Q1 Highlights

Pennsylvania Entertainment (Nasdaq:Payne) released its Q1 financial report last week. The results were viewed as relatively negative by the market, with the stock down about 15% in the last week.The good news is that Penn Entertainment has plan repurchase An additional $750 million in share repurchases authorized in December 2022 and an additional $80 million in share repurchases authorized in February 2022. At current prices, this equates to the company repurchasing approximately 32 million shares. With about 154 million shares outstanding, that number might not be as significant as it might seem at first glance, but combined with other catalysts such as higher earnings in the sports betting space, and increased revenue through the combination of Barstool Sports, PENN stock looks like a great buy at its current price. Become a top-notch buyer.

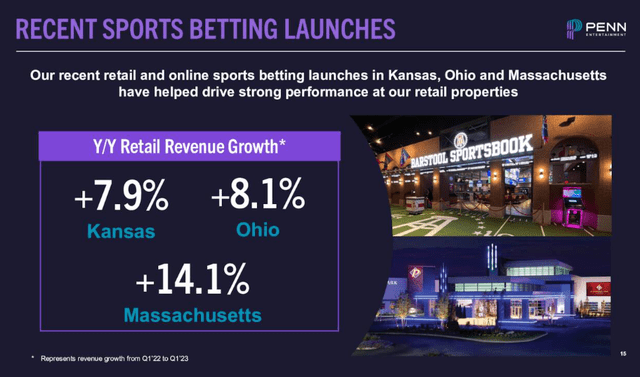

Figure 1. Sports betting expands into more areas More states will allow PENN to continue driving higher growth for the foreseeable future (PENN Q1 earnings presentation)

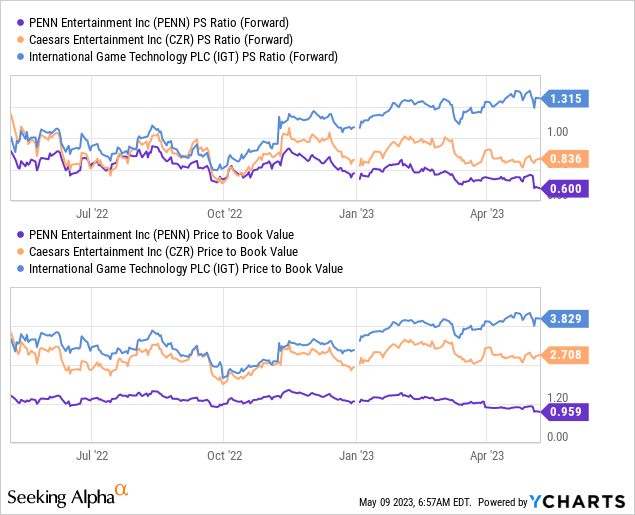

Penn Entertainment Trade at a lower price than peers From a price-to-book, price-to-sales, and price-to-earnings perspective, we think the stock has upside potential of as much as 80% over the next two years if all goes well. Penn’s short interest is also high at around 10% and has a history of rising prices in fast clips, so in our view it could be in for a short squeeze at some point.

current valuation

PENN stock trades at 0.6 times sales and less than 1 times book value. This suggests that the stock may be undervalued by as much as 50% compared to its peers (Figure 2). The stock is also cheap from a GAAP price-to-earnings ratio perspective, and all of the above metrics are trading well below PENN’s 5-year historical trading average.

Figure 2. PENN is trading at over 50% discount to its peers in terms of P/S ratio and cheaper in terms of P/B ratio, suggesting a potential doubling and still relatively reasonable valuation

As buybacks continue and the proceeds of the Barstool acquisition take shape, PENN will only become more undervalued.The strength of the company Profitability Indicators and what their upcoming key weaknesses may be in their way forward to grow. Earnings in the first quarter showed some signs of a slowdown in underlying growth, which may be more due to macroeconomic headwinds, which we believe are largely responsible for the decline in earnings. For PENN to return along with its peers’ valuations, it may take a good quarter or two to show year-over-year growth again, and the stock could rise by 80% — conservatively speaking, as peers are undervalued by about 40% on average. % from the above indicators. We gave a conservative 1-2 year timeframe for formation, but if favorable market conditions resume, it could happen as soon as possible within the next 2-3 quarters.

risk

PENN Entertainment does have a lot of debt. This should be monitored going forward, especially in a high interest rate environment. A positive sign is to see them starting to pay down this debt after subsequent buybacks. This will compress the enterprise value of the stock and make the valuation more favorable.

Another key metric to watch will be the profitability of sports betting operations throughout the second half of the year. Names like DraftKings (DKNG) yes Expect to post some of their first profitable quarters This year and the Barstool segment will need to do the same for PENN to be successful in the current trading environment.

indisputable information

“In God we trust. All others must bring data” – Robert Hayden

Something new that we’ll try to start incorporating into our stock coverage is a simple statistic from every business we research in depth that sets the company apart from the competition and screams buy or sell.Think about that classic story Jeff Bezos’ Thoughts on Starting Amazon“As he described it, when he read that the use of the Web was growing at an alarming rate, his alarm bells went off. 2,000% per year. A few months later, he quit his day job and left New York with his wife, MacKenzie, and their dog. His adoptive father, gave him a car and invested $300,000 of his pension into a new venture. “You know the rest of the story of what Amazon has become today. We’re going to try to find this undeniable information and an eye for those looking to find the next Amazon in their never-ending stock-picking adventure.” Statistics cannot be ignored.

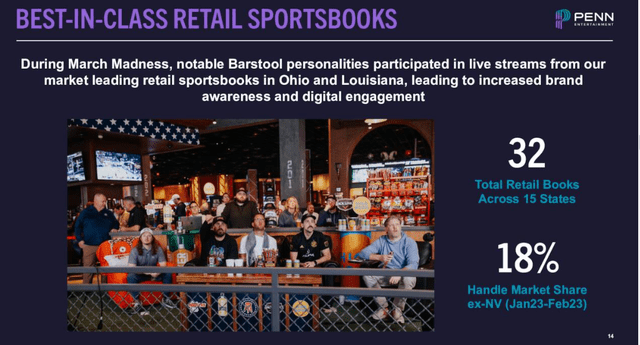

PENN has approximately 18% market share in the retail sports betting market.This market is expected to be close to 11% rate over the next ten years. That would value PENN’s roughly $1 billion market share at close to $2.5 billion by 2030, assuming they perform in line with the rest of the market.

Figure 3. PENN Entertainment’s Sportsbook division is just scratching the surface of its potential as sports betting legalization rolls out across the country with 35 more states to play (PENN earnings call)

PENN’s sports betting division should drive revenue growth for the foreseeable future, while diversification from the rest of their portfolio should keep them consistently profitable.

Overall Investment Summary

PENN Entertainment got an undue blow in its latest earnings. Debt levels remain at risk, but if the company can change its focus and start paying down debt, the stock will trade at a steep discount next to its competitors. Growth has been questionable over the past few quarters, but should take off with the help of growth in online gaming, sports betting, and the newly acquired Barstool segment. We see a conservative upside potential of up to 80% for the stock over the next 1-2 years. Depending on how macroeconomic conditions change in the second half of the year, this price target could be mediocrely raised or lowered, as PENN’s valuation is likely to depend heavily on their ability to service long-term debt. Anything in the $25 range or lower looks like a good bet for high-risk, high-reward investors looking to invest in the growing wave of sports betting.

[ad_2]

Source link