[ad_1]

Howard Marks said it well when he didn’t worry about stock price volatility, “The risk I worry about is the possibility of permanent loss…every real investor I know does.” So when you evaluate a company Astute investors seem to know that debt – often associated with bankruptcy – is a very important factor when it comes to risk levels. important, Chicken Soup for the Soul Entertainment (NASDAQ: CSSE) are indeed in debt. But the bigger question is: How risky is the debt?

When is debt dangerous?

Debt and other liabilities become risky for businesses when they cannot easily meet these obligations through free cash flow or by raising funds at attractive prices. In a worst-case scenario, a company can go bankrupt if it can’t pay its creditors. More frequently (but still costly), however, companies have to issue stock at cheap prices, permanently diluting shareholders, to shore up their balance sheets. But by replacing dilution, debt can be an excellent vehicle for businesses that need capital to invest in growth at a high rate of return. When we examine debt levels, we first consider both cash and debt levels.

See our latest analysis for Chicken Soup for the Soul in Entertainment

How much debt does Soul Entertainment Chicken Soup owe?

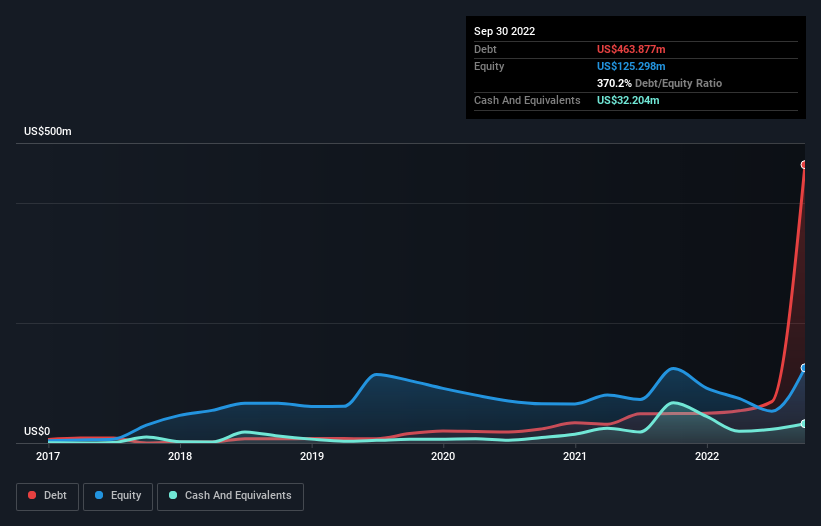

The chart below shows Chicken Soup for the Soul has $463.9 million in debt as of September 2022, up from $49 million in a year. However, it also has $32.2 million in cash, so its net debt is $431.7 million.

How strong is the chicken soup of Soul Entertainment’s balance sheet?

Zooming in on the latest balance sheet data, we can see that Chicken Soup has $141.3 million in liabilities due within 12 months and $650.8 million in liabilities due 12 months later. To offset these debts, it has $32.2 million in cash and $96.1 million worth of receivables due within 12 months. As a result, its total liabilities are $663.8 million more than its cash and short-term receivables combined.

The flaws here weigh heavily on the $130.2 million company itself, like a child struggling under the weight of a giant backpack filled with books, his sports gear, and a small. So we definitely think shareholders need to pay close attention to that. After all, Chicken Soup for the Soul would likely need to undergo a major recapitalization if creditors had to be paid today. When analyzing debt levels, the balance sheet is the obvious place to start. But the most important thing is that future earnings will determine whether Chicken Soup for Soul Entertainment can maintain a healthy balance sheet in the future.So if you follow the future, you can look at this free A report showing analyst profit forecasts.

Last year, Chicken Soup for the Soul didn’t turn a profit on EBIT, but its revenue rose 85% to $175 million. With any luck, the company will be able to turn a profit.

emptor emptor

While Chicken Soup for the Soul’s revenue growth has been pretty ingenious, the cold hard truth is that its EBIT is losing money. Its EBIT loss was as high as $60 million. Combine this information with the significant liabilities we’ve touched upon, and we’re very hesitant about this stock, to say the least. Of course, with a little luck and good execution, it might improve its situation. But we think that’s unlikely because it has low liquid assets and burned through $62 million last year. So we think this stock is risky, like walking through a dirty dog park with a mask on. Without a doubt, the debt we know the most from the balance sheet. But in the end, every company can control the risks that exist off the balance sheet.For example, we have determined 2 Warning Signs of Chicken Soup for the Soul Entertainment You should know.

If you are interested in investing in a business that can grow your profits without the debt load, check this out free List of growth companies with net cash on their balance sheets.

What are the risks and opportunities Chicken Soup for the Soul?

Chicken Soup for the Soul Entertainment

award

Transaction price is 87.6% below our estimate of its fair value

Revenue expected to grow 58.02% annually

risk

Shareholders have been diluted in the past year

Has cash runway for less than 1 year

Have feedback on this article? Concerned about content? keep in touch Contact us directly. Alternatively, email the editorial team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only an unbiased methodology to provide reviews based on historical data and analyst forecasts, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no positions in any of the stocks mentioned.

[ad_2]

Source link