[ad_1]

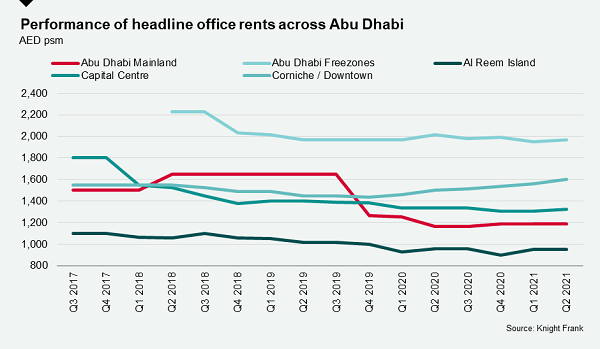

According to Knight Frank’s biennial Abu Dhabi office market review in the summer of 2021, office rents for the best buildings in Abu Dhabi have begun to stabilize and even increase in some cases.

Faisal Durrani, Head of Middle East Research at Knight Frank explained, “Businesses continue to zero out first-class office space, and this trend is intensified by the pandemic. Except for the Corniche-Downtown area, office rents are still lower than they were five years ago, which adds to the appeal of office building upgrades.

“The overall theme echoes other global cities, where companies are actively targeting the best offices to ease employee attractiveness and retention challenges-this problem will transcend the pandemic and will only intensify. With the expected economic recovery in Abu Dhabi and the UAE, companies will have to work hard to fill vacancies. Occupying first-class office space will become an important tool in the battle for talent.”

Although rents for the best buildings in the UAE capital have begun to pick up, the vacancy rate has remained relatively stable. Knight Frank said that this is partly because landlords need to increase rental income to meet their financing obligations, so some people may increase rents without new demand to support any growth.

“Although some landlords are trying to create an illusion that vacant inventory is squeezed, the demand for new space is rising. Driven by the banking and financial sectors, as well as the healthcare and education sectors, the level of demand in the second quarter was approximately higher than last year. 15%, each department accounts for about 20% of new demand.

“Interestingly, the demand from the healthcare and education sectors partly stems from the government’s decision to produce the Covid-19 vaccine in KIZAD, which has increased the demand for office space for healthcare-related companies, some of which are looking for the first base in Abu Dhabi. “, Added Durani.

Knight Frank pointed out that the industrial and logistics sectors accounted for the third largest source of new space demand, accounting for 17.8%. Among them, the largest single source of demand was the demand for 2,000 square meters of space in the central area of the capital.

Another notable source of investigation comes from Israeli companies related to the technology industry, who are seeking to start operations in the UAE for the first time after the normalization of relations between the two countries in September 2020.

[ad_2]

Source link